💵 💴 💶Bitcoin Demand Stabilizes, Will There Be an Upsurge in Q4?💵 💴 💶

While signals of balance in Bitcoin demand are emerging, a more significant rise is needed in Q4 for prices to reach higher levels. According to a report by CryptoQuant analysts, BTC prices have seen a slight increase of 1.2% in the last hour, continuing to trade above the $62,000 level. CryptoQuant data shows that while volatility for Bitcoin decreased in September, demand steadily increased. However, analysts pointed out that this rise in demand during September was not enough to trigger a sustained price rally. They highlight that in April, when demand surged to 496,000 Bitcoins, the price reached the $70,000 levels, stressing the need for a larger demand increase in Q4.

US Stocks Closed Flat Ahead of Employment Data. Eyes on the Middle East

Despite Israel announcing retaliation against Iran, the market didn’t react much to the situation today. Furthermore, there was limited response from stocks to the September ADP Employment Change Report, which didn’t sway thoughts on the economy’s soft landing scenario. Employment growth was at a good level (143,000), wage inflation declined, and both the goods and services sectors saw hiring, with this trend present across all regions. The relative strength in the semiconductor sector provided some support to the market, as the PHLX Semiconductor Index (SOX) closed 1.5% higher. The price movement also supported the S&P 500 information technology sector (+0.6%), rising along with Apple’s (+0.3%) increase.

Eurozone Inflation Fell Below Target

The European Central Bank (ECB) anticipated that this inflation data would be weak, as President Christine Lagarde mentioned during a press conference in September. However, the figures came in slightly weaker than most analysts had expected. While a recovery is expected in the fourth quarter, there are questions about how significant this will be, especially as oil prices fall rapidly.

Technical Overview

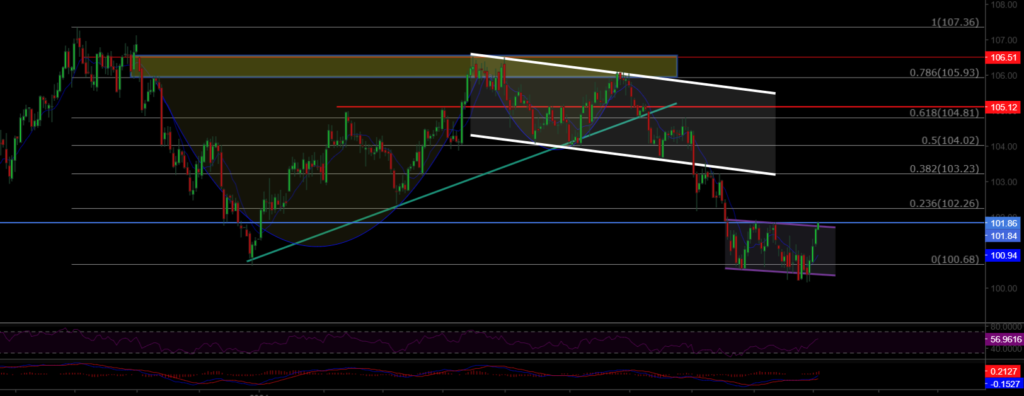

DXY

The Dollar Index continues within a falling channel this week. DXY found buyers from the 100.68 support, and recoveries continue. If there are strong closures below this region, selling pressure on the index will increase. As long as DXY remains above the 100.68 support area, the momentum will be upward.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistance Levels: 64,290 / 66,148 / 68,350

Support Levels: 62,487 / 60,000 / 56,600

ETH/USD

ETHUSD broke its rising channel and continues to face selling pressure. It is currently priced at the 2,600 level, having lost its horizontal major support. The key support to monitor is 2,200, which is where buyers are expected to be stronger. To continue its upward trend, ETH needs to close above the major resistance level of 2,922 with strong volume.

Resistance Levels: 2,565 / 3,000 / 3,364

Support Levels: 2,200 / 1,700 / 1,052

NASDAQ

The NASDAQ100 index continues the week with a bullish trend. Having broken the resistance of the flag formation, the index is maintaining its position above the 20,000 level. As long as it continues to hold above this resistance zone, the index is expected to sustain its upward trend.

Resistance Levels: 19,445 / 20,000 / 20,985

Support Levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is showing medium-term recoveries. Having regained its channel structure, Brent continues its upward trend. If it can reclaim the 76.98 area, it will likely price in the 80.00 – 82.00 range. The key support level to watch is 72.37.

Resistance Levels: 74.45 / 76.98 / 79.84

Support Levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke its rising channel resistance, managing to hold above both the horizontal resistance and channel resistance. It stayed above the 1.0983 resistance zone and reached our target resistance level of 1.114. After facing selling pressure and losing the 1.11 level, it saw a pullback. The key support level to monitor is 1.0983.

Resistance Levels: 1.114 / 1.130 / 1.135

Support Levels: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD broke its rising channel structure with high volume, continuing its pricing above the 2,645 resistance level. As long as it remains above this resistance, the upward trend will continue. The key support level to watch is 2,644.

Resistance Levels: 2,690 / 2,720 / 2,750

Support Levels: 2,644 / 2,585 / 2,527

Leave A Comment