💵 💴 💶ECB Minutes Open the Door for a Possible Rate Cut in September💵 💴 💶

The newly released ECB minutes from the July meeting keep the door open for a possible rate cut in September but do not commit to any definite action. In the July meeting, ECB President Christine Lagarde adopted a more cautious stance regarding the central bank’s next steps, avoiding clear forward guidance on monetary policy. The newly released minutes reflect this cautious approach: the ECB wants to keep all options on the table for the September meeting, being more attentive to growth and inflation.

A Critical Moment That Will Determine the Fate of the Economy!

Fed Chairman Jerome Powell has been determined to combat inflation over the past two years, even if it leads to a recession. Now, he is on the brink of winning this battle without collapsing the economy, but the next few months will be crucial. If successful and if he can reduce inflation without a significant increase in unemployment, it will be a historic success in central banking. Conversely, failure could lead the economy into a recession under the weight of high interest rates, proving the old adage about the Fed.

Watch Bitcoin: US Dollar Index (DXY) at Record Lows in 2024

Bitcoin (BTCUSD) regained the $61,000 level after the release of the Federal Open Market Committee (FOMC) minutes. For Bitcoin price predictions, particularly given Bitcoin’s relationship with global liquidity, there is renewed interest and positive reflections. This relationship also draws attention to how changes in the US Dollar Index (DXY) might impact BTC. Typically, when the dollar weakens, investors turn to alternative assets, boosting Bitcoin.

Technical Overview

DXY

The US Dollar Index (DXY) continues its downtrend and has fallen to the expected support level of 100.68. It has turned the lost channel support into resistance, continuing the downtrend. The support level to watch is 100.68; if this level is lost due to selling pressure, it could drop to 98.00.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

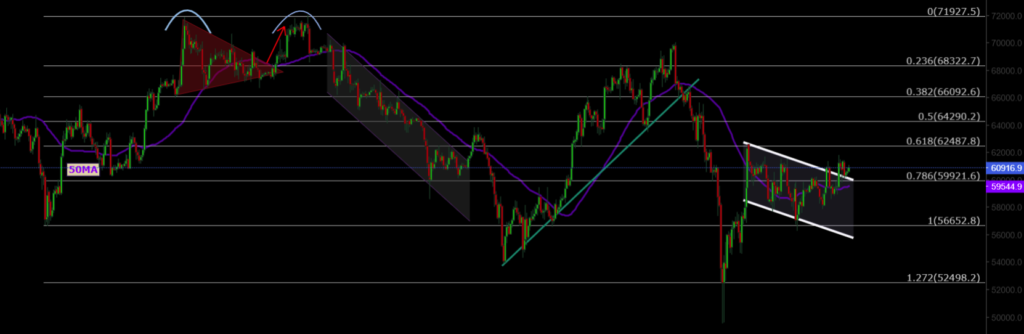

BTC/USD

BTCUSD shows continued signs of recovery. Trading around the 60,900 level, the pair remains above the channel resistance. The support level to watch is 59,900; breaking this level could push the pair to lower levels, but closing above the channel resistance with volume could drive the price to 62,400 and 64,300.

Resistances: 62,000 / 64,000 / 66,000

Supports: 60,000 / 56,600 / 52,500

ETH/USD

ETHUSD broke the rising channel structure, continuing potential selling pressure. Currently, it has reached the major horizontal support and is in an uptrend from this level. If ETHUSD breaks and turns the 2,565 resistance level into support, it could push the pair higher.

Resistances: 3,364 / 4,078 / 4,340

Supports: 2,565 / 2,565 / 2,200

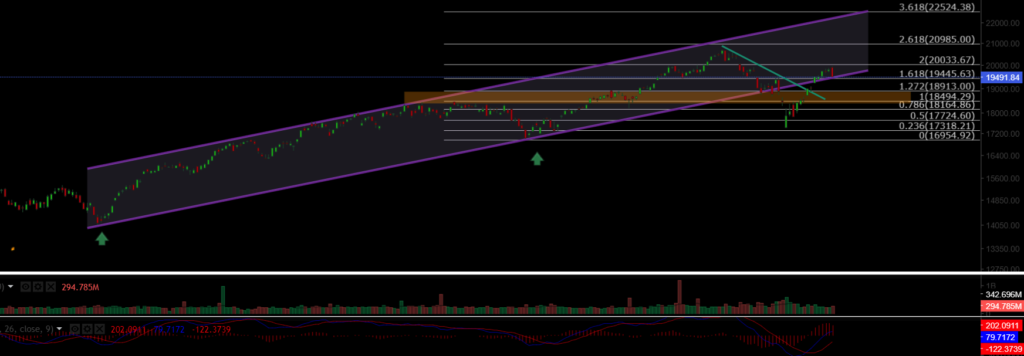

NASDAQ

The NASDAQ100 Index has regained the lost rising channel, trading around 19,500. The index may continue its uptrend by recovering from the channel support. Volume trends indicate increasing inflows. The support level to watch is 18,913.

Resistances: 19,445 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,164

BRENT

Brent Crude Oil is continuing its medium-term correction. The recent news of a Greek oil tanker being attacked by Houthi forces in the Red Sea has spurred a renewed upward trend in oil prices. The support level to watch is 76.98, which could act as a buying area during pullbacks. A strong move above the 82.15 resistance could drive the price up to the channel’s upper band at 84.50.

Resistances: 76.98 / 79.84 / 82.15

Supports: 74.45 / 72.37 / 70.00

EURUSD

EURUSD has broken through both horizontal and rising channel resistances, reaching the 1.0983 resistance level and achieving our target of 1.114. There may be corrections from this level, but if it maintains volume above the resistance, the uptrend may continue.

Resistances: 1.114 / 1.120 / 1.125

Supports: 1.088 / 1.080 / 1.071

XAUUSD

XAUUSD broke the rising channel structure with significant volume, reaching an all-time high of 2,530. Following a drop, it has re-entered the rising channel. The support level to watch is 2,477; testing the 2,500 level could lead to further corrections.

Resistances: 2,530 / 2,570 / 2,600

Supports: 2,488 / 2,477 / 2,450

Leave A Comment