💵 💴 💶Global Markets💵 💴 💶

U.S. stocks rebounded on Monday after significant losses last week. This recovery included a broad rally across assets: oil prices rose by 1%, and Bitcoin increased by 4.42%. Europe’s Stoxx 600 index rose by 0.82%, marking a positive movement for the first time in days. However, despite this general recovery, luxury fashion brands Burberry, Hugo Boss, and Kering saw declines in their stock prices.

Oil Remains Under Pressure

Despite OPEC+ postponing the increase in supply by two months, oil prices closed weakly last week. ICE Brent closed on Friday with a 2.24% drop, just above $71 per barrel. Weak demand and concerns about a soft oil balance in 2025 are still sources of worry. While OPEC+ cuts may tighten the market somewhat for the rest of the year, they do not address the expected surplus next year. However, prices are showing a stronger trend in early morning trading today.

Trump-Harris Debate and U.S. CPI Data to Create Volatility in Crypto Markets

The debate between presidential candidates Donald Trump and Kamala Harris could impact the U.S. presidential election in November and might also have repercussions for cryptocurrencies. Investors will be closely watching the debate for clues about potential regulations in the sector. If Trump wins, Bitcoin could reach new highs between $80,000 and $90,000 by the end of the fourth quarter. On the other hand, if Harris wins, Bitcoin may fall back to between $30,000 and $40,000 from its current $50,000 level.

Technical Overview

DXY

The Dollar Index continues to show buying interest at the start of the week. It has rebounded from the 100.68 support level and is gaining upward momentum. The key resistance level to watch is 102.26, but if it loses the current support level, the downtrend may continue.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

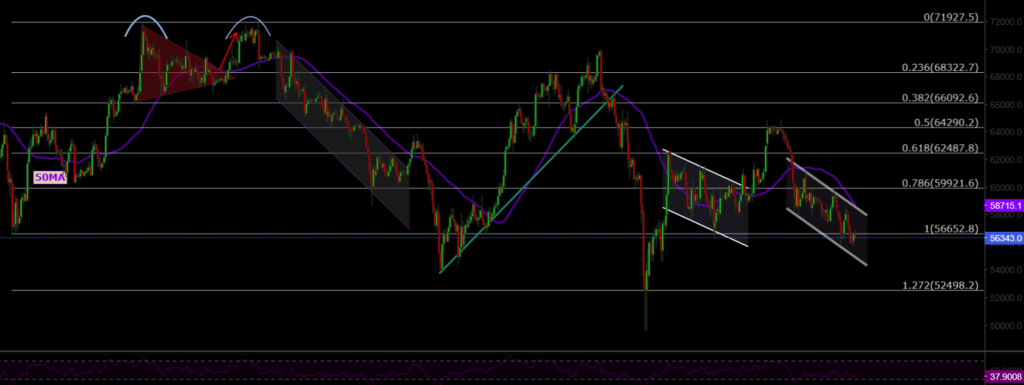

BTC/USD

BTCUSD is still recovering. For a short-term upward trend to be confirmed, it needs to trade above the $60,000 level. Key resistance levels are $60,000 and $62,487.

Resistances: 60,000 / 62,487 / 64,290

Supports: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD has continued its potential selling pressure after breaking the rising channel structure. Currently, ETHUSD is trading at $2,466, having lost its major horizontal support. The key support level to watch is $2,200.

Resistances: 2,565 / 3,000 / 3,364

Supports: 2,200 / 1,700 / 1,052

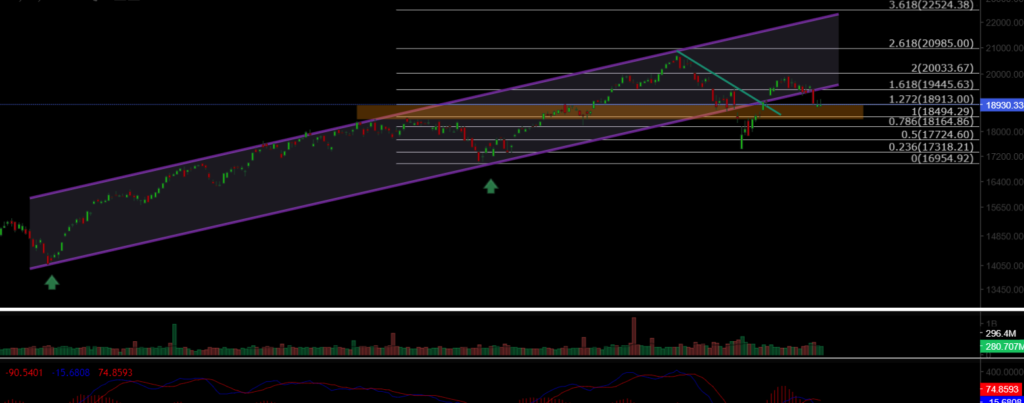

NASDAQ

The NASDAQ 100 Index started the week with selling pressure. It has retreated to the channel support and has dropped to 18,900. If it loses the 18,490 level, the index may continue to show selling pressure. Key support levels are 18,164 and 17,724.

Resistances: 19,445 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,164

BRENT

Brent Oil is continuing its medium-term correction. After losing its support level, oil has retreated to the lower support level of the falling channel and is maintaining a downtrend under selling pressure. For an uptrend to resume, it needs to gain above $74.45 with substantial volume.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke the rising channel resistance and managed to price above both the horizontal resistance and channel resistance. It remained above the 1.0983 resistance level and reached the target resistance level of 1.114. After losing the 1.11 resistance level again, it experienced a pullback. The key support level to watch is 1.0983.

Resistances: 1.127 / 1.130 / 1.135

Supports: 1.117 / 1.088 / 1.080

XAUUSD

XAUUSD broke the falling channel structure with volume, reaching an ATH (All-Time High) of 2,530. After losing the support of the rising triangle formation, gold could continue to retreat with geopolitical risks. The key support and buying area to watch is the rising support level of 2,450.

Resistances: 2,530 / 2,570 / 2,600

Supports: 2,488 / 2,477 / 2,450

Leave A Comment