💵 💴 💶Oil Prices💴 💶

Oil prices surged as the European Union approved a new sanctions package that threatens Russian oil flows and could tighten global crude oil supply. Brent crude oil futures rose by 1.94% to $73.59 per barrel, while U.S. West Texas Intermediate crude oil futures climbed by 2.57% to $70.35 per barrel. The implementation of strict measures is emerging as a supportive factor for the market, diverting attention from traditional demand metrics. OPEC acknowledges the challenges it faces in balancing the market toward 2025. Cuts in demand growth forecasts highlight the complexity of these efforts.

U.S. Supreme Court Allows Nvidia Shareholders’ Crypto Revenue Lawsuit

The U.S. Supreme Court rejected Nvidia Corp.’s appeal, allowing a shareholder lawsuit related to the company’s cryptocurrency revenues to proceed. The lawsuit accuses the company of misleading investors about its reliance on cryptocurrency mining revenues ahead of a major market downturn.

Tech Sector Rally Pushes Nasdaq to 20,000

In the U.S. stock markets, the S&P 500 index closed the day with gains, while the Nasdaq crossed the 20,000-point threshold for the first time, buoyed by strength in the technology sector. This move was supported by U.S. inflation data, which raised expectations of an interest rate cut from the Federal Reserve. Treasury yields increased following the 10-year benchmark bond auction and data showing a widening budget deficit. The U.S. dollar strengthened. Gold prices saw a slight increase, while oil prices jumped following the European Union’s approval of additional sanctions that could threaten Russian oil supply.

Technical Overview

DXY

The U.S. Dollar Index (DXY) continues to trade within a descending wedge on the daily chart. Currently priced at 106.39, the index is holding above the 105.68 horizontal support level, suggesting the uptrend may persist for a while longer. If the trend continues, potential resistance levels are 107.34 and 110. A strong breakout above 107.34 could push the index towards 112.

Resistances: 108.00 / 110.00 / 115.76

Supports: 105.68 / 104.38 / 103.46

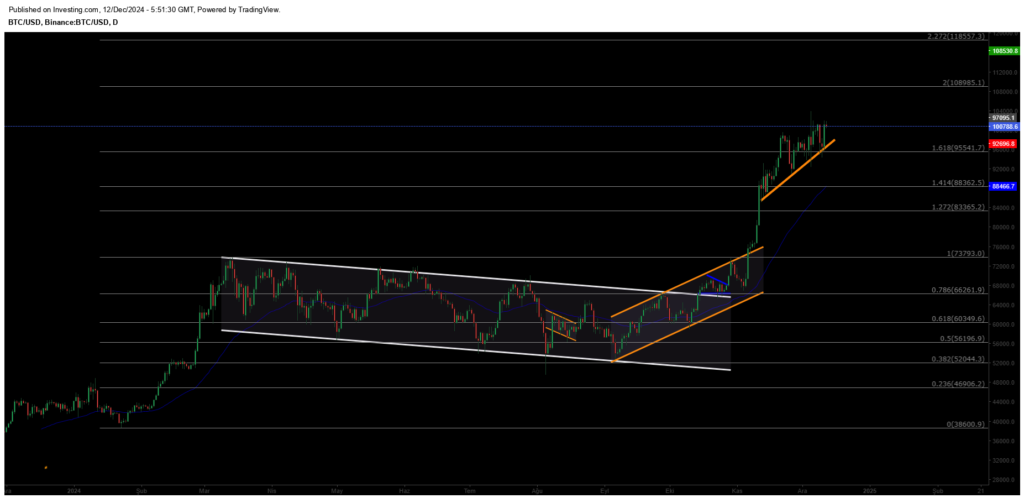

BTC/USD

Bitcoin’s uptrend has regained momentum, with the price currently at $97,691. Following recent declines, recovery efforts are ongoing. The key level to watch is $95,540. As long as this support level holds, Bitcoin may continue its climb towards $108,995. However, losing the $95,540 support could trigger a bearish trend, potentially pulling the price down to $88,362.

Resistances: 108,985 / 118,500 / 123,550

Supports: 95,500 / 88,362 / 83,365

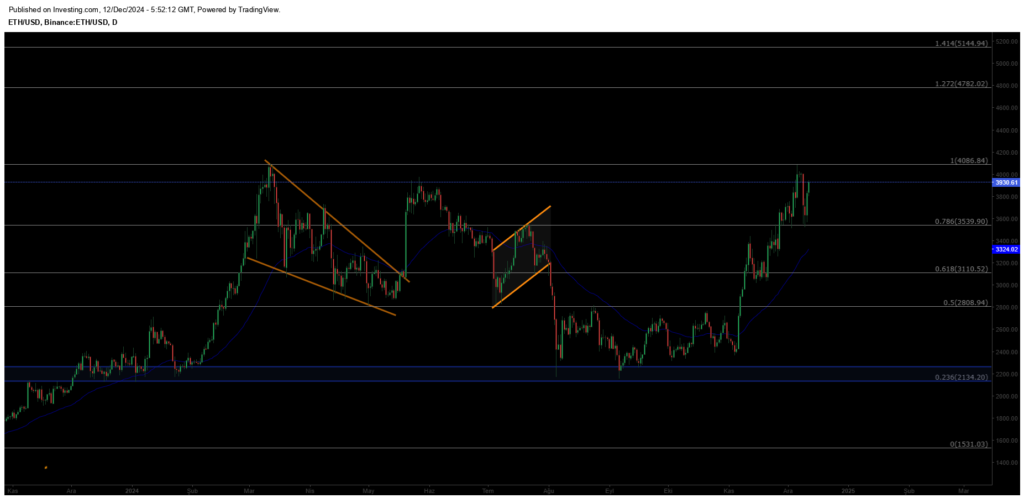

ETH/USD

Ethereum has reached its expected target of $4,086 before facing a sharp pullback. It is now trading at $3,673. The critical level to monitor is $3,539, which acts as horizontal support. As long as the price holds above this level, the outlook remains positive. However, if Ethereum closes below $3,539, the price could slide further to $3,110.

