💵 💴 💶The Fed’s Rate Cut Strategy and Possible Scenarios💵 💴 💶

Federal Reserve Chair Jerome llll faces a tough decision as the central bank prepares to cut interest rates next week: Should the Fed start with small steps or take a big one? The central bank is gearing up for its first rate cut since 2020 at its meeting on September 17-18. As officials hint that they may make several rate cuts in the coming months, they are faced with questions on whether to opt for a traditional 0.25-point cut or a larger 0.5-point reduction.

GLOBAL MARKETS

The Euro (EURUSD) rose by 0.09% today to 1.1084 USD, following a 0.57% increase yesterday after the European Central Bank (ECB) made a quarter-point rate cut in line with expectations. This came after ECB President Christine Lagarde lowered rate cut expectations for October during a press conference.

SEC Chair Gary Gensler Under Investigation for Political Hiring Allegations

Republican lawmakers have accused U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler of hiring employees based on their political ideologies. They have requested documents related to the SEC’s hiring processes, suggesting that this practice might violate laws. The allegations come from the Chair of the House Financial Services Committee Patrick McHenry, House Judiciary Committee Chair Jim Jordan, and House Oversight and Accountability Committee Chair James Comer. The lawmakers have asked Gensler to provide documents showing whether political ideologies played a role in SEC hiring decisions. They claim this practice may breach the Civil Service Reform Act of 1978.In their letter, the lawmakers said, “The oversight by our committees is critical to assess whether the SEC is complying with federal laws when hiring public officials and to what extent political affiliations are influencing personnel decisions.”

Technical Overview

DXY

The Dollar Index (DXY) continues to consolidate this week. Buyers are stepping in at the 100.68 support level, and recoveries are ongoing. If the DXY closes below this level with volume, it will increase the selling pressure on the index. As long as it stays above the 100.68 support zone, its momentum will remain upward.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

BTC/USD

BTCUSD continues its recovery. To confirm the start of a short-term uptrend, it needs to trade above the 60,000 level. Key resistance levels to watch are 60,000 and 62,487. The current support level is 52,685.

Resistances: 60,000 / 62,487 / 64,290

Supports: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD broke its rising channel structure, continuing its potential selling pressure. It is currently priced at 2466, having lost its horizontal major support. The 2200 level is a key support zone to monitor where buyers may step in.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

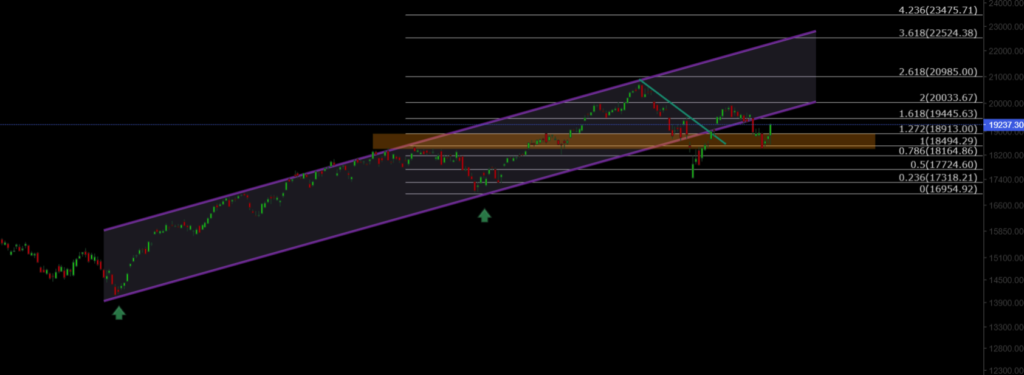

NASDAQ

NASDAQ 100 Index continues the week with a positive trend. After falling back to its channel support at the 18900 level and losing it, the index has regained upward momentum from its major support. The resistance level to watch is 19,445.

Resistances: 19,445 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,164

BRENT

Brent Crude Oil continues its medium-term correction. It has lost its support level and declined to the lower support level of its falling channel, maintaining its downward trend due to selling pressure. To resume its upward trend, it needs to break above the 74.45 level with volume.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke the rising channel resistance and managed to stay above both horizontal resistance and channel resistance, reaching the 1.114 target resistance level. It has since fallen back below the 1.11 resistance level and experienced a pullback. The key support level to monitor for EURUSD is 1.0983.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

XAUUSD

XAUUSD broke the falling channel structure significantly and reached the 2530 ATH level. With geopolitical risks continuing, gold’s decline could persist. The key support level to monitor, and where buying might emerge, is the rising support level at 2450.

Resistance: 2,530 / 2,570 / 2,600

Support: 2,488 / 2,477 / 2,450

Leave A Comment