💵 💴 💶GLOBAL MARKETS💵 💴 💶

Donald Trump Surges Ahead of Harris by 10 Points on Polymarket

Former President Donald Trump is currently leading Vice President Kamala Harris by 10 points on the Polymarket prediction platform, marking a sharp reversal from betting odds in September. The former President has also overturned Harris’s lead in 4 of the 6 swing states, now leading in Arizona, Georgia, Michigan, and Pennsylvania. Arizona and Georgia stand out as the strongest regions for the Republican candidate.

Arkham, Backed by Sam Altman, to Launch Derivatives Exchange

Arkham Intelligence, known for tracking accounts such as Mt. Gox, the U.S. government, and German state sales, and gaining visibility through a sponsorship deal with Galatasaray in Turkey, is set to launch a derivatives exchange next month. Sam Altman, co-founder of OpenAI, is among its backers, and the company has reportedly completed all preparations for the launch, according to Bloomberg’s unnamed sources. Additionally, Arkham plans to relocate its headquarters from London and New York to the Dominican Republic.

GLOBAL MARKETS

Uncertainty Surrounds China’s Fiscal Stimulus Package

The global economy’s attention is on China as Beijing prepares a fiscal stimulus package worth hundreds of billions of dollars to revive its struggling economy. However, there is uncertainty about how much of this stimulus will be directed toward consumers. During a press conference on Saturday, China’s Finance Minister Lan Fo’an revealed some spending plans to address the country’s economic challenges, but provided no clear details on the size of the stimulus package. This uncertainty may lead to market fluctuations when mainland China and Hong Kong stock exchanges open on Monday.

Technical Overview

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

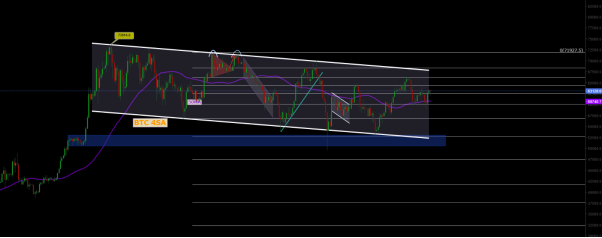

BTC/USD

The recovery in BTC/USD continues without slowing down. The 50-day moving average (MA50) support zone at 60,037 provided a solid foundation for buyers, leading to a resurgence in the upward trend. BTC/USD is now heading back towards the channel resistance, maintaining its bullish momentum. The key resistance level to watch is 66,150. A break above this level could trigger a new wave of upward movement.

Resistances: 64,290 / 66,148 / 68,350

Supports: 60,000 / 56,600 / 52,685

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

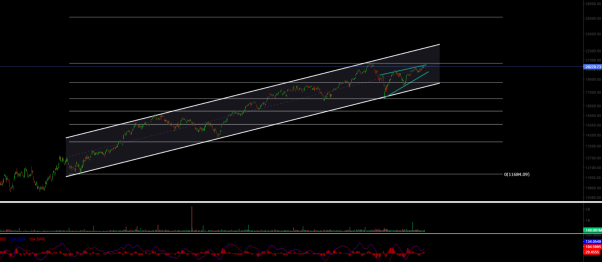

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment