💵 💴 💶GLOBAL MARKETS💵 💴 💶

October Slump Over, Crypto Inflows Rebound

During the first week of October, crypto inflows experienced a significant decline. The market saw a loss of $147 million, ending the positive inflow streak that began on September 9. During this period, investors shifted focus to the broader U.S. economy and opted for multi-asset investments. A new catalyst has emerged: the ongoing U.S. presidential elections, which are making waves in the coin market. This evolving influence is expected to guide crypto inflows as well. Bitcoin is sometimes positively, sometimes negatively impacted by the sentiment changes during the election process. For example, last week, the U.S. elections led the way with $419 million in inflows into digital asset investment products.

Uncertainty Surrounds China’s Fiscal Stimulus Package

The global economy’s attention is on China as Beijing prepares a fiscal stimulus package worth hundreds of billions of dollars to revive its struggling economy. However, there is uncertainty about how much of this stimulus will be directed toward consumers. During a press conference on Saturday, China’s Finance Minister Lan Fo’an revealed some spending plans to address the country’s economic challenges, but provided no clear details on the size of the stimulus

GLOBAL MARKETS

Asian markets rose, supported by a strong close on Wall Street yesterday and positive expectations regarding earnings. The U.S. dollar traded near its two-month high on expectations that the Federal Reserve (Fed) will opt for a smaller interest rate cut next month. The dollar has gained support from expectations that the Fed will cut rates by 25 basis points instead of 50 in November, due to the U.S. economy continuing to grow without overheating. Following reports that Israeli Prime Minister Benjamin Netanyahu told the U.S. that his country intends to strike military targets in Iran but has no desire to attack nuclear facilities or oil plants, concerns about supply disruptions eased. As a result, oil prices fell by about 3%.

Technical Overview

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

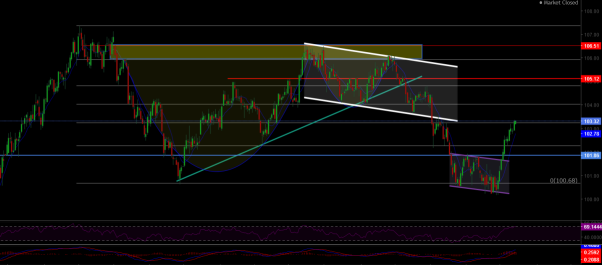

BTC/USD

The recovery in BTC/USD continues without slowing down. The 50-day moving average (MA50) support zone at 60,037 provided a solid foundation for buyers, leading to a resurgence in the upward trend. BTC/USD is now heading back towards the channel resistance, maintaining its bullish momentum. The key resistance level to watch is 66,150. A break above this level could trigger a new wave of upward movement.

Resistances: 64,290 / 66,148 / 68,350

Supports: 60,000 / 56,600 / 52,685

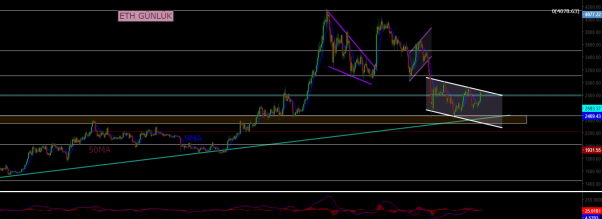

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

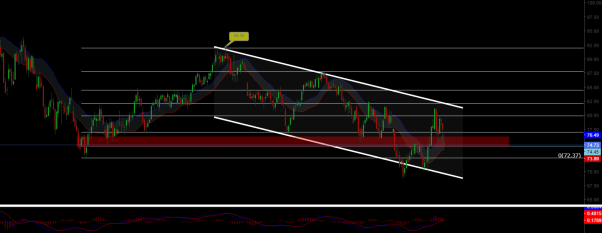

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment