💵 💴 💶Telegram Founder Pavel Durov Arrested: Reactions Intensify💵 💴 💶

Pavel Durov, founder and CEO of Telegram, has been detained by French authorities. According to Le Monde and other French media outlets, Durov was arrested at Le Bourget airport, north of Paris, after arriving on a private jet from Azerbaijan. Le Monde has referred to sources close to the case who confirmed Durov’s arrest. Additionally, Bloomberg reported that Maria Zakharova, spokesperson for the Russian Foreign Ministry, confirmed this information in a Telegram post.

GLOBAL MARKETS

Central banks should raise their intervention thresholds for economic stability. Excessive leverage can increase financial instability risks. Paradoxically, economic stability can heighten the likelihood of financial market instability.

In his speech on Friday at Jackson Hole, Fed Chair Jerome Powell’s remarks suggested a mild celebratory tone. The frightening predictions that the Fed would need to raise policy rates and drive unemployment to high levels to control inflation did not materialize. However, the Fed cannot yet declare “mission accomplished,” as the final steps may be the hardest, given ongoing services and housing inflation. Nonetheless, the American central bank has made significant progress from a 9% Consumer Price Index (CPI) inflation in June 2022 to below 3% last month. While trying to understand how this has occurred, we cannot ignore the potential risks.

Oil Market: Supply Surplus and Price Drops

As we approach 2025, expectations for a supply surplus and price declines in the global oil market are strengthening. Economic slowdown in China, the rise of electric vehicles, and a halt in U.S. shale oil production are pressuring demand growth, while non-OPEC supply falls short of expectations, disrupting market balances. Brent crude oil prices are forecasted to be around $75 per barrel in 2025, indicating a challenging period ahead for the oil markets.

Technical Overview

DXY

The Dollar Index (DXY) started the week with a bearish trend, retreating to our anticipated support level of 100.68. Losing its channel support, it has continued its downtrend. The key support to watch is the 100.68 level, where we might see a rebound. However, if this level is lost, it could fall to around 98.00.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

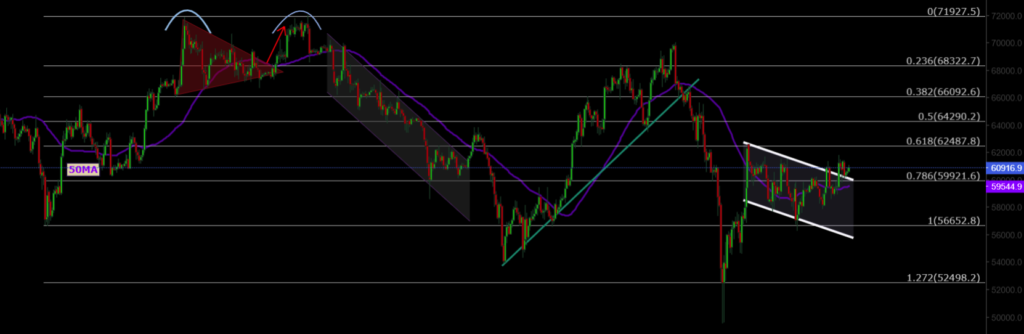

BTC/USD

BTC/USD shows continued signs of recovery. The pair has broken its channel resistance at the 64,000 level and continues its upward trend. Powell’s statements regarding potential future interest rate cuts have spurred a rise in cryptocurrencies. The key support level to monitor is 62,487.

Resistance: 64,290 / 66,000 / 68,300

Support: 62,487 / 60,000 / 56,600

ETH/USD

ETH/USD has continued its potential selling pressure after breaking its rising channel structure. Currently reaching a major horizontal support level, ETH/USD is trying to turn the 2,565 resistance level into support. Sustaining above this level could push the pair higher.

Resistance: 3,000 / 3,364 / 4,078

Support: 2,565 / 2,565 / 2,200

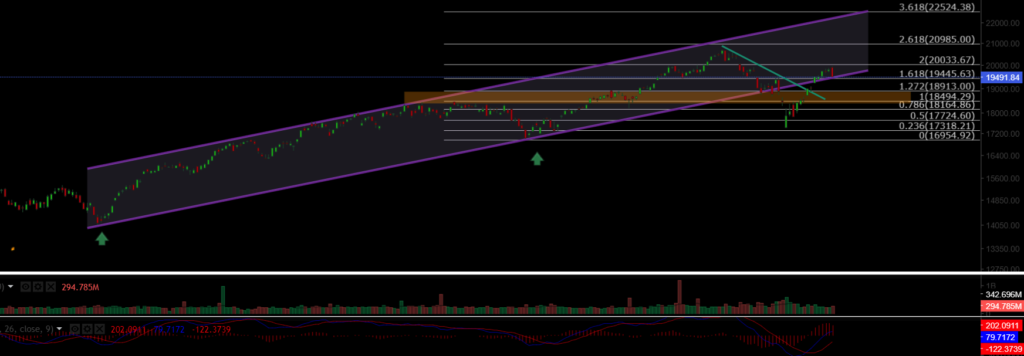

NASDAQ

The NASDAQ100 Index started the week with a bullish trend. It has regained its lost rising channel and is now priced at 19,500. The index could continue its upward trend if it recovers from the channel support. Volume trends show increasing inflows. The key support level to watch is 18,913.

Resistance: 20,000 / 20,985 / 22,250

Support: 19,445 / 18,913 / 18,500

BRENT

Brent Crude Oil is continuing its medium-term correction. Recent news of a Greek oil tanker being attacked by Houthi forces in the Red Sea has led to a renewed attempt to enter an upward trend. The support level to watch is 76.98, where buying might occur during pullbacks. If the resistance at 82.15 is gained with significant volume, oil could rise to the channel’s upper band resistance of 84.50.

Resistance: 76.98 / 79.84 / 82.15

Support: 74.45 / 72.37 / 70.00

EURUSD

EUR/USD has broken its rising channel resistance and is now trading above both horizontal and channel resistances. It has reached the 1.114 target resistance level from 1.0983. If the pair maintains above 1.11, the next target for EUR/USD could be 1.1277.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

XAUUSD

XAUUSD broke the rising channel structure with significant volume, reaching an all-time high of 2,530. Following a drop, it has re-entered the rising channel. The support level to watch is 2,477; testing the 2,500 level could lead to further corrections.

Resistances: 2,530 / 2,570 / 2,600

Supports: 2,488 / 2,477 / 2,450

Leave A Comment