💵 💴 💶GLOBAL MARKETS💵 💴 💶

After the release of employment data in the US once again eased recession concerns and reduced expectations for a 50 basis point rate cut, Asian markets rose, and the dollar climbed to a seven-week high against the yen. According to data released in the US on Friday, non-farm payrolls unexpectedly posted the largest increase in six months in September, indicating that the economy has not lost momentum. Following the data, the yield on the US 2-year Treasury notes (US2YT=RR) increased by another 1.7 basis points today, reaching 3.9488%, the highest level in over a month. Despite Israel’s bombing of targets in Lebanon and the Gaza Strip on the anniversary of the Hamas attacks that triggered the war in Gaza, oil prices retreated from a one-month high.

The Implications of Israel’s Potential Response for the Oil Market

ICE Brent crude rose more than 8% compared to levels before Iran’s missile attack on Israel. However, the bulk of this increase occurred on Thursday when President Biden responded, “We are discussing it,” when asked if he would support an Israeli attack on Iran’s oil infrastructure. Depending on the scale of such a response, this could be significant for the oil market. This situation is not just about the loss of Iranian supply, but also carries the risk of escalating into a more extreme scenario. In such a case, disruptions could occur in oil and LNG flows through the Strait of Hormuz in the Persian Gulf.

Eurozone Inflation Falls Below Target

Asian markets declined, while tensions in the Middle East put markets on edge ahead of the US non-farm payrolls report expected later in the day. Oil prices, meanwhile, are set for the sharpest weekly rise in over a year. US President Joe Biden said yesterday that the US was considering supporting an Israeli attack on Iran’s oil facilities as retaliation for Iran’s missile strikes on Israel earlier in the week, while the Israeli army carried out new airstrikes on Beirut. Following Biden’s statements, oil prices, which were already rising due to the escalating conflicts in the Middle East, surged further.

Technical Overview

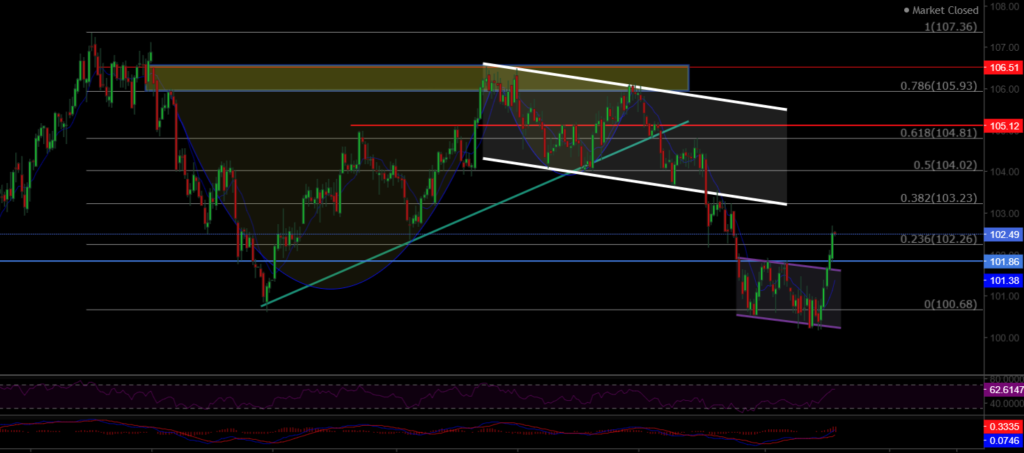

DXY

The Dollar Index continues within a falling channel this week. DXY found buyers from the 100.68 support, and recoveries continue. If there are strong closures below this region, selling pressure on the index will increase. As long as DXY remains above the 100.68 support area, the momentum will be upward.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistance Levels: 64,290 / 66,148 / 68,350

Support Levels: 62,487 / 60,000 / 56,600

ETH/USD

ETHUSD broke its rising channel and continues to face selling pressure. It is currently priced at the 2,600 level, having lost its horizontal major support. The key support to monitor is 2,200, which is where buyers are expected to be stronger. To continue its upward trend, ETH needs to close above the major resistance level of 2,922 with strong volume.

Resistance Levels: 2,565 / 3,000 / 3,364

Support Levels: 2,200 / 1,700 / 1,052

NASDAQ

The NASDAQ100 index continues the week with a bullish trend. Having broken the resistance of the flag formation, the index is maintaining its position above the 20,000 level. As long as it continues to hold above this resistance zone, the index is expected to sustain its upward trend.

Resistance Levels: 19,445 / 20,000 / 20,985

Support Levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is showing medium-term recoveries. Having regained its channel structure, Brent continues its upward trend. If it can reclaim the 76.98 area, it will likely price in the 80.00 – 82.00 range. The key support level to watch is 72.37.

Resistance Levels: 74.45 / 76.98 / 79.84

Support Levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke its rising channel resistance, managing to hold above both the horizontal resistance and channel resistance. It stayed above the 1.0983 resistance zone and reached our target resistance level of 1.114. After facing selling pressure and losing the 1.11 level, it saw a pullback. The key support level to monitor is 1.0983.

Resistance Levels: 1.114 / 1.130 / 1.135

Support Levels: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD broke its rising channel structure with high volume, continuing its priacing above the 2,645 resistance level. As long as it remains above this resistance, the upward trend will continue. The key support level to watch is 2,644.

Resistance Levels: 2,690 / 2,720 / 2,750

Support Levels: 2,644 / 2,585 / 2,527

Leave A Comment