💵 💴 💶GLOBAL MARKETS💵 💴 💶

Canary Capital applies for Litecoin ETF to the SEC

US-based investment management firm Canary Capital has applied for a Litecoin spot Exchange Traded Fund (ETF). In the Form S-1 application submitted to the SEC, the company named its new product the Canary Litecoin ETF. Litecoin stands out as one of the few digital assets generally not considered a security by the US SEC. As one of the oldest assets in the industry, Litecoin holds a status purely as a utility tool. This application marks the first of its kind for a Litecoin ETF product in the US. In its application, Canary Capital highlighted that Litecoin’s consistent, uninterrupted operation and its long-standing blockchain make it suitable for institutional-level usage. It is believed that Litecoin can offer institutional-level opportunities to investors. The Litecoin ETF application follows the company’s earlier XRP ETF application submitted earlier this month. With this new product, the number of digital currencies directly linked to regulated funds continues to grow.

Donald Trump’s crypto project WLFI opens for presale

World Liberty Financial, a project supported by US presidential candidate Donald Trump and his family, has begun presales for its tokens. The project platform launched token sales around 15:40 Turkish time today, but due to high interest, the site has intermittently crashed. As of 17:45 Turkish time, the platform has been inaccessible for about an hour. Over 350 million tokens sold so far. Out of a total supply of 100 billion WLFI tokens, more than 350 million have been sold to date. The project is reportedly aiming for $300 million in investments, with the total value expected to reach $1.5 billion.

GLOBAL MARKETS

Asian markets declined as global chip stocks fell after ASML, Europe’s largest technology company and chip manufacturer, announced lower sales expectations for 2025. Expectations that the US Federal Reserve (Fed) will implement small interest rate cuts continue to support the dollar. According to the CME FedWatch tool, markets are pricing in a 96% probability that the Fed will cut rates by 25 basis points next month.

Technical Overview

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

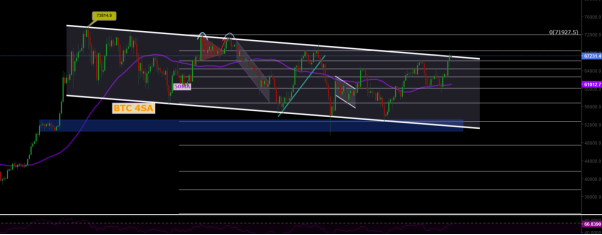

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and is currently attempting to break through this critical level with significant volume. This resistance zone holds vital importance for BTC, as a successful breakout could open the doors to a new upward trend in the cryptocurrency markets. If this strategic level is surpassed to the upside, it could trigger bullish momentum for Bitcoin and other altcoins, leading to a rally gaining traction across the market. Therefore, the current levels represent a pivotal point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

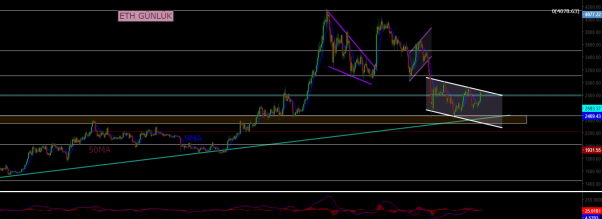

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

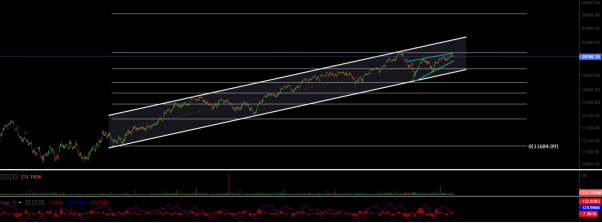

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

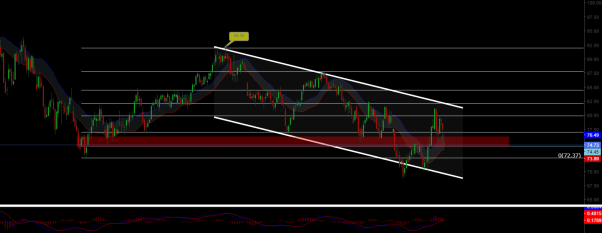

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment