US Inflation Data

The money markets are pricing in a 100 basis point interest rate cut by the Fed this year. However, some analysts believe that such a large cut is not fully supported by economic data. The Consumer Price Index (CPI) for July, to be announced on Wednesday, and retail sales data on Thursday will be decisive for the Fed’s interest rate decisions. Fears of a recession have increased following weak employment data, causing sharp declines in US Treasury yields and the dollar.

China Halts Gold Purchases

Central banks continued gold purchases in June, with the World Gold Council (WGC) reporting a net acquisition of 12 tons for the month. Purchases in June were again led by emerging market central banks, with Uzbekistan and India adding 9 tons to their reserves. However, China has slowed its gold purchases in recent months. The People’s Bank of China (PBoC) did not add to its gold reserves for the third consecutive month in July. The PBoC ended an 18-month buying streak in May, which led to record high gold prices. High gold prices now seem to be deterring purchases. According to official data, the amount of bullion held by the PBoC remained at 72.8 million troy ounces at the end of last month.

Celsius Sues Tether for Over $3.5 Billion in Fraudulent Bitcoin Transfers

The bankrupt crypto lender Celsius is pursuing billions of dollars from Tether, the issuer of the largest stablecoin, USDT. In a court filing on August 9, Celsius requested compensation equivalent to 57,428.64 BTC, or approximately $3.5 billion at the time of the report.

Technical Overview

DXY

The Dollar Index lost its current descending channel level under selling pressure; if no rebound occurs within the channel, we may see selling pressure extend to 102.26. The resistance level to watch is 103.23.

Resistances: 103.23 / 104.02 / 104.81

Supports: 102.26 / 100.68 / 100

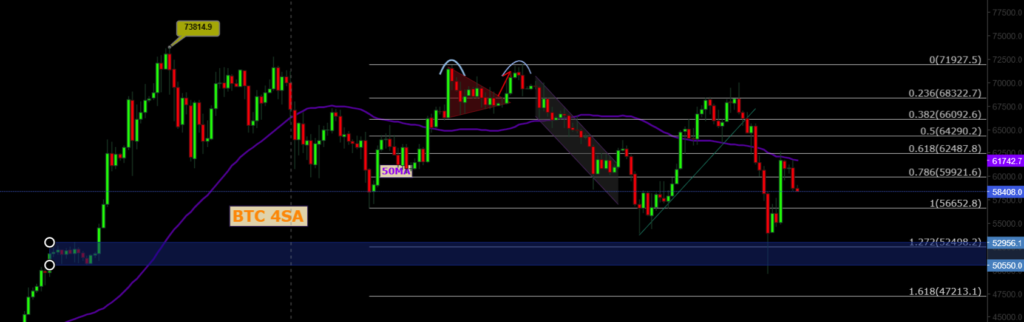

BTC/USD

BTCUSD continues its uptrend with recoveries observed after a drop to $50,000. The pair encountered selling at the MA50 and is correcting to $56,652. The resistance to monitor is the 62,487 region.

Resistances: 60,000 / 62,000 / 64,000

Supports: 56,600 / 52,500 / 47,200

ETH/USD

NASDAQ

ETHUSD continued potential selling pressure after breaking its rising channel structure. The pair reached major horizontal support and is now attempting to turn the 2565 resistance level into support. Maintaining above this level could drive the pair higher.

Resistances: 3364 / 4078 / 4340

Supports: 2565 / 2565 / 2200

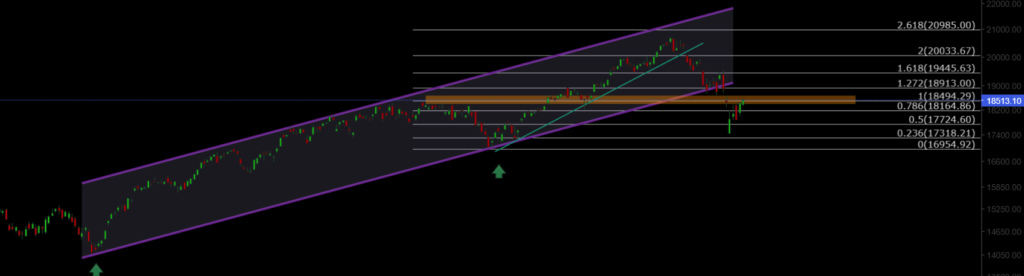

NASDAQ

The NASDAQ100 Index lost its rising channel support. If expected selling pressure emerges, the index may continue its downward trend from the 18500 resistance level. Losing the 16954 level could lead to new lows.

Resistances: 18500 / 18913 / 19445

Supports: 18164 / 17724 / 17318

BRENT

Brent Crude Oil continues its medium-term downtrend. It remains within its short-term descending channel, with the 74.45 level being a key support. A continued decline could bring prices to this level. Breaking the descending resistance within the channel is necessary to start an uptrend.

Resistances: 79.84 / 82.15 / 84.46

Supports: 76.98 / 74.45 / 72.37

EURUSD

EURUSD broke the descending channel resistance and gained momentum from the channel support, trading above the 1.0881 resistance level but pulled back from 1.098. The rising channel structure should be watched, and breaking the resistance could push EURUSD to higher levels.

Resistances: 1.098 / 1.0114 / 1.012

Supports: 1.088 / 1.080 / 1.071

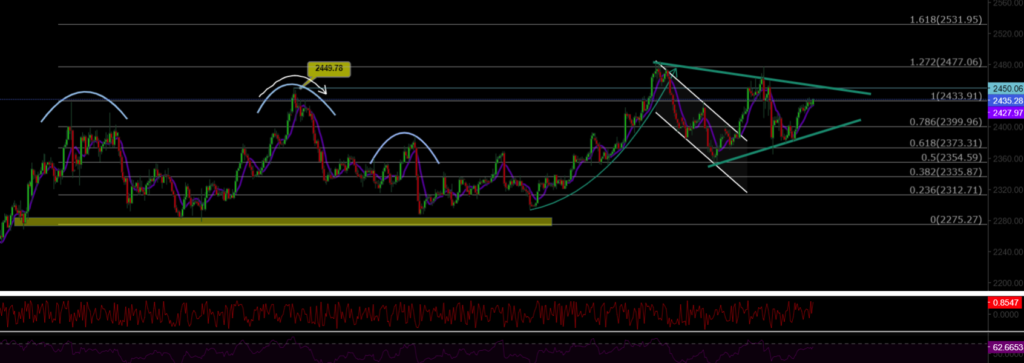

XAUUSD

XAUUSD broke the descending channel structure with significant volume and is trading above the 2400 resistance level. The pair is still moving within a rising triangle structure. A significant move above the 2458 resistance could continue the uptrend.

Resistances: 2450 / 2477 / 2488

Supports: 2400 / 2373 / 2354

Leave A Comment