💵 💴 💶GLOBAL MARKETS💵 💴 💶

Approved Bitcoin ETF Options Providers

Options trading will now be available for 11 ETF providers approved on the NYSE, including Fidelity Wise Origin Bitcoin Fund, ARK21Shares Bitcoin ETF, Invesco Galaxy Bitcoin ETF, Franklin Bitcoin ETF, VanEck Bitcoin Trust, WisdomTree Bitcoin Fund, Grayscale Bitcoin Trust, Grayscale Bitcoin Mini Trust, Bitwise Bitcoin ETF, BlackRock’s iShares Bitcoin Trust ETF, and Valkyrie Bitcoin Fund. In August 2024, the Chicago Options Exchange filed a rule change proposal to list options for spot Bitcoin ETF providers. This regulatory policy change puts Bitcoin ETF options in the same category as other commodity-based ETFs approved by the SEC for listing on CBOE, excluding Grayscale’s Bitcoin Mini Trust.

Iran’s Oil Exports

The new sanctions measures imposed by the U.S. on Iran on October 11 suggest that the U.S. could target every aspect of Iran’s oil trade and punish anyone involved. U.S. Deputy Treasury Secretary Wally Adeyemo said, “We have made it very clear that we are ready to impose more sanctions if Iran continues its destabilizing activities and attacks on Israel.” However, U.S. officials privately acknowledge that they have been hesitant to take direct action against large Chinese buyers and intermediaries in the United Arab Emirates, who have helped boost Iran’s oil exports since the second half of 2019. Despite the re-imposition of restrictions by the Trump administration at that time, Iran’s exports quickly rebounded.

GLOBAL MARKETS

Asian stocks struggled to find direction under pressure from weak Chinese stock markets, while the cryptocurrency Bitcoin surged to a three-month high, driven by pricing speculation regarding Donald Trump’s chances of re-election. Gold once again reached a historical peak as conflicts in the Middle East and the approaching U.S. elections continue to fuel a tight race. As long as uncertainty remains high, gold’s appeal is expected to continue. The spot price of gold rose to $2,727.39 per ounce today, hitting a new historical high after climbing 2.7% last week. In China, initial optimism about the economic support measures announced for the first time in September has given way to cautious waiting. Investors are now awaiting details on the measures from officials.

Technical Overview

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

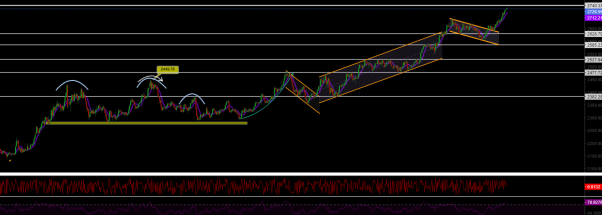

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

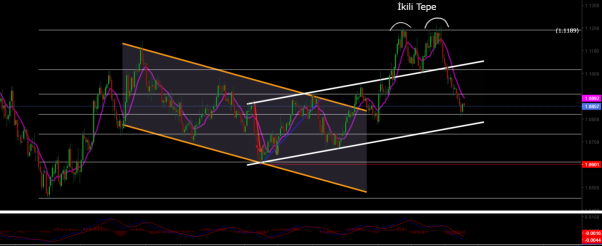

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment