💵 💴 💶SMarkets Trying to Push Powell Toward a 50 bps Thresholdtarting the Day…💵 💴 💶

The markets continue to strengthen their positions against the dollar ahead of tomorrow’s FOMC announcement. These currency dynamics are a direct result of the steady dovish repricing of interest rate expectations, and the swap market currently assigns a 70% implied probability (43 basis points) for a 50 basis point cut. Remember, the last two key data sets (employment and inflation) did not actually point to a half-point cut. Dovish expectations have risen, based on media reports last weekend suggesting that today’s decision would be close between 25 and 50 basis points.

GLOBAL MARKETS

Investors are awaiting today’s interest rate decision, which will indicate whether the Fed will opt for a larger-than-expected rate cut. Meanwhile, the dollar gave back some of yesterday’s gains, and Asian markets traded mixed. The dollar sharply fell against the yen today, giving back one-third of yesterday’s gains. Yesterday’s better-than-expected U.S. retail sales data had weakened expectations of an aggressive Fed rate cut, boosting the dollar. The yen and the euro also gained against the dollar, recovering nearly all of yesterday’s losses. The possibility of a 50 basis point rate cut by the Fed has led to volatile trading in Asia. According to LSEG data, the likelihood of a 50 basis point cut dropped to 63% earlier today before rising back to 65%. This figure stood at around 67% early yesterday.

Binance CEO Teng!

The effects of Fed rate cuts on the digital asset market remain uncertain, but indicators suggest that September’s policy changes could present a good timing opportunity for crypto investors.

Technical Overview

DXY

The Dollar Index continues to consolidate this week. The DXY has found buyers at the 100.68 support level, and the recovery continues. If the index closes below this level with volume, it will increase the selling pressure. As long as the DXY remains above the 100.68 support zone, its momentum will continue to be upward.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

BTC/USD

The recovery in BTCUSD continues. To confirm the start of a short-term uptrend, it needs to price above the 60,000 region. The resistance levels to watch are 60,000 and 62,487.

Resistance: 60,000 / 62,487 / 64,290

Support: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD broke its rising channel structure, continuing its potential selling pressure. It is currently priced at 2466, having lost its horizontal major support. The 2200 level is a key support zone to monitor where buyers may step in.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

NASDAQ

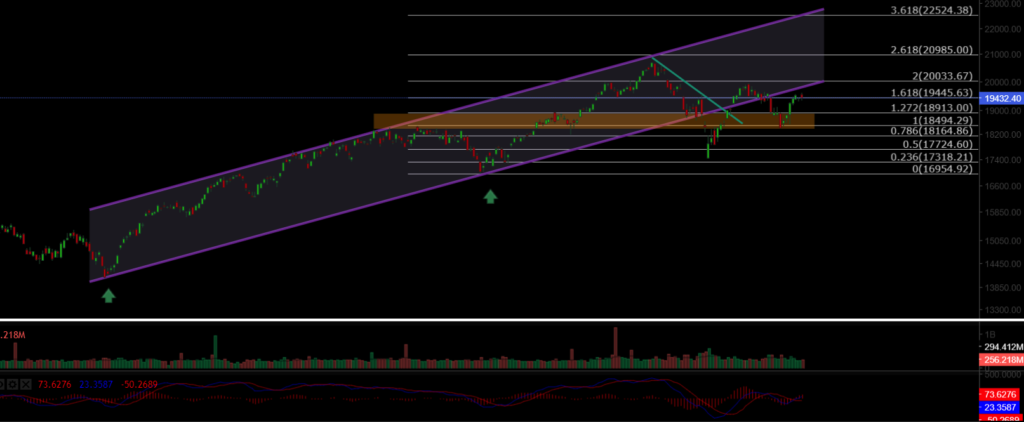

The NASDAQ100 Index continues its positive trend this week. The index fell back to and lost its channel support, dropping to the 18,900 region, but managed to re-enter the upward trend from the major support zone. The key resistance level to watch is 19,445.

Resistance: 19,445 / 20,000 / 20,985

Support: 18,913 / 18,500 / 18,164

BRENT

We see a medium-term recovery in Brent Crude Oil. Brent has regained its lost channel structure and continues its upward trend. If it reclaims the 76.98 region, it may price between 80.00 – 82.00. The key support level to monitor is at 72.37.

Resistance: 74.45 / 76.98 / 79.84

Support: 72.37 / 71.00 / 70.50

EURUSD

EURUSD has broken its rising channel resistance and managed to price above both the horizontal resistance and channel resistance. It has remained above the 1.0983 resistance zone and reached our target of 1.114. However, it lost the 1.11 resistance level due to selling pressure and saw a pullback. The key support level to watch is at 1.0983.

Resistance: 1.114 / 1.130 / 1.135

Support: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD broke the 2527 resistance level with volume and reached our target of 2585. If it closes above this region, gold’s upward trend may continue to the 2644 level. The key support level to watch in case of a pullback is 2527.

Resistance: 2585 / 2644 / 2690

Support: 2527 / 2477 / 2382

Leave A Comment