💵 💴 💶The Fed Cuts Interest Rates by 50 Basis Points to Prevent Recession💵 💴 💶

The U.S. Federal Reserve is increasingly prioritizing weakness in the labor market and is more satisfied with the inflation outlook. We expect an additional 150 basis points of rate cuts by next summer, but there is a higher risk that the central bank may need to do more. Therefore, despite stating that the economy is “growing at a solid pace,” the long-awaited 50 basis points interest rate cut has taken place. Despite core inflation being relatively “high” at 0.3% on a monthly basis and the August jobs report showing a stronger picture than expected, expectations for a larger move had increased last week.

Wall Street Trades Volatile After Fed’s Rate Cut

Today’s trading session started sluggishly before the afternoon Federal Open Market Committee (FOMC) meeting decision. The Fed cut its policy rate by 50 basis points, bringing it to the 4.75% – 5.00% range. The decision was not unanimous; Fed member Bowman preferred a 25 basis points cut. In its statement, the Fed emphasized that they had “gained more confidence that inflation is approaching the 2% target sustainably” and that “the risks of achieving employment and inflation targets are balanced.” However, in the economic projections, the unemployment rate expectation for 2024 was raised from 4.0% to 4.4%, the PCE inflation expectation was lowered from 2.6% to 2.3%, and core PCE inflation was reduced from 2.8% to 2.6%. Additionally, more rate cuts are expected in 2025 and later this year.

Fed Cuts Rates, Bitcoin Price Rises

The Federal Reserve’s decision to cut rates by 50 basis points, bringing the range to 4.75% – 5.00%, led to an immediate increase in Bitcoin’s price. While short-term market volatility is expected, analysts recommend focusing on long-term opportunities. After the Fed’s interest rate cut and its impact on Bitcoin, the price of Bitcoin (BTC) quickly surged, reaching approximately $62,302 within 5 minutes, according to CÖC data. The Fed stated in its announcement that economic activity continues to grow robustly, job gains have slowed, and the unemployment rate remains low. It also reiterated that inflation is still progressing toward the 2% target, although it remains elevated.

Technical Overview

DXY

The Dollar Index continues to consolidate this week. The DXY has found buyers at the 100.68 support level, and the recovery continues. If the index closes below this level with volume, it will increase the selling pressure. As long as the DXY remains above the 100.68 support zone, its momentum will continue to be upward.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

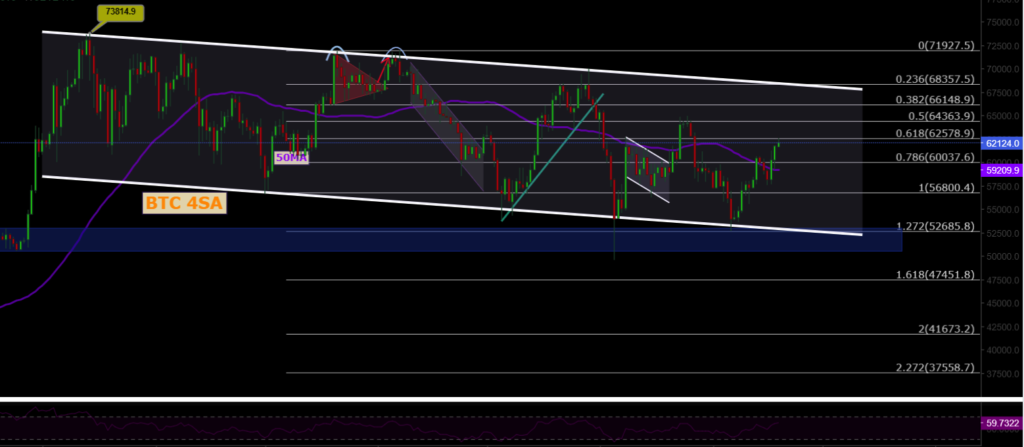

BTC/USD

The recovery in BTCUSD continues. To confirm the start of a short-term uptrend, it needs to price above the 60,000 region. The resistance levels to watch are 60,000 and 62,487.

Resistance: 60,000 / 62,487 / 64,290

Support: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD continues its potential selling pressure after breaking the rising channel structure. Currently, it is trading around 2466 after losing its horizontal major support. The key support zone to monitor is at 2200.

Resistance: 2565 / 3000 / 3364

Support: 2200 / 1700 / 1052

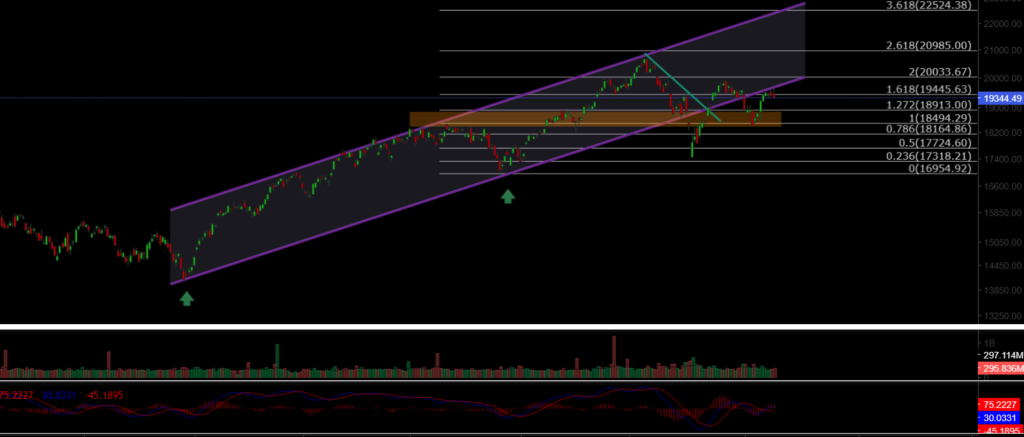

NASDAQ

The NASDAQ100 Index continues its positive trend this week. The index fell back to and lost its channel support, dropping to the 18,900 region, but managed to re-enter the upward trend from the major support zone. The key resistance level to watch is 19,445.

Resistance: 19,445 / 20,000 / 20,985

Support: 18,913 / 18,500 / 18,164

BRENT

We see a medium-term recovery in Brent Crude Oil. Brent has regained its lost channel structure and continues its upward trend. If it reclaims the 76.98 region, it may price between 80.00 – 82.00. The key support level to monitor is at 72.37.

Resistance: 74.45 / 76.98 / 79.84

Support: 72.37 / 71.00 / 70.50

EURUSD

EURUSD has broken its rising channel resistance and managed to price above both the horizontal resistance and channel resistance. It has remained above the 1.0983 resistance zone and reached our target of 1.114. However, it lost the 1.11 resistance level due to selling pressure and saw a pullback. The key support level to watch is at 1.0983.

Resistance: 1.114 / 1.130 / 1.135

Support: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD broke the 2527 resistance level with volume and reached our target of 2585. If it closes above this region, gold’s upward trend may continue to the 2644 level. The key support level to watch in case of a pullback is 2527.

Resistance: 2585 / 2644 / 2690

Support: 2527 / 2477 / 2382

Leave A Comment