💵 💴 💶Currency Around 34, with Focus on US Inflation Data💵 💴 💶

As the currency continues its movements around the 34 level, today’s market attention is on the upcoming US inflation data. Although the Federal Reserve (Fed) has clearly stated that employment is a more crucial focus than inflation, investors looking for clues on monetary policy will be closely watching the US Consumer Price Index (CPI) data set to be released today. While the Fed is expected to lower interest rates next week, the mixed results from last Friday’s employment data did not provide clarity on the extent of the rate cut.

Oil Under Pressure

Despite OPEC+ delaying its production increase by two months, oil prices experienced a weak closing last week. ICE Brent closed on Friday with a 2.24% drop, just above $71 per barrel. Weak demand and concerns about a soft oil balance in 2025 are still a worry. Although OPEC+ cuts may tighten the market for the remainder of this year, this does not address the expected surplus next year. However, prices have shown a stronger performance in early morning trading today.

Harris’ Chances Increasing

The first debate between US Vice President Kamala Harris and former President Donald Trump led investors to evaluate its impact on asset prices. The debate covered a wide range of topics, from economic plans to US-China relations and immigration policies. Following the debate, Harris’ chances of winning increased on the PredictIt platform. Bitcoin experienced a sharp decline before the debate but has recovered partially. US stock futures and the dollar index have slightly retreated, while US Treasury bonds remain steady. Meanwhile, Taylor Swift expressed her support for Democratic candidate Kamala Harris immediately after the debate.

Technical Overview

DXY

The Dollar Index (DXY) starts the week with consolidation. The DXY, which found buyers at the 100.68 support level, continues to recover. Closing below this level with volume would increase selling pressure on the index. As long as it trades above the 100.68 support area, its momentum will remain upward.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

BTC/USD

BTC/USD continues to recover. For a short-term uptrend to be confirmed, it needs to trade above the 60,000 level. Key resistance levels to watch are 60,000 and 62,487. The current support level is 52,685.

Resistance: 60,000 / 62,487 / 64,290

Support: 56,600 / 52,498 / 50,000

ETH/USD

ETH/USD continues to face potential selling pressure after breaking its rising channel structure. Currently trading at 2,466, ETH/USD has lost its major horizontal support. The key support level to monitor, where buying interest may be strong, is 2,200.

Resistance: 2,565 / 3,000 / 3,364

Support: 2,200 / 1,700 / 1,052

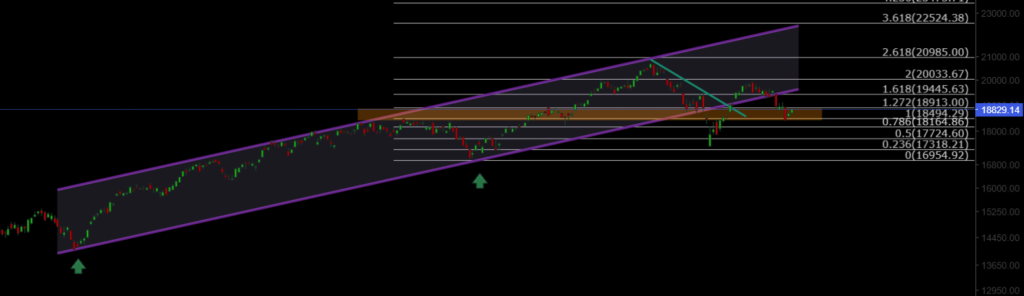

NASDAQ

The NASDAQ100 index started the week with a bearish tone. The index retreated to the 18,900 area after falling below the channel support. If the 18,490 level is lost, the index is likely to continue its bearish trend. Key support levels to watch are 18,164 and 17,724.

Resistance: 19,445 / 20,000 / 20,985

Support: 18,913 / 18,500 / 18,164

BRENT

Brent Crude Oil continues its medium-term correction. Having lost its support level, oil has fallen to the lower support level of its descending channel and continues its downtrend with selling pressure. For an uptrend to restart, it needs to gain volume above 74.45.

Resistance: 74.45 / 76.98 / 79.84

Support: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD broke through its rising channel resistance and managed to price above both horizontal and channel resistances. It reached our target resistance of 1.114 but faced selling pressure and retreated from the 1.11 resistance level. The support level to monitor is 1.0983.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

XAUUSD

XAU/USD broke out of its descending channel structure and reached an all-time high (ATH) of 2,530. After losing support from the rising triangle formation, gold may continue to retreat due to geopolitical risks. The support level to watch is the rising support level at 2,450.

Resistance: 2,530 / 2,570 / 2,600

Support: 2,488 / 2,477 / 2,450

Leave A Comment