💵 💴 💶SEC Vote: A Critical Week for the Crypto World💴 💶

The United States Department of the Treasury has officially recognized Bitcoin as “digital gold,” highlighting its primary role as a store of value. Alongside this acknowledgment, the Treasury noted that the rising adoption of stablecoins has increased demand for Treasury bonds. The Treasury’s report emphasizes the rapid expansion of digital assets, including Bitcoin, Ethereum, and stablecoins, while noting that the market remains relatively small compared to traditional financial instruments like U.S. government bonds.

Google Introduces the Willow Quantum Chip: Bitcoin Security Sparks Debate

Google CEO Sundar Pichai has unveiled “Willow,” a groundbreaking new quantum computing chip with advanced capabilities. This announcement has raised concerns within the community about the potential for Bitcoin’s cryptographic algorithms to be cracked. However, community members have reassured the space, noting that Bitcoin users had anticipated this possibility years ago and that any real threat to security is still years away.

Crude Oil Futures:

Crude oil futures gradually strengthened from the opening but continued to trade within recent ranges due to geopolitical uncertainties. Over the weekend, the seizure of Damascus by rebel forces and the overthrow of Bashar al-Assad’s regime increased market unpredictability. However, Saudi Arabia’s decision to lower official selling prices (OSP) for crude oil in Asia and Northwest Europe for January limited the gains.

Technical Overview

DXY

The Dollar Index (DXY) is strongly recovering at the start of the week, continuing its upward trend. Finding strength at the critical support level of 100.68, the DXY is expected to maintain its upward momentum as long as it stays above this support. Especially as it trades above the 106.68 level, upward movements are anticipated to accelerate. Buyers are observed to be dominant in this area, and the index is likely to advance toward resistance levels.

