💵 💴 💶Robinhood plans to issue a stablecoin.💵 💴 💶

The S&P 500 hit a new record today, driven by Micron’s (+14.7%) better-than-expected earnings report, signals of stimulus from China, and positive unemployment data. The semiconductor stocks led this surge. It was a profitable day not only for the S&P 500 but for other indices as well. Overall buying interest was fueled by the expectation that global growth would strengthen, as the Fed, the European Central Bank, and the People’s Bank of China continue to move toward more accommodative monetary policies. Other central banks are following suit. For example, the Swiss National Bank lowered its policy rate by 25 basis points to 1.00% and indicated that further cuts could come. Mexico’s central bank also lowered its policy rate by 25 basis points, bringing it down to 10.50%.

W

all Street Rises on Strong Economic Data Ahead of PCESweden’s Riksbank is expected to cut interest rates by another 25 basis points today. Governor Erik Thedeen and his colleagues have signaled three rate cuts by the end of the year, offering clear forward guidance to the markets. While there is modest speculation of a 50 basis point cut at one of these meetings, we believe signs of stability in the Swedish economy should deter moves larger than 25 basis points. Markets have fully priced in today’s expected 25 basis point cut, and we will likely hear a reiteration of the rate-cutting commitment for this year. As a result, SEK should remain largely sensitive to external factors since the rate-cutting cycle appears priced in, and Riksbank seems to be following a stable and predictable path. EUR/SEK may face some pressure and could test the 11.20 level in the short term.

D

ovish 25 bps Rate Cut by the Swiss National BankThe Swiss National Bank cut its policy rate by 25 basis points to 1%, as expected, due to a noticeable decline in inflationary pressures. Inflation in Switzerland fell from 1.3% in July to 1.1% in August. While this rate remains within the SNB’s target range of 0-2%, it is significantly below the SNB’s forecasts. This drop is attributed to weaker-than-expected price increases in imported goods and services following the appreciation of the Swiss franc. The SNB significantly revised its conditional inflation forecasts downward. It now expects average inflation to be 1.3% in 2024, 0.6% in 2025, and 0.7% in 2026. These figures are much lower than the June forecasts of 1.3%, 1.1%, and 1%, respectively. For the first half of 2027, inflation is projected to be 0.6%.

Technical Overview

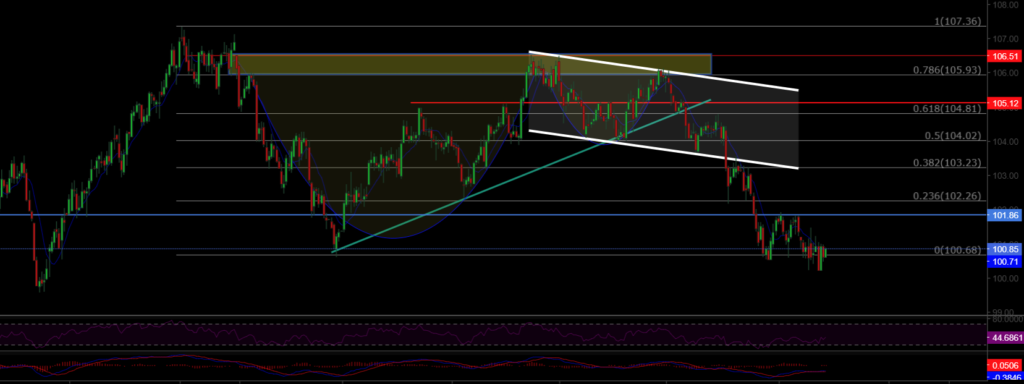

DXY

The Dollar Index continues to consolidate this week. The DXY continues to recover after finding buyers at the 100.68 support level. If it closes below this region with volume, the selling pressure on the index will increase. As long as it remains above the 100.68 support region, its momentum will be upward.

Resistance levels: 102.26 / 103.23 / 104.02

Support levels: 100.68 / 98.00 / 97.00

BTC/USD

Resistance levels: 64,290 / 66,148 / 68,350

Support levels: 62,487 / 60,000 / 56,600

ETH/USD

ETHUSD has broken out of its ascending channel, continuing to experience potential selling pressure. It continues to hover around the 2,600 level, having lost its horizontal major support. The 2,200 level should be watched as a region of strong support. For the uptrend to continue on the ETH side, it needs to close with volume above the major resistance level of 2,922.

Resistance levels: 2,565 / 3,000 / 3,364

Support levels: 2,200 / 1,700 / 1,052

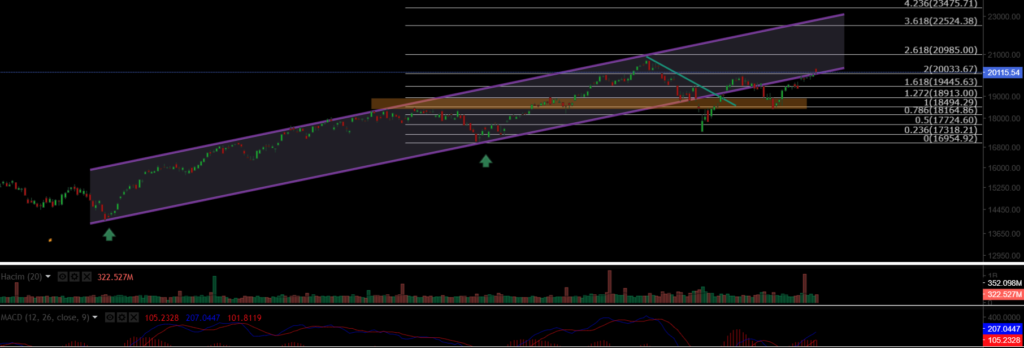

NASDAQ

The NASDAQ100 index continues the week with gains. After pulling back and losing its channel support, the index retreated to the 18,900 region but managed to re-enter its upward trend from the major support region. The 19,445 region stands out as the resistance level to watch.

Resistance levels: 19,445 / 20,000 / 20,985

Support levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is seeing medium-term recoveries. Having regained its lost channel structure, oil continues its upward trend. If it reclaims the 76.98 level, it could price up to the 80.00–82.00 level. The 72.37 region stands out as the support level to watch.

Resistance levels: 74.45 / 76.98 / 79.84

Support levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD has broken its ascending channel resistance and managed to price above both horizontal and channel resistance. It has remained above the 1.0983 resistance region and reached our target resistance level of 1.114. It then lost the 1.11 resistance level under selling pressure, leaving behind a deviation and pulling back. The 1.0983 level stands out as the support level to watch in EURUSD.

Resistance levels: 1.114 / 1.130 / 1.135

Support levels: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD continues to trade above the 2645 resistance level after breaking out of the rising channel structure with significant volume. As long as it remains above this current resistance, the price is expected to maintain its upward trend. We should monitor the 2644 level as a key support zone.

Resistance levels: 2690 / 2720 / 2750

Support levels: 2644 / 2585 / 2527

Leave A Comment