💵 💴 💶The TCMB Held Interest Rates Steady But Softened Tightening Stance💵 💴 💶

The Central Bank of the Republic of Turkey (TCMB) concluded that the monthly inflation trend in August did not improve in line with the year-end target (1.5% seasonally adjusted monthly). Additionally, the TCMB noted that core goods inflation remained low despite a slight increase; annual inflation in this category stood at 29% as of August. For service sector inflation, the TCMB revised its statement from “the improvement in service inflation will be delayed” to “the improvement is expected to occur in the last quarter.” In this regard, the TCMB continued to cite inflation expectations and pricing behaviors as factors posing risks to the inflation outlook. However, previous references to “stickiness in service inflation” and “geopolitical developments” were removed. The Central Bank also slightly revised its statement, now saying that “monetary policy tools will be used effectively if a significant and permanent deterioration in inflation is foreseen.” This replaced the previous statement, which mentioned that “the monetary policy stance would be tightened.”

Rate cut could trigger a Bitcoin

Rally The stock market performed strongly today. The S&P 500 rose 1.7%, the Dow Jones Industrial Average reached new all-time highs with a 1.3% gain, while the Nasdaq Composite surged 2.5%. This rise came in response to yesterday’s FOMC decision to lower the federal funds rate target by 50 basis points to the 4.75%-5.00% range. Today’s gains also reflected the belief that the economy is in good shape and that the Fed will cut rates if needed to maintain a solid economic environment. Data released this morning further supported this optimistic view. While weekly jobless claims remained near recession levels, the Philadelphia Fed Index returned to expansion territory (above 0.0) in September. Although August existing home sales fell slightly below expectations, the market remained tight.

U.S. Stocks Surge on Rate Cut Excitement

The Federal Reserve’s decision to cut interest rates by 50 basis points, bringing the range to 4.75%-5.00%, immediately caused a rise in Bitcoin prices. While short-term market fluctuations are expected following the decision, analysts recommend focusing on long-term opportunities. The Fed’s rate cut and its impact on Bitcoin The U.S. Federal Reserve met expectations from economists and traders by lowering the federal funds rate by 50 basis points to the 4.75%-5.00% range. After the decision, Bitcoin (BTC) prices rapidly increased, trading at approximately $62,302 within 5 minutes, according to CÖC data. In its statement, the Fed noted that economic activity continued to grow strongly, job gains had slowed, and the unemployment rate remained at low levels. The Fed also emphasized that inflation is still progressing toward its 2% target, though it remains high.

Technical Overview

DXY

The Dollar Index continues to consolidate this week. The DXY has found buyers at the 100.68 support level, and the recovery continues. If the index closes below this level with volume, it will increase the selling pressure. As long as the DXY remains above the 100.68 support zone, its momentum will continue to be upward.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

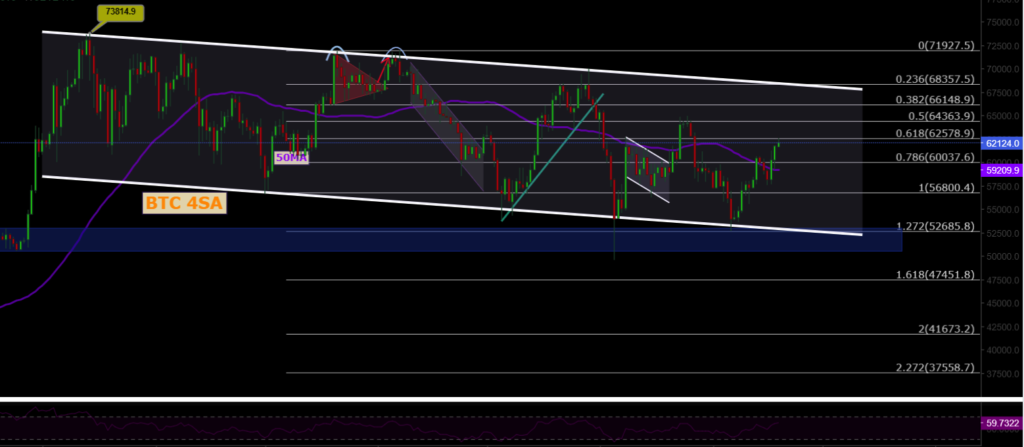

BTC/USD

The recovery in BTCUSD continues. To confirm the start of a short-term uptrend, it needs to price above the 60,000 region. The resistance levels to watch are 60,000 and 62,487.

Resistance: 60,000 / 62,487 / 64,290

Support: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD continues its potential selling pressure after breaking the rising channel structure. Currently, it is trading around 2466 after losing its horizontal major support. The key support zone to monitor is at 2200.

Resistance: 2565 / 3000 / 3364

Support: 2200 / 1700 / 1052

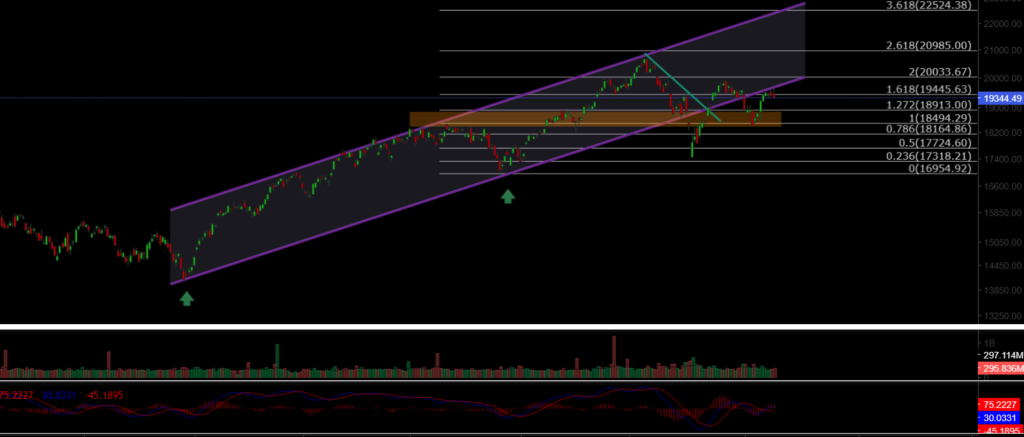

NASDAQ

The NASDAQ100 Index continues its positive trend this week. The index fell back to and lost its channel support, dropping to the 18,900 region, but managed to re-enter the upward trend from the major support zone. The key resistance level to watch is 19,445.

Resistance: 19,445 / 20,000 / 20,985

Support: 18,913 / 18,500 / 18,164

BRENT

We see a medium-term recovery in Brent Crude Oil. Brent has regained its lost channel structure and continues its upward trend. If it reclaims the 76.98 region, it may price between 80.00 – 82.00. The key support level to monitor is at 72.37.

Resistance: 74.45 / 76.98 / 79.84

Support: 72.37 / 71.00 / 70.50

EURUSD

EURUSD has broken its rising channel resistance and managed to price above both the horizontal resistance and channel resistance. It has remained above the 1.0983 resistance zone and reached our target of 1.114. However, it lost the 1.11 resistance level due to selling pressure and saw a pullback. The key support level to watch is at 1.0983.

Resistance: 1.114 / 1.130 / 1.135

Support: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD broke the 2527 resistance level with volume and reached our target of 2585. If it closes above this region, gold’s upward trend may continue to the 2644 level. The key support level to watch in case of a pullback is 2527.

Resistance: 2585 / 2644 / 2690

Support: 2527 / 2477 / 2382

🇹🇷Türkçe🇹🇷

v

Leave A Comment