Ethereum Surpasses Bitcoin

Europe’s largest digital asset management firm, CoinShares, has released its weekly crypto fund report. This time, investor preference shifted from Bitcoin funds to Ether funds. While net inflows into funds amounted to $176 million, analysts noted in the report, “Investors viewed price declines as a significant buying opportunity.”

Ether funds saw net inflows of $155 million, making them the most invested fund group, while Bitcoin funds had a mere $13 million in net inflows.

GLOBAL MARKETS

Investors are awaiting inflation data from the US, which will influence the Federal Reserve’s (Fed) monetary policy outlook. Last week, recession fears in the US and the appreciating yen led to significant sales. The market may experience movement when the US Producer Price Index (PPI) is released later today, as it could impact the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Index.

Tomorrow, the July Personal Consumption Expenditures Index is expected to show a slight increase in monthly inflation to 0.2%. Retail sales data will be released on Thursday.

Stock Market Recovery Halted by Rising Oil Prices

Wall Street stocks ended mixed as investors awaited US economic data, particularly consumer prices, to assess Federal Reserve policy expectations, amidst rising oil prices due to war concerns. Treasury yields fell as markets awaited inflation data to gauge the Fed’s policy direction. The dollar remained flat while gold prices rose. Oil prices also increased due to escalating conflicts in the Middle East.

Technical Overview

DXY

The Dollar Index (DXY) has lost its position within the falling channel due to selling pressure. If it does not attempt to re-enter the channel, we might see selling pressure extend to the 102.26 level. The key resistance level to watch is 103.23.

Resistance: 103.23 / 104.02 / 104.81

Support: 102.26 / 100.68 / 100

BTC/USD

BTCUSD continues its uptrend, with the pair recovering from a drop to $50,000 and showing a correction up to $56,652. Key resistance to watch is around $62,487.

Resistance: 60,000 / 62,000 / 64,000

Support: 56,600 / 52,500 / 47,200

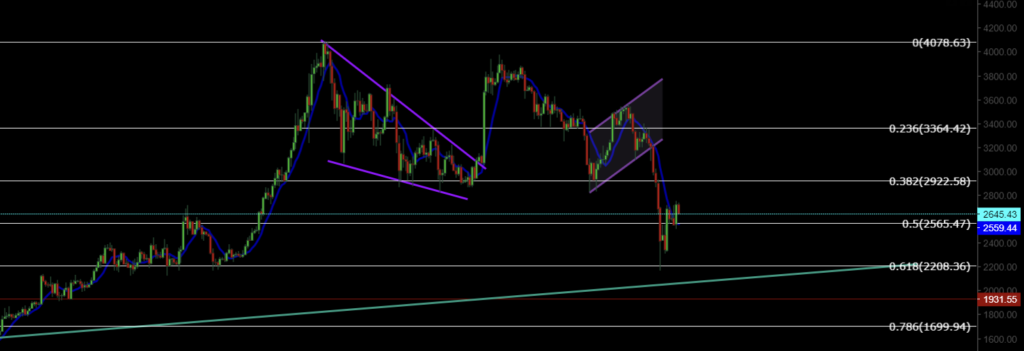

ETH/USD

ETHUSD broke its rising channel pattern, continuing potential selling pressure. Currently, it is reaching a major horizontal support level and has begun an uptrend from this point. If ETHUSD maintains above the 2565 resistance level, it could push the pair higher.

Resistance: 3364 / 4078 / 4340

Support: 2565 / 2565 / 2200

NASDAQ

The NASDAQ100 Index lost support from its rising channel pattern. Trading around the 18500 resistance level, if selling pressure increases, the index may continue its downward trend. If it loses the 16954 level, it could create new lows.

Resistance: 18500 / 18913 / 19445

Support: 18164 / 17724 / 17318

BRENT

Brent Crude Oil continues its medium-term uptrend, having risen to 82.15 after breaking a declining trend within its channel. We may see volatility with the release of oil data today. Key support level to watch is 79.84.

Resistance: 82.15 / 84.46 / 87.74

Support: 79.84 / 76.98 / 74.45

EURUSD

EURUSD managed to break the descending channel resistance and gained momentum from the channel support, trading above the 1.0881 resistance level. It experienced a pullback from the 1.098 resistance level. The ascending channel structure is being tested, and breaking through this area could lead to higher levels for EURUSD.

Resistance: 1.098 / 1.0114 / 1.012

Support: 1.088 / 1.080 / 1.071

XAUUSD

XAUUSD broke its descending channel pattern with high volume and managed to trade above the 2433 resistance level. The rising channel structure saw a pullback from the resistance level. Key support levels to watch are 2433 and 2400.

Resistance: 2477 / 2488 / 2530

Support: 2450 / 2400 / 2373

Leave A Comment