💵 💴 💶US Stock Markets Close Lower Due to Nvidia Drop💵 💴 💶

US stock markets closed lower due to a drop in Nvidia shares, while investors await an important inflation report set to be released on Friday. Both the S&P 500 and Nasdaq indices fell due to Nvidia’s decline, and investors are adopting a cautious stance ahead of upcoming inflation data from the US.

Telegram CEO’s Detention Extended, India Launches Investigation

Russian Foreign Ministry has requested consular access following the detention of Pavel Durov, the CEO and founder of Telegram, in France. Durov was arrested upon arriving at Paris’ Le Bourget Airport on his private jet. Russian officials describe this as a hostile act.

Strong Russian Reaction

The Russian Embassy in France reported that French authorities have not responded to requests for access to Durov. Russian officials insist on the protection of Durov’s rights and access to consular services. According to French media, Durov faces charges related to money laundering and pedocriminal content due to alleged lack of oversight on the Telegram platform. Telegram has stated that it complies with EU laws and that Durov frequently travels within Europe. Following Durov’s arrest, prominent figures like Elon Musk and Vitalik Buterin have expressed their support. Toncoin’s value dropped by 13% after this news.

Gold Tests $2530 High Again

Following Fed Chairman Jerome Powell’s speech at the Jackson Hole Symposium indicating that the time for a rate cut has come, gold started the new week with upward momentum. The ongoing conflict between Israel and Hamas, along with escalating tensions between Israel and Hezbollah, has further pushed investors towards gold as a safe haven. Gold reached $2525.825 per ounce and is currently trading at $2524.80, up 0.49% from Friday.

Technical Overview

DXY

The US Dollar Index (DXY) began the week with a bearish tone, falling to the anticipated support level of 100.68. The loss of channel support has turned it into resistance, continuing the downward trend. A key support level to watch is 100.68, which might see a recovery. However, if this level is lost, DXY could drop to 98.00.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

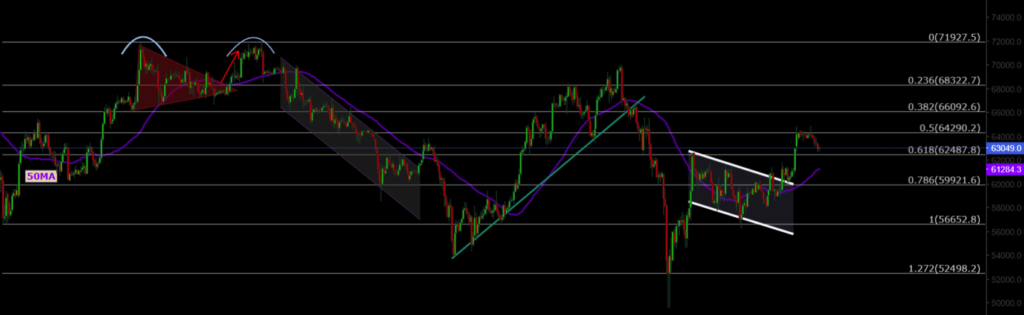

BTC/USD

BTC/USD shows signs of recovery. Trading at $64,000, the pair has broken the channel resistance and continued its upward trend. Powell’s statements regarding potential rate cuts have also boosted cryptocurrencies. Key support to watch is at $62,487.

Resistance: 64,290 / 66,000 / 68,300

Support: 62,487 / 60,000 / 56,600

ETH/USD

ETH/USD broke its rising channel pattern and continues to face potential selling pressure. Currently at a horizontal major support level, ETH/USD is aiming to break and hold above the $2565 resistance to move higher.

