💵 💴 💶GLOBAL MARKETS💵 💴 💶

US Inflation Data Influences Fed’s Rate Decision

US inflation data and the employment report have not yet led to a clear conclusion regarding expectations for Fed policy. Policymakers will need to proceed cautiously, but our base scenario suggests there will be 25 basis point rate cuts in both November and December.

ECB Minutes Show What’s Changing Soon

The minutes from the European Central Bank’s (ECB) September meeting reveal increasing concern over disappointing growth, though the bank remains reluctant to signal any definitive relief regarding inflation. The release of the minutes just one week before the next ECB meeting is unusual, with the delay attributed to scheduling changes during the summer months. Despite this, the minutes provide less insight into the ECB’s future steps than usual. In fact, they highlight how just a few weeks can significantly shift the ECB’s mindset.

GLOBAL MARKETS

Asian markets found support from rising Chinese stocks, bolstered by the People’s Bank of China’s (PBOC) 500 billion yuan stimulus aimed at revitalizing capital markets. The dollar traded near its two-month high ahead of the US inflation data release later today. Investors are watching the consumer inflation figures for further clues on potential rate cuts. Economists polled by Reuters predict that core inflation will remain steady at 3.2% year-on-year. Additionally, the PBOC announced it will begin accepting applications from financial institutions wishing to participate in a newly established financing program, which was introduced on September 24 as part of the support measures.

Technical Overview

DXY

The DXY continues to sustain a strong recovery. Finding strength from the critical support zone at 100.68, the DXY is expected to maintain its upward momentum as long as it remains above this support level. As long as the index stays above 100.68, upward movements are likely to accelerate. Buyers appear dominant in this zone, and the index may advance towards resistance levels.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

BTC/USD

The recovery in BTC/USD continues without slowing down. The 50-day moving average (MA50) support zone at 60,037 provided a solid foundation for buyers, leading to a resurgence in the upward trend. BTC/USD is now heading back towards the channel resistance, maintaining its bullish momentum. The key resistance level to watch is 66,150. A break above this level could trigger a new wave of upward movement.

Resistances: 64,290 / 66,148 / 68,350

Supports: 60,000 / 56,600 / 52,685

ETH/USD

ETH/USD broke out of its ascending channel structure, continuing to move under selling pressure. After losing its horizontal major support, ETH/USD is currently trading around 2400. If the selling deepens, the critical support level to watch is 2100, where buyers may become more active. On the other hand, for ETH to resume its upward trend, it needs to see a strong close above the major resistance at 2922. If this resistance is surpassed, another uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

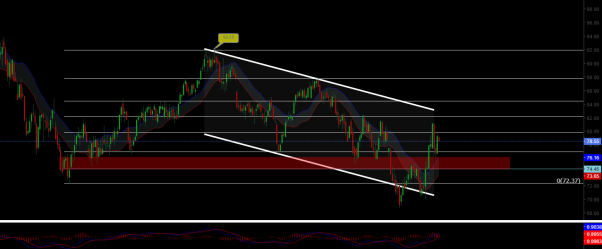

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

XAUUSD

XAU/USD has rebounded strongly from the support of its descending channel, testing the 2640 resistance level once again. Breaking this critical level could allow gold to reach a new all-time high (ATH) and continue its upward trend for a while longer. Especially if it can maintain stability above this resistance zone, gold’s upward movement could gain further momentum.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment