💵 💴 💶Wall Street Closes Positive After Brief Decline Following Powell’s Remarks💵 💴 💶

Today, the stock market showed a mostly stagnant performance throughout the day. However, a late push for gains helped finish the third quarter on a positive note. Losses remained limited during the session. The lowest levels occurred around 2:30 PM, following Federal Reserve Chairman Powell’s comments at the NABE Conference. Powell indicated that, should the economy progress as expected, the Fed could cut interest rates by 25 basis points two more times this year. The Fed funds futures market, on the other hand, was expecting a total of 75 basis points in cuts by the end of the year. These remarks triggered a brief wave of selling, causing the S&P 500 to decline by up to 0.6% during the day.

GLOBAL MARKETS

Asian markets declined but remained close to a two-and-a-half-year high. The dollar gained value following comments by Federal Reserve Chairman Jerome Powell, which dampened expectations for significant rate cuts. Ongoing tensions in the Middle East continued to pressure risk appetite. Oil prices were steady, while gold traded just below last week’s record high. Investors are closely watching today’s release of the U.S. JOLTS job openings data for more clues on the pace of rate cuts in the U.S.

Bitcoin Price Drop: Long Squeeze and Impact of Global Markets

Bitcoin’s price dropped by over 3% in the last 24 hours. The main cause of this decline is attributed to a “long squeeze.” These types of squeezes are especially common in leveraged futures markets, where a decline in asset prices leads to increased selling pressure. A long squeeze typically occurs when prices fall, forcing investors in long positions to either hit stop-loss orders or meet margin calls, leading to the closing of their positions. This increases the selling pressure on the market, further driving down prices.

Technical Overview

DXY

The Dollar Index continues within a falling channel this week. DXY found buyers from the 100.68 support, and recoveries continue. If there are strong closures below this region, selling pressure on the index will increase. As long as DXY remains above the 100.68 support area, the momentum will be upward.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

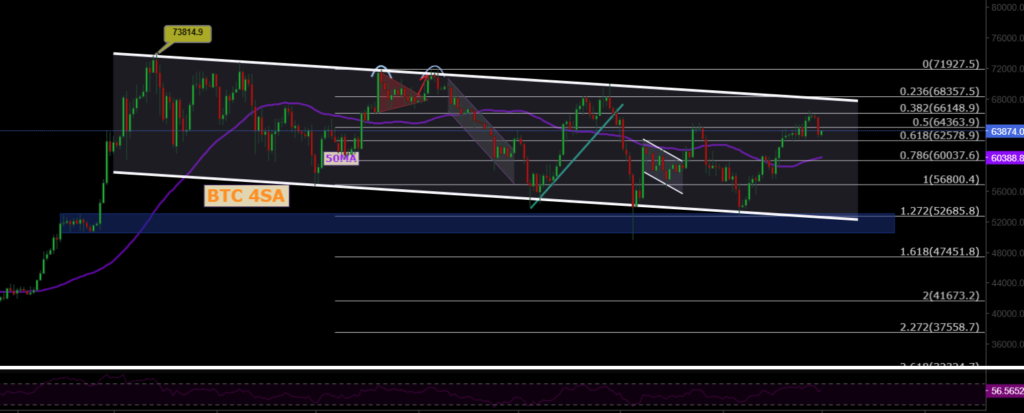

BTC/USD

The uptrend in BTCUSD continues. Following US data, it maintained its upward trend. Closures above the 64,300 level will push BTC to the 68,350 level. This area serves as a major resistance zone for BTC. Daily closures above 68,350 with high volume suggest that the trend will continue for BTC and other cryptocurrencies.

Resistance Levels: 64,290 / 66,148 / 68,350

Support Levels: 62,487 / 60,000 / 56,600

ETH/USD

ETHUSD broke its rising channel and continues to face selling pressure. It is currently priced at the 2,600 level, having lost its horizontal major support. The key support to monitor is 2,200, which is where buyers are expected to be stronger. To continue its upward trend, ETH needs to close above the major resistance level of 2,922 with strong volume.

Resistance Levels: 2,565 / 3,000 / 3,364

Support Levels: 2,200 / 1,700 / 1,052

NASDAQ

The NASDAQ100 index continues the week with a bullish trend. Having broken the resistance of the flag formation, the index is maintaining its position above the 20,000 level. As long as it continues to hold above this resistance zone, the index is expected to sustain its upward trend.

Resistance Levels: 19,445 / 20,000 / 20,985

Support Levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is showing medium-term recoveries. Having regained its channel structure, Brent continues its upward trend. If it can reclaim the 76.98 area, it will likely price in the 80.00 – 82.00 range. The key support level to watch is 72.37.

Resistance Levels: 74.45 / 76.98 / 79.84

Support Levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke its rising channel resistance, managing to hold above both the horizontal resistance and channel resistance. It stayed above the 1.0983 resistance zone and reached our target resistance level of 1.114. After facing selling pressure and losing the 1.11 level, it saw a pullback. The key support level to monitor is 1.0983.

Resistance Levels: 1.114 / 1.130 / 1.135

Support Levels: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD broke its rising channel structure with high volume, continuing its pricing above the 2,645 resistance level. As long as it remains above this resistance, the upward trend will continue. The key support level to watch is 2,644.

Resistance Levels: 2,690 / 2,720 / 2,750

Support Levels: 2,644 / 2,585 / 2,527

Leave A Comment