Resistance: 3000 / 3364 / 4078

Support: 2565 / 2200 / 1700

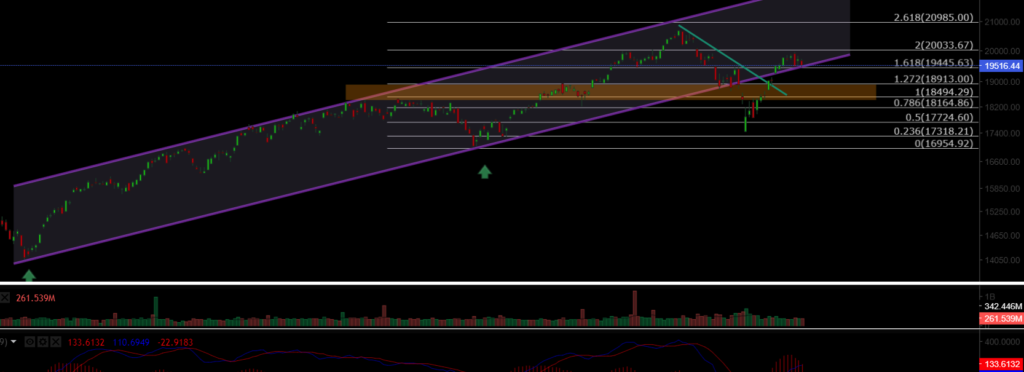

NASDAQ

The NASDAQ 100 Index began the week positively, regaining its lost rising channel and trading at 19,500. The index may recover and continue its upward trend from the channel support. Volume trends are increasing, indicating positive momentum. A key support level to watch is 18,913.

Resistance: 20,000 / 20,985 / 22,250

Support: 19,445 / 18,913 / 18,500

BRENT

Brent Crude Oil is continuing its medium-term correction. An incident involving a Greek oil tanker being attacked in the Red Sea by Houthi forces has led to renewed interest in oil. The support level is at 76.98, which could serve as a buying area in case of pullbacks. A significant resistance level is 82.15; breaking this could push oil towards the channel’s upper band at 84.50.

Resistance: 76.98 / 79.84 / 82.15

Support: 74.45 / 72.37 / 70.00

EURUSD

EUR/USD broke its rising channel resistance and has successfully maintained above both the horizontal and channel resistances. The pair reached the 1.114 target resistance. If it stays above 1.11, the next target could be 1.1277.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

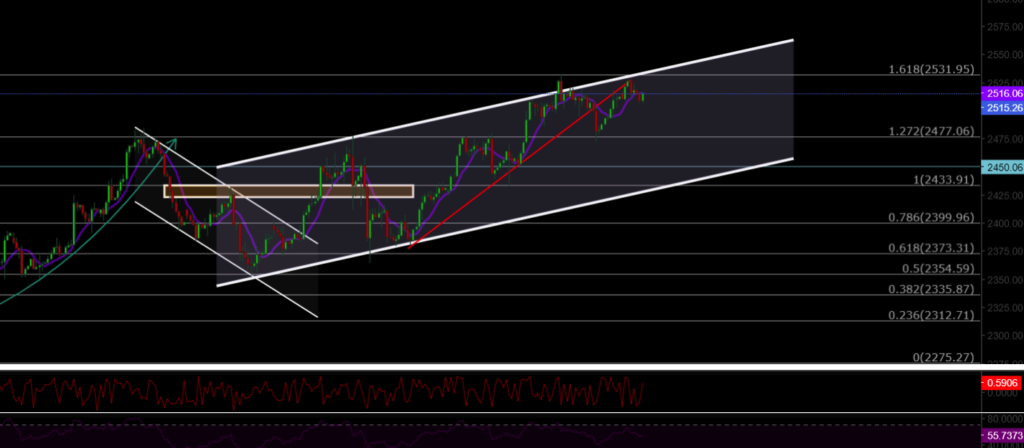

XAUUSD

XAU/USD broke out of its rising channel and reached a high of $2530. It has since re-entered the channel but lost the rising support. Currently, gold is receiving support at the $2477 level. A key resistance to monitor is $2530, which if breached, could lead to further adjustments.

Resistance: 2530 / 2570 / 2600

Support: 2488 / 2477 / 2450

Leave A Comment