💵 💴 💶Minutes Show Fed is Preparing for Rate Cuts💵 💴 💶

The minutes indicate that some policymakers considered a 0.25-point rate cut during the July 30-31 meeting to be a ‘reasonable situation.’ Federal Reserve (Fed) officials were largely in agreement about lowering interest rates in their next meeting in September. In fact, some officials even suggested that a cut could have been made in July. Fed Chair Jerome Powell acknowledged during a press conference after the July meeting that some of his colleagues were evaluating the possibility of a rate cut that day. However, he noted that “a large majority” preferred to wait until September.

Gold Hits New High While Bitcoin Shakes: A Break in Correlation!

Over the past 12 months, periods with a correlation of +0.25 or higher have seen Bitcoin following the upward movement of gold, suggesting that some investors view Bitcoin as a store of value similar to gold. However, with the increasing risk of recession, gold has reached new historical highs, while Bitcoin has experienced a roughly 13% decline over the past month. Since August 1, 2024, the correlation between gold and Bitcoin has weakened, with the correlation coefficient nearing zero. This change indicates that, amidst recession risks, investors do not yet see Bitcoin as a strong store of value.

Revisions in U.S. Employment Data Push Fed to Act

After considerable delay and confusion, we have reached final fundamental revisions in U.S. non-farm employment data. The Bureau of Labor Statistics (BLS) has aligned non-farm employment estimates with official tax data, the real reference for U.S. employment. This means a significant discrepancy of 818,000 jobs. Instead of the 2.9 million jobs added in the 12 months up to March 2024, only 2.1 million jobs were added—a 0.5% error rate in employment data. Consequently, the average monthly job growth was 178,000 instead of 246,000.

Technical Overview

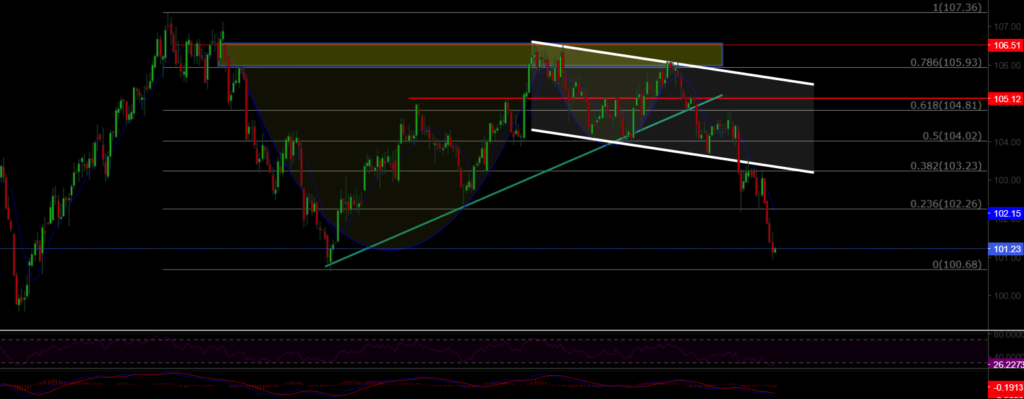

DXY

The Dollar Index continues its downtrend and has retreated to our anticipated support level of 100.68. Having turned the lost channel support into resistance, the downtrend persists. The level to watch is 100.68; if it fails to hold, a decline to 98.00 could be expected.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

BTC/USD

BTC/USD shows continued signs of recovery. The pair is trading above the channel resistance at 60,900. The key support level to watch is 59,900; breaking this level could drive the pair lower. However, sustained trading above the channel resistance could lead to an uptrend towards 62,400 and 64,300.

Resistance: 62,000 / 64,000 / 66,000

Support: 60,000 / 56,600 / 52,50

ETH/USD

ETH/USD has continued its potential selling pressure after breaking the rising channel structure. Currently, the pair is at a major horizontal support level and has started an uptrend. ETH/USD needs to break and turn the 2,565 resistance level into support for further gains. Holding above this level could push the pair higher.

Resistance: 3,364 / 4,078 / 4,340

Support: 2,565 / 2,565 / 2,200

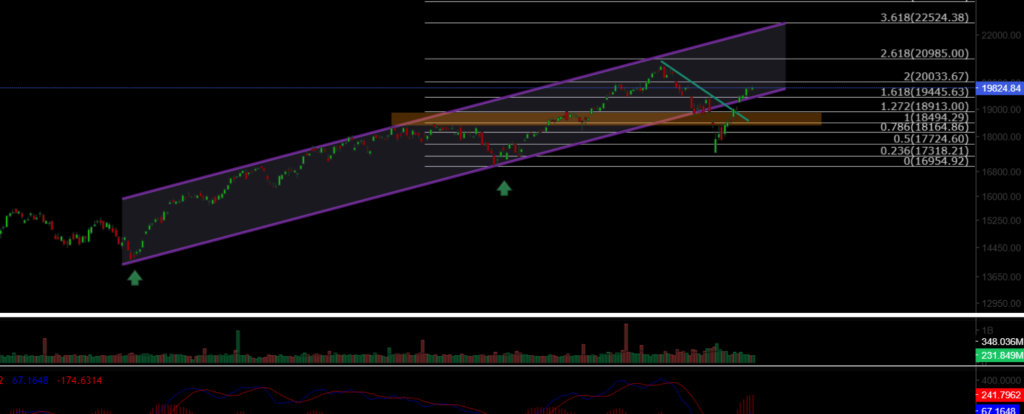

NASDAQ

The NASDAQ100 Index has regained its lost rising channel and is now trading at 19,500. Looking at volume trends, we see increased inflows into the index. The key support level to monitor is 18,913.

Resistance: 19,445 / 20,000 / 20,985

Support: 18,913 / 18,500 / 18,164

BRENT

Brent Crude Oil is continuing its medium-term correction. The support level to watch is 76.98, which could be a buying zone in case of pullbacks. A strong hold above 82.15 could push oil prices up to the channel’s upper band at 84.50.

Resistance: 76.98 / 79.84 / 82.15

Support: 74.45 / 72.37 / 70.00

EURUSD

EUR/USD has broken the rising channel resistance and has managed to trade above both the horizontal resistance and channel resistance levels. It has reached the 1.0983 resistance level and hit our target of 1.114. We might see corrections from this point. If the pair closes above the resistance level with volume, the trend could continue.

Resistance: 1.114 / 1.120 / 1.125

Support: 1.088 / 1.080 / 1.071

XAUUSD

XAU/USD has broken the rising channel structure with significant volume, trading above 2,500, a new ATH. Gold has turned the channel resistance into support. If it continues to trade within the channel, we might see pullbacks. The key support level to watch is 2,477.

Resistance: 2,530 / 2,570 / 2,600

Support: 2,488 / 2,477 / 2,450

Leave A Comment