💵 💴 💶Ripple Co-Founder Donates $10 Million XRP to Kamala Harris💵 💴 💶

Chris Larsen, Ripple’s co-founder and executive chairman, donated $10 million in XRP to a political action committee (PAC) supporting Kamala Harris in the U.S. presidential election. In an October 21st post on X, Larsen confirmed his contribution of $10 million worth of XRP to Future Forward USA, a super PAC supporting the Democratic presidential candidate. This donation follows Larsen’s previous contribution of $1 million to Future Forward in August.

Bond Yields Rise on Stronger Economic Expectations

U.S. Treasury bond yields increased as investors priced in a stronger American economy and less dovish Federal Reserve outlook. Bond yields rose after September’s employment report came in much stronger than expected. This report has reduced the likelihood of major rate cuts from the Federal Reserve in the future. Following the 50-basis point cut last month, no further rate cuts are expected. Prior to the employment report, the bond market was considering the possibility of a recession and expecting more aggressive rate cuts by the Fed. However, this report shifted investor expectations towards a stronger economic outlook and a more cautious stance from the Fed.

Gold prices took a breather after reaching record highs earlier in the day. Rising U.S. bond yields and a stronger dollar balanced the support for gold amid increasing uncertainty around the U.S. presidential election and the war in the Middle East. As 10-year bond yields rose and the dollar strengthened, gold faced pressure. Spot gold fell 0.03% to $2,719.51 per ounce, having reached a record high of $2,740.37 earlier. Meanwhile, U.S. gold futures rose 0.21% to $2,735.70 per ounce.

Technical Overview

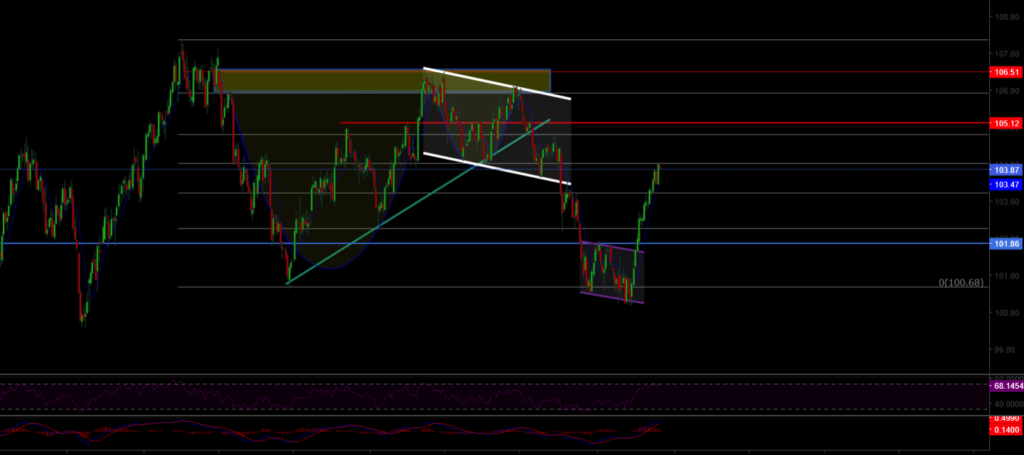

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistances: 68,350 / 71,927 / 75,000

supports: 66,148 / 64,290 / 60,000

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

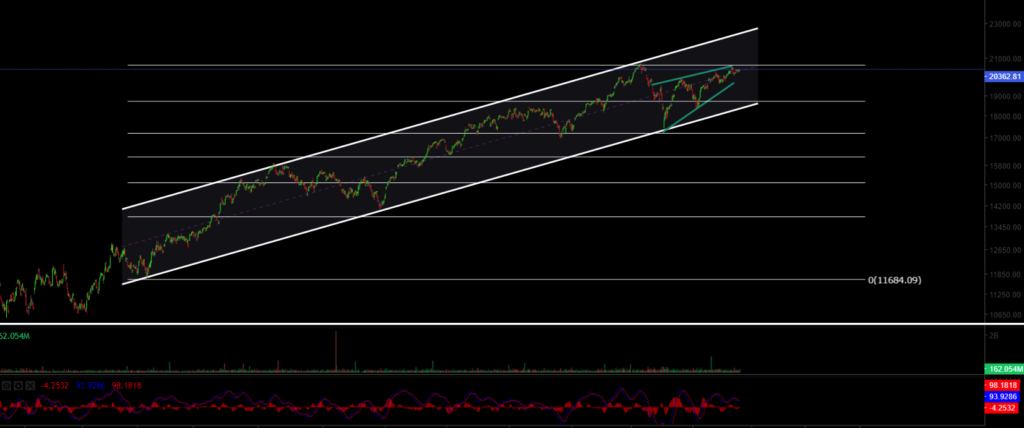

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

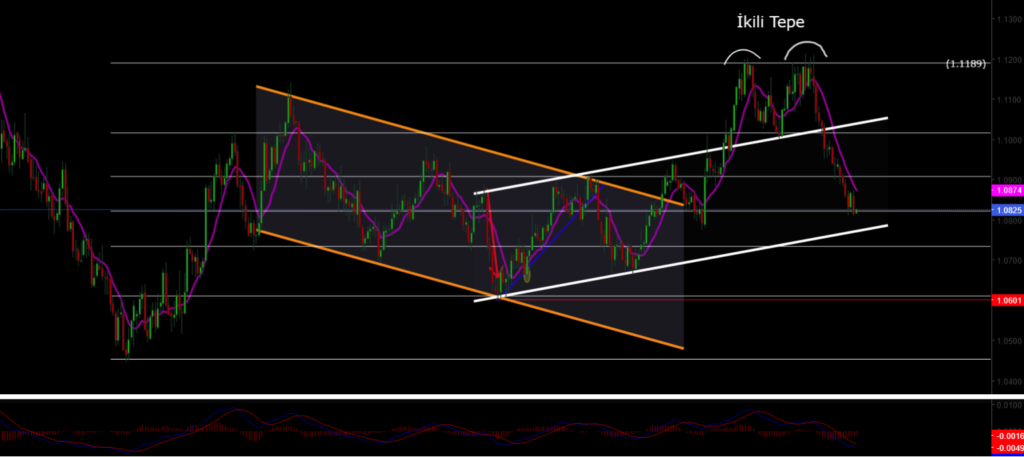

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

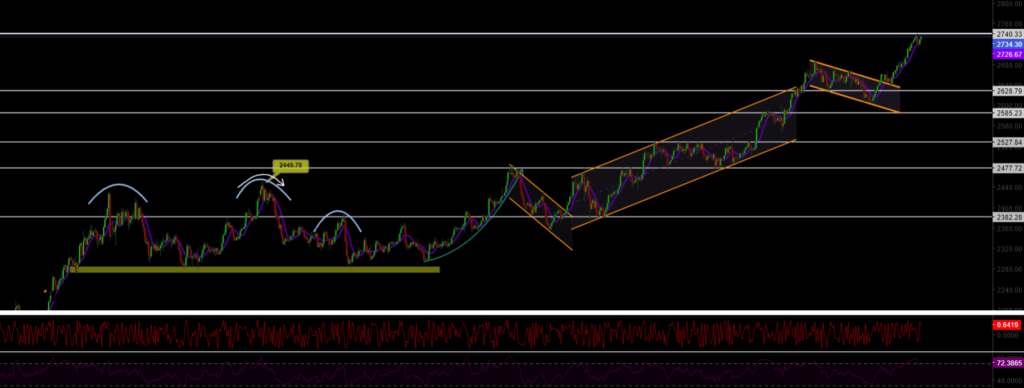

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment