💵 💴 💶GLOBAL MARKETS💵 💴 💶

SEC’s Twitter Account Hacker Arrested by FBI

FBI’s Fight Against SIM Swapping. The FBI announced today that it has arrested an individual suspected of carrying out a SIM swapping attack on the SEC’s X account in January. The hacker posted false messages from the SEC’s official account, causing an immediate $230 million liquidation in the cryptocurrency market. Legal authorities have identified 25-year-old Alabama resident Eric Council Jr. as the prime suspect in this attack.

Ukrainian Grain Sowing Progresses Well

Ukraine’s Ministry of Agriculture reported that, as of October 15, winter grain sowing areas in Ukraine had reached 4.75 million hectares, an increase from 4.5 million hectares in the same period last year. Of this area, 3.3 million hectares have been allocated for winter wheat sowing, which is higher than the 3 million hectares at the same time last year. The latest crop progress report from the US Department of Agriculture (USDA) shows that 64% of the US corn crop is in good condition, compared to 53% at the same time last year. The harvest rate has reached 47%, exceeding last year’s rate of 42% and the five-year average of 39%. Soybean harvest rate stands at 67%, compared to 57% last year and 51% in the five-year average. Finally, the winter wheat sowing rate reached 64%, close to last year’s 65% and the five-year average of 66%.

GLOBAL MARKETS

Chinese stock markets rose after the People’s Bank of China (PBOC) officially launched a swap facility aimed at boosting the stock market, but mixed trading was observed in other Asian countries’ markets following data showing slowing economic growth in China. China’s economy grew by 0.9% in the third quarter compared to the previous quarter, falling short of the 1% expectation. The dollar traded near an 11-week high, buoyed by data that allows the US Federal Reserve (Fed) to move more slowly in easing monetary policy. Increasing expectations that Donald Trump could win the US presidential election also supported the dollar. It is believed that Trump’s tax and immigration policies could drive inflation, further boosting gold to new record highs.

Technical Overview

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

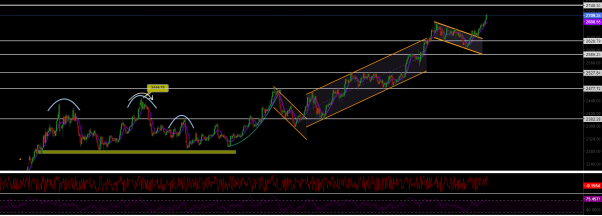

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment