💵 💴 💶GLOBAL MARKETS💵 💴 💶

The Mystery of Satoshi Nakamoto: Research Increases Tenfold, So Who Do the Clues Point To?

The crypto community is divided over the true identity of Bitcoin’s creator, Satoshi Nakamoto. Discussions have heated up ahead of an upcoming HBO documentary, which promises to reveal its candidates. These discussions revolve around two main theories: Satoshi is either a single person or part of a larger group. The Occam’s Razor theory, which favors the simplest explanation, supports the idea of a single inventor. However, some argue that the creation of Bitcoin might be more complex. A strong candidate for Satoshi’s identity is Nick Szabo, a computer scientist and cryptographer. 10X Research, a respected source for crypto insights, points to Szabo as the likely figure behind Bitcoin, highlighting his early work on decentralized currencies and cryptographic techniques

US Bank Earnings Reports Expected to Show Declines in Profits

JPMorgan Chase and Wells Fargo are set to release their earnings reports this week, and investors are particularly focused on the banks’ net interest income. Recent strong employment data has added uncertainty to the future of Federal Reserve rate cuts. The third-quarter profits of these two banks are expected to decline, as interest income shrinks and credit demand remains low. Banks have made significant gains in net interest income over the past few years due to Fed rate hikes. However, weak credit growth, rising deposits, and increasing unemployment, along with higher provisions for loan losses, are now putting pressure on profitability. Further rate cuts could reduce banks’ interest income but may also increase borrowing and transaction activity.

Saudi Arabia Raises Prices for Asian Buyers

Oil prices eased this morning as new developments in the Middle East are anticipated. It is reported that U.S. President Joe Biden is trying to dissuade Israel from attacking Iran’s oil facilities (following Iran’s missile attack last week). According to OPEC’s latest monthly oil market report, Iran produces around 3.3 million barrels of oil per day, and any disruption in this supply could create a shortage in the oil market. Meanwhile, Saudi Arabia raised official selling prices (OSP) for November shipments for Asian buyers, while lowering prices for European and U.S. buyers. Aramco raised the premium for Arab Light crude for Asian buyers by $0.90 per barrel, bringing it to $2.20. The market had expected a smaller increase of $0.65 per barrel. On the other hand, prices for all oil grades for November shipments to Europe were reduced by $0.90 per barrel, likely in an effort to regain market share in Europe. The varying prices for different regions might reflect expectations of local imbalances in the oil market.

Technical Overview

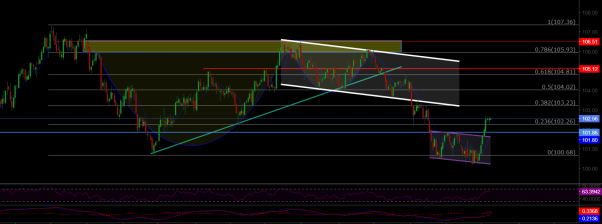

DXY

The Dollar Index continues the week with a bullish momentum. The DXY, which found support at the 100.68 level, is showing signs of recovery. As long as it remains priced above the 100.68 support zone, its upward momentum is expected to continue.

Resistance levels: 102.26 / 103.23 / 104.02

Support levels: 100.68 / 98.00 / 97.00

BTC/USD

Recoveries in BTCUSD continue. The price is bouncing back from the MA50 level, which acts as a buying zone at 60,037, and is continuing its trend to test the channel resistance again. The 66,150 level emerges as the key resistance area to watch.

Resistance levels: 64,290 / 66,148 / 68,350

Support levels: 60,000 / 56,600 / 52,685

ETH/USD

ETHUSD broke its rising channel and continues to face selling pressure. It is currently priced at the 2,600 level, having lost its horizontal major support. The key support to monitor is 2,200, which is where buyers are expected to be stronger. To continue its upward trend, ETH needs to close above the major resistance level of 2,922 with strong volume.

Resistance Levels: 2,565 / 3,000 / 3,364

Support Levels: 2,200 / 1,700 / 1,052

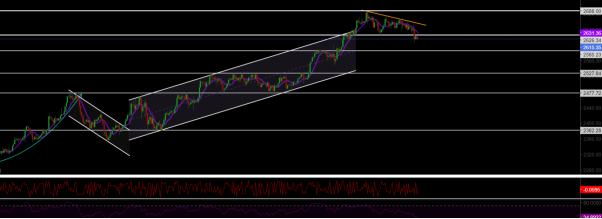

NASDAQ

The NASDAQ100 Index continues the week with a bearish trend. The index, which has approached the 19,900 resistance zone, is likely to see further pullbacks as long as it continues to price below this resistance level. The key support zone to watch is at the 18,490 level.

Resistance levels: 19,900 / 20,000 / 20,985

Support levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is showing medium-term recoveries. Having regained its channel structure, Brent continues its upward trend. If it can reclaim the 76.98 area, it will likely price in the 80.00 – 82.00 range. The key support level to watch is 72.37.

Resistance Levels: 74.45 / 76.98 / 79.84

Support Levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke its rising channel resistance, managing to hold above both the horizontal resistance and channel resistance. It stayed above the 1.0983 resistance zone and reached our target resistance level of 1.114. After facing selling pressure and losing the 1.11 level, it saw a pullback. The key support level to monitor is 1.0983.

Resistance Levels: 1.114 / 1.130 / 1.135

Support Levels: 1.098 / 1.088 / 1.080

XAUUSD

Gold (XAUUSD) continues its selling pressure after losing the 2625 support level. It has retested this level and converted it into resistance. The 2585 level stands out as a potential buying zone. To confirm a continuation of the uptrend, it is essential to monitor a breakout of the falling resistance.

Resistance Levels: 2625 / 2690 / 2720

Support Levels: 2585 / 2527 / 2472

Leave A Comment