💵 💴 💶Japanese Company Strengthens Bitcoin Reserves by Selling Bitcoin Options💵 💴 💶

Japan-based investment firm Metaplanet Inc. has taken a significant step to bolster its Bitcoin reserves. By selling put options, the company earned approximately 23,972 BTC (about $1.46 million). This move brought their total holdings to 530,717 BTC. Growth through Put Option Strategy Metaplanet announced its entry into Bitcoin put option transactions with QCP Capital. These options require purchasing Bitcoin if the price drops below $62,000. CEO Simon Gerovich noted that Bitcoin’s volatility presents such opportunities. Gerovich explained that while the company holds a large portion of its assets directly in Bitcoin to support its strategies, they also generate additional earnings through option strategies.

Gold Price Surge and Bitcoin’s Reaction

According to JPMorgan analysts, rising geopolitical uncertainties since 2022 and the upcoming 2024 U.S. presidential elections could drive investors toward gold and Bitcoin. Recently, gold prices have surged as U.S. Treasury yields declined. This trend has been accelerated by budget deficits in major economies and weakened confidence in fiat currencies. The depreciation of the U.S. dollar and significant drops in real yields on U.S. Treasury bonds have contributed to gold’s price rise. Gold’s price, which approached $2,700 in September, cannot be explained solely by these factors, indicating the return of the “debasement trade” strategy. However, Bitcoin has yet to show the same positive momentum as gold. JPMorgan analysts suggest that Bitcoin has not yet caught up to gold’s momentum in this environment.

Eurozone Inflation Fell Below Target

Asian stock markets retreated while escalating tensions in the Middle East kept investors on edge ahead of the release of U.S. non-farm payroll data later in the day. Meanwhile, oil prices are heading toward their sharpest weekly gain in over a year. U.S. President Joe Biden announced that the U.S. is considering retaliating against Iran’s missile attack on Israel earlier this week by targeting Iranian oil facilities, while the Israeli military conducted new airstrikes on Beirut. Following Biden’s statements, oil prices, already on the rise due to the escalating conflict in the Middle East, surged sharply this week.

Technical Overview

DXY

The Dollar Index continues within a falling channel this week. DXY found buyers from the 100.68 support, and recoveries continue. If there are strong closures below this region, selling pressure on the index will increase. As long as DXY remains above the 100.68 support area, the momentum will be upward.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

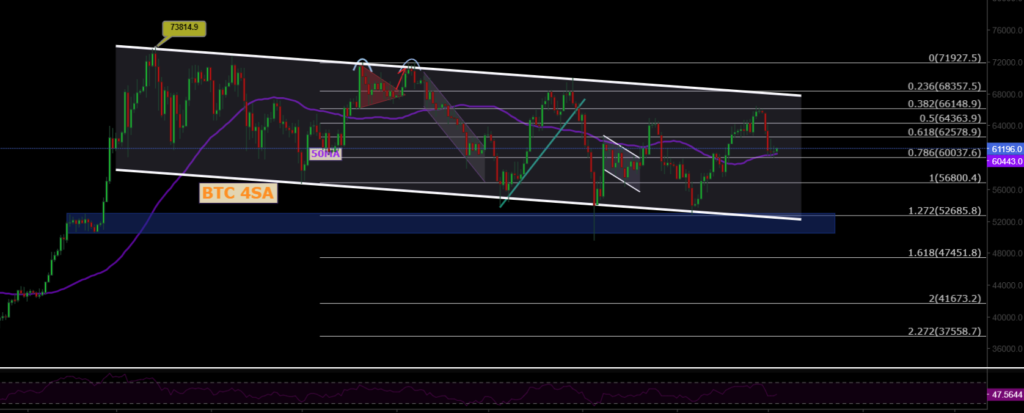

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistance Levels: 64,290 / 66,148 / 68,350

Support Levels: 62,487 / 60,000 / 56,600

ETH/USD

ETHUSD broke its rising channel and continues to face selling pressure. It is currently priced at the 2,600 level, having lost its horizontal major support. The key support to monitor is 2,200, which is where buyers are expected to be stronger. To continue its upward trend, ETH needs to close above the major resistance level of 2,922 with strong volume.

Resistance Levels: 2,565 / 3,000 / 3,364

Support Levels: 2,200 / 1,700 / 1,052

NASDAQ

The NASDAQ100 index continues the week with a bullish trend. Having broken the resistance of the flag formation, the index is maintaining its position above the 20,000 level. As long as it continues to hold above this resistance zone, the index is expected to sustain its upward trend.

Resistance Levels: 19,445 / 20,000 / 20,985

Support Levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is showing medium-term recoveries. Having regained its channel structure, Brent continues its upward trend. If it can reclaim the 76.98 area, it will likely price in the 80.00 – 82.00 range. The key support level to watch is 72.37.

Resistance Levels: 74.45 / 76.98 / 79.84

Support Levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke its rising channel resistance, managing to hold above both the horizontal resistance and channel resistance. It stayed above the 1.0983 resistance zone and reached our target resistance level of 1.114. After facing selling pressure and losing the 1.11 level, it saw a pullback. The key support level to monitor is 1.0983.

Resistance Levels: 1.114 / 1.130 / 1.135

Support Levels: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD broke its rising channel structure with high volume, continuing its priacing above the 2,645 resistance level. As long as it remains above this resistance, the upward trend will continue. The key support level to watch is 2,644.

Resistance Levels: 2,690 / 2,720 / 2,750

Support Levels: 2,644 / 2,585 / 2,527

Leave A Comment