💵 💴 💶Opportunity for Ethereum Investors💵 💴 💶

With the decline in Ethereum’s price and the general downturn in the market, a wave of panic has started. The 8.3% drop in the last 24 hours has led investors to sell off their holdings. According to the Realized Loss Indicator, $144 million worth of ETH was sold in one day. This indicator measures the total losses incurred from the ETH sold in the past 24 hours. The intention behind this move was not to profit but to balance losses, and it seems investors still ended up at a loss. This panic selling does not reflect the broader market sentiment. The $144 million in losses represents only 0.65% of Ethereum’s $22.03 billion 24-hour trading volume.

Libya Oil Supply Disruption

Following news of a potential halt in oil production in Libya due to political conflicts, oil prices rose again to over $81 per barrel, increasing by more than 3%. The internationally recognized Tripoli-based government wants to replace the current central bank governor. However, the unrecognized eastern Libyan government supports the current governor and is using this as a negotiation tactic, threatening to halt oil production. Since Libya’s oil production is between 1.1-1.2 million barrels per day, this situation is significant for the oil market.

GLOBAL MARKETS

Asian stocks fell in line with Wall Street futures, despite AI giant Nvidia’s revenue increase. Nvidia disappointed investors who were expecting its investment in the sector’s future to drive stock prices higher. The dollar remained stable while Treasury yields came close to turning positive. Investors are awaiting U.S. weekly jobless claims data and inflation figures from Germany and Spain for clues on future interest rate cuts by the Federal Reserve (Fed) and the health of the labor market.

Technical Overview

DXY

The Dollar Index started the week on a bearish note and retreated to the support level of 100.68, the area we had anticipated. Having lost its channel support, the index turned it into a resistance and continued its downtrend. The 100.68 level is a key support to watch; a rebound could occur from this area, but if it is lost under selling pressure, it could drop to around 98.00.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

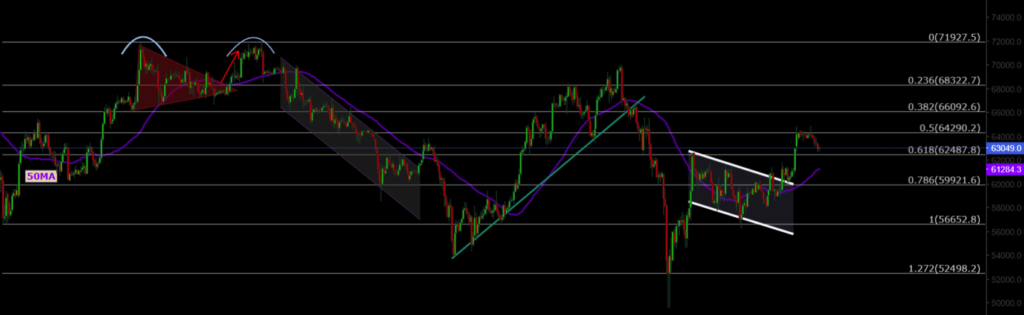

BTC/USD

Bitcoin (BTC/USD) fell below the 60,000 mark. As long as the 56,650 level is not breached, the trend could gain short-term upward momentum. Key resistance levels to watch are 60,000 and 62,487.

Resistance: 60,000 / 62,487 / 64,290

Support: 56,600 / 52,498 / 50,000

ETH/USD

Ethereum (ETH/USD) has broken its rising channel structure and is experiencing potential selling pressure. Currently trading around the major support of 2,466, the critical level to watch is 2,200, where buying interest may be strong.

Resistance: 2,565 / 3,000 / 3,364

Support: 2,200 / 1,700 / 1,052

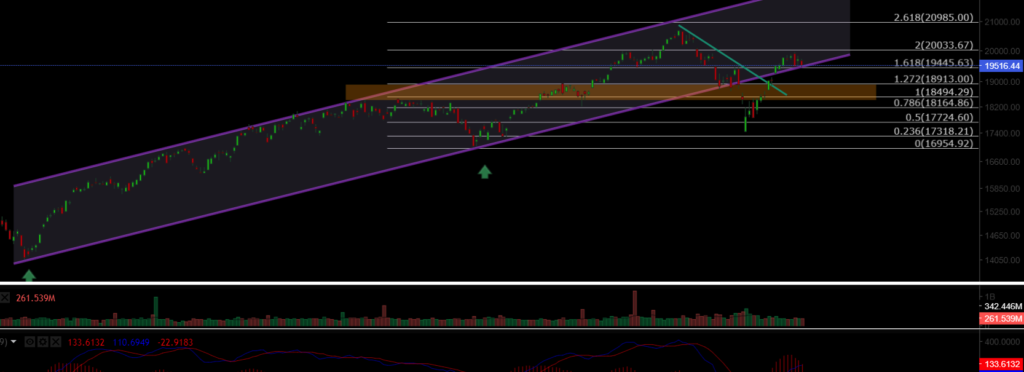

NASDAQ

The NASDAQ 100 Index started the week with a bullish trend. After regaining its lost rising channel, the index is trading around 19,500. It could continue its uptrend if it recovers from the channel support. The volume trend indicates increasing buying interest. Key support to watch is the 18,913 level.

Resistance: 20,000 / 20,985 / 22,250

Support: 19,445 / 18,913 / 18,500

BRENT

Brent Crude Oil continues its medium-term correction. It showed recovery signals but retreated after the latest oil data. The key support level to watch is 76.98.

Resistance: 79.84 / 82.15 / 84.46

Support: 76.98 / 74.45 / 72.37

EURUSD

EUR/USD broke through the rising channel resistance and is trading above both horizontal and channel resistance levels. It has reached the target resistance of 1.114 and remains above the 1.11 resistance level. If it stays above this level, the next target could be 1.1277.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

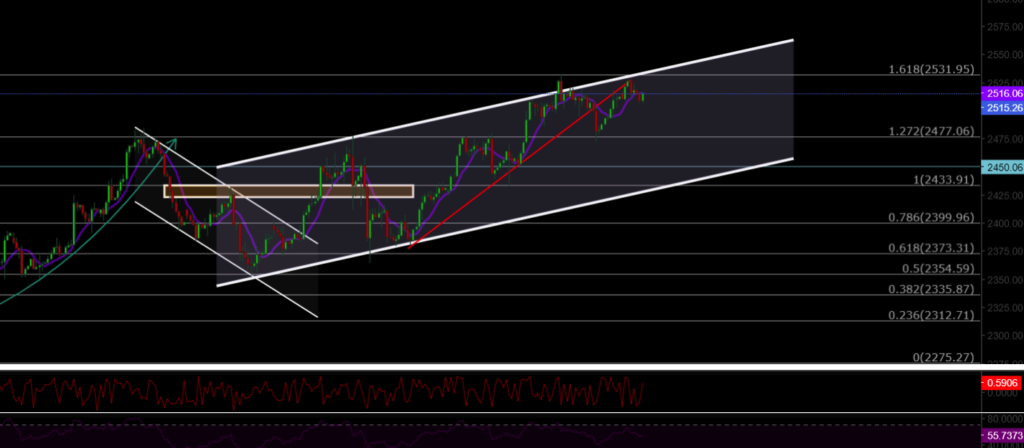

XAUUSD

Gold (XAU/USD) broke its falling channel structure with high volume and reached an all-time high (ATH) of 2,530. It continues to trade within a rising triangle formation. Volume closures above 2,530 will push gold to new ATH levels. Key support levels to watch are 2,500 and 2,477.

Resistance: 2,530 / 2,570 / 2,600

Support: 2,488 / 2,477 / 2,450

Leave A Comment