Resistances: 104.76 / 106.00 / 107.35

Supports: 104.02 / 102.26 / 100.68

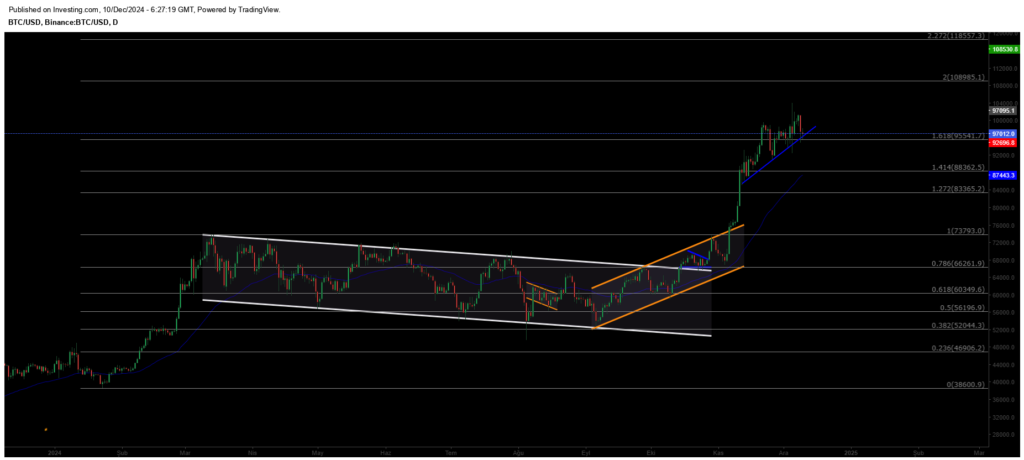

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

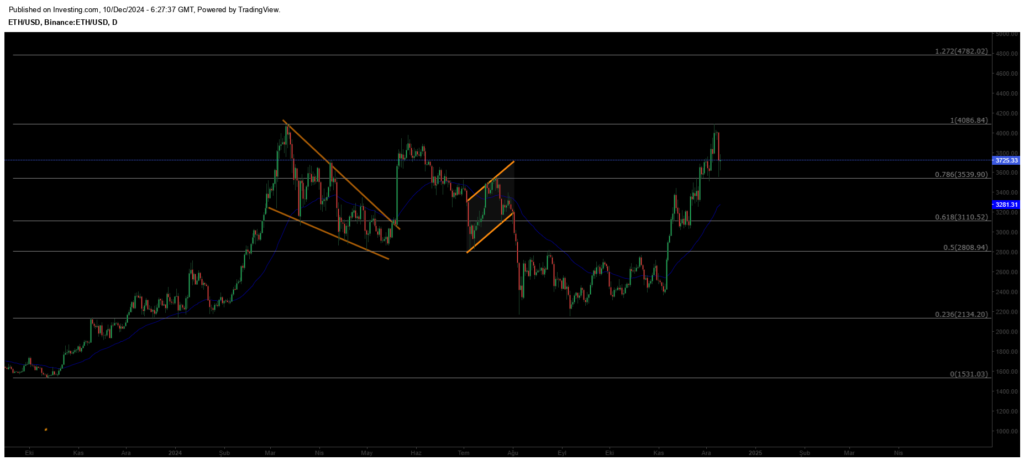

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

NASDAQ

The index, continuing its upward trend, is pricing above the 20,635 resistance level, maintaining its bullish momentum. In the event of potential pullbacks, two critical support levels stand out. Firstly, the 19,600 level serves as an important support zone in the short term. In case of a deeper pullback, the 18,400 level should be monitored as a strong buying area. Buyers are expected to step in at these levels.

Resistances: 20,635 / 22,400 / 23,000

Supports: 18,913 / 18,670 / 17,200

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

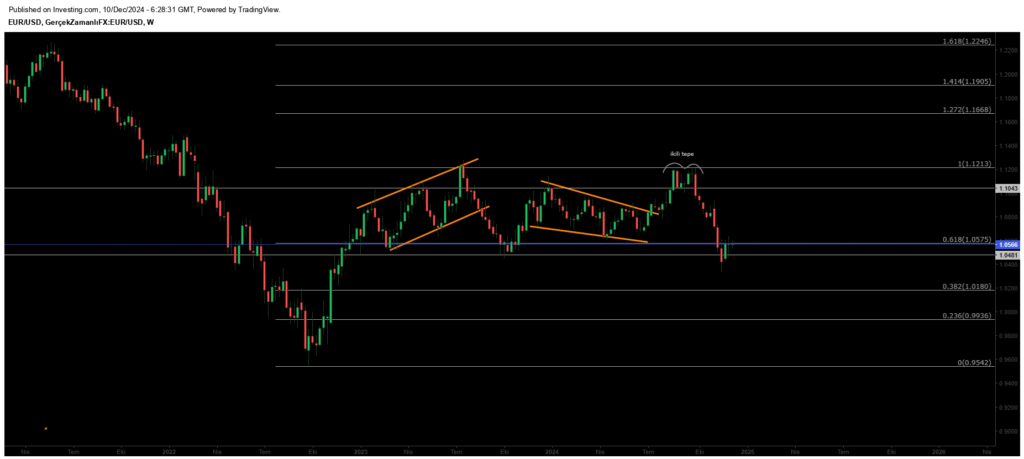

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

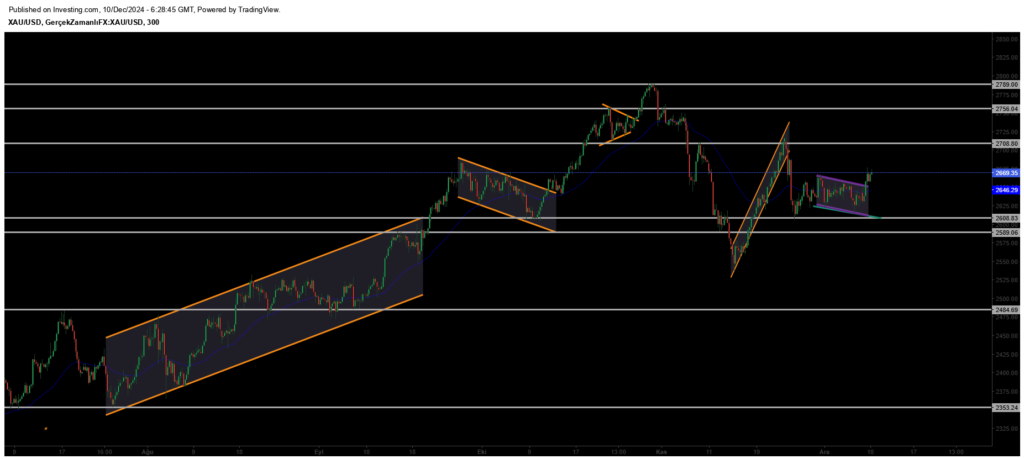

XAUUSD

Gold has successfully rebounded from the 2533 level, reaching the anticipated target. However, it faced strong selling pressure from the rising channel resistance and horizontal resistance zone. It is currently trading actively at the 2668 level. Further pullbacks seem likely in the near term. In this context, the 2652 level emerges as a key support to monitor closely.

Resistance Levels: 2711 / 2757 / 2800

Support Levels: 2622 / 2590 / 2530

Leave A Comment