Resistances: 4,086 / 4,782 / 5,144

Supports: 3,539 / 3,110 / 2,808

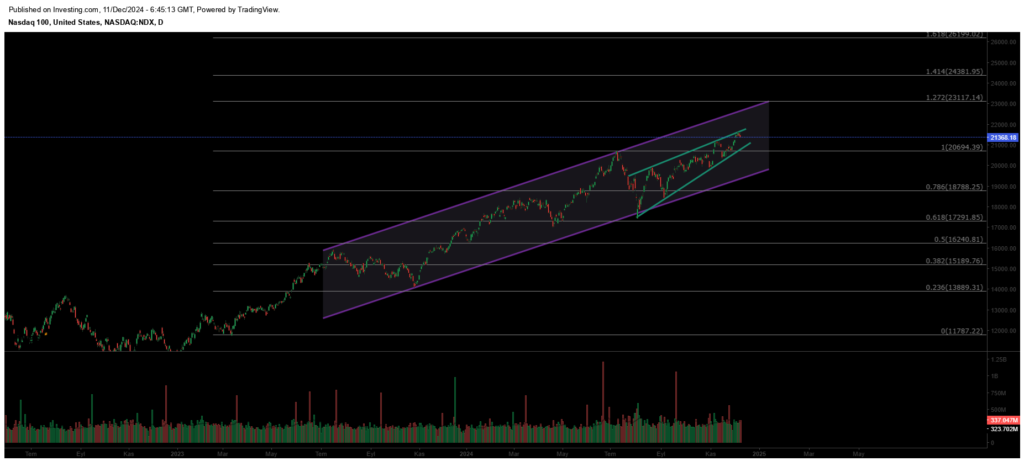

NASDAQ

The Nasdaq index continues its uptrend within a rising channel on the weekly chart. However, a wedge formation within the channel has rejected the price at the resistance level, with the index currently trading at 21,368. If the 21,700 level is surpassed and maintained, the index could break the main channel resistance and extend its rally to 22,500. On the downside, breaking below the critical 20,695 support may invite selling pressure, potentially pulling the index down to 20,000.

Resistances: 23,117 / 24,380 / 26,200

Supports: 20,694 / 18,788 / 17,291

BRENT

Brent crude has shown mid-term recovery, regaining its previously lost channel structure. Having surpassed the 76.98 resistance level, the price is likely to rise towards the 80.00–82.00 range if it maintains this level. Key support stands at 72.37, where buyers are expected to step in to sustain the trend.

Resistances: 76.15 / 85.84 / 95.53

Supports: 70.17 / 69.00 / 67.80

EURUSD

The Euro formed a double top at 1.11 and entered a downtrend. Losing the 1.10 support led to a pullback to the lower channel boundary at 1.07. After breaking the rising support level, the Euro slid to 1.046. At this critical support level, buyers are likely to re-enter the market. However, if the support is broken, the Euro may face deeper declines, potentially reaching 1.099. Price action at these levels will be pivotal in determining the next directional move.

Resistances: 1.0575 / 1.1043 / 1.1213

Supports: 1.0180 / 0.9936 / 0.9542

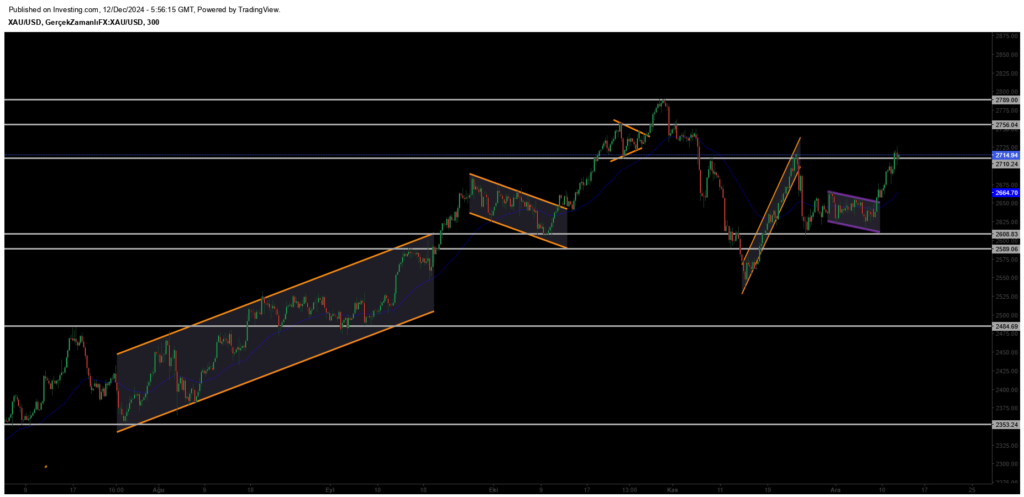

XAUUSD

Gold recovered from the 2533 level, reaching its expected target, but encountered strong selling pressure at the rising channel resistance and horizontal resistance zones. Currently trading at 2668, further pullbacks are likely. The 2652 level serves as the key support to watch.

Resistance Levels: 2708 / 2757 / 2790

Support Levels: 2622 / 2590 / 2530

Leave A Comment