💵 💴 💶US Inflation Moves Towards Fed Rate Cut💵 💴 💶

US inflation is on track to reach the 2% target by early next year, and the latest PCE Deflator data signals a green light for a rate cut in September. However, consumer spending remains robust, which might make the Fed hesitant to act aggressively. Nevertheless, a weak employment report scheduled for September 6 could increase the likelihood of a 50-basis point rate cut.

Lira Remains Stable Above 34, Data Calendar to Be Monitored

The USD/TRY, which has slowed its upward movement, continues to trade just above the 34 level as growth data is awaited. Today’s domestic agenda includes the second quarter growth figures, August’s manufacturing PMI, and the Trade Ministry’s foreign trade balance data, which will be released at 10:00. According to a Reuters survey, Turkey’s economy is expected to grow by 3.2% in the second quarter and by 3.35% for the entire year of 2024, influenced by tight monetary and fiscal policies and slowing domestic consumption. Inflation will be monitored in tomorrow’s data agenda, and the updated Medium-Term Program (OVP) is also anticipated this month. As of 08:36 this morning, USD/TRY was trading at 34.0905. The lira experienced its most significant value loss since March in August, with a depreciation of approximately 2.7%.

Telegram’s Financial Statement Shows $400 Million in Crypto Assets

Telegram, whose CEO Pavel Durov was arrested on August 24, reported in its 2023 financial statement that it held $400 million in digital assets at the end of last year. The app had around four million premium users at the end of 2023, a number that has now exceeded five million. Telegram reported an operating loss of $108 million for the year ending December 31, 2023, while generating $342.5 million in revenue. According to the Financial Times, about 40% of Telegram’s revenue comes from digital asset activities under the categories of “integrated wallet” and “collection sales.”

Technical Overview

DXY

The Dollar Index (DXY) started the week positively and retreated to the expected support level of 100.68, showing signs of recovery. It continued its downtrend by turning its lost channel support into resistance. The 100.68 level is a critical support; if lost, it could push the DXY lower.

Supports: 100.68 / 98.00 / 97.00

Resistances: 102.26 / 103.23 / 104.02

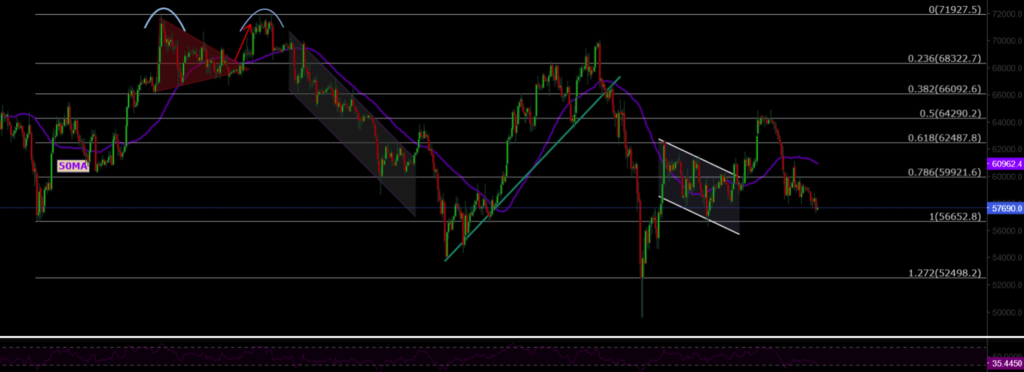

BTC/USD

BTC/USD fell below the 57,000 level. As long as the 56,650 region is not lost, the trend may gain short-term upward momentum. The key resistance levels to watch are 60,000 and 62,487.

Supports: 56,600 / 52,498 / 50,000

Resistances: 60,000 / 62,487 / 64,290

ETH/USD

ETH/USD has broken its rising channel structure, continuing potential selling pressure. Currently trading at 2,466, ETH/USD has lost its major horizontal support. The key support and strong buying zone to watch is 2,200.

Supports: 2,200 / 1,700 / 1,052

Resistances: 2,565 / 3,000 / 3,364

NASDAQ

The NASDAQ100 Index began the week with gains. Having regained its lost rising channel, it is trading at 19,500. The index may continue its upward trend if it recovers from the channel support. Volume trends are showing increased entries. The key support level to monitor is 18,913.

Resistances: 20,000 / 20,985 / 22,250

Supports: 19,445 / 18,913 / 18,500

BRENT

Brent Crude is continuing its medium-term correction. Oil is testing the support region again, showing signs of recovery. The key support level to watch is 76.98.

Supports: 76.98 / 74.45 / 72.37

Resistances: 79.84 / 82.15 / 84.46

EURUSD

EUR/USD broke its rising channel resistance and managed to stay above both horizontal and channel resistance levels. It reached the target resistance of 1.114 but has faced selling pressure. EUR/USD might test the 1.1277 level.

Resistances: 1.127 / 1.130 / 1.135

Supports: 1.117 / 1.088 / 1.080

XAUUSD

XAU/USD reached the ATH level of 2,530 by breaking out of the falling channel structure. If gold continues to decline with geopolitical risks, the key support and buying region to watch is 2,450.

Supports: 2,488 / 2,477 / 2,450

Resistances: 2,530 / 2,570 / 2,600

Leave A Comment