💵 💴 💶China’s Crypto Warning to Banks: Now They Must Report💴 💶

In China, where cryptocurrencies have been banned since 2021, the State Administration of Foreign Exchange (SAFE), the government body responsible for overseeing foreign exchange transactions, issued a new set of warnings to banks. SAFE has mandated that banks must report transactions or transfers they consider risky. Despite the ban on cryptocurrencies, investors in China are known to use VPNs and decentralized finance platforms to carry out crypto transactions. Some citizens also conduct transactions through Hong Kong, where cryptocurrencies are not banned.

GLOBAL MARKETS

Chinese stock markets, which sharply declined yesterday due to concerns over economic growth and fears of a potential trade war initiated by Donald Trump when he takes office on January 20, remained flat today.

Geopolitical Risks: Europe and BeyondGeopolitical risks remain on investors’ radars at the beginning of the new year. The diminishing role of Russia in energy markets and uncertainties surrounding U.S. trade policies are among the factors that could create market volatility. The potential impact of trade tariffs on global growth will be closely monitored in early 2025.

Technical Overview

DXY

On the daily chart, the DXY index broke out of a falling wedge pattern and is continuing its upward trend. Currently trading at 109.10, the DXY is expected to maintain its upward trend unless the horizontal support level at 105.68 is breached. If the trend continues, the resistance levels to watch are 112.34 and 115. If the price consolidates significantly at the 112.34 level, the trend could potentially extend to 112.

Resistance Levels: 112.34 / 115.00 / 120.76

Support Levels: 107.34 / 105.68 / 104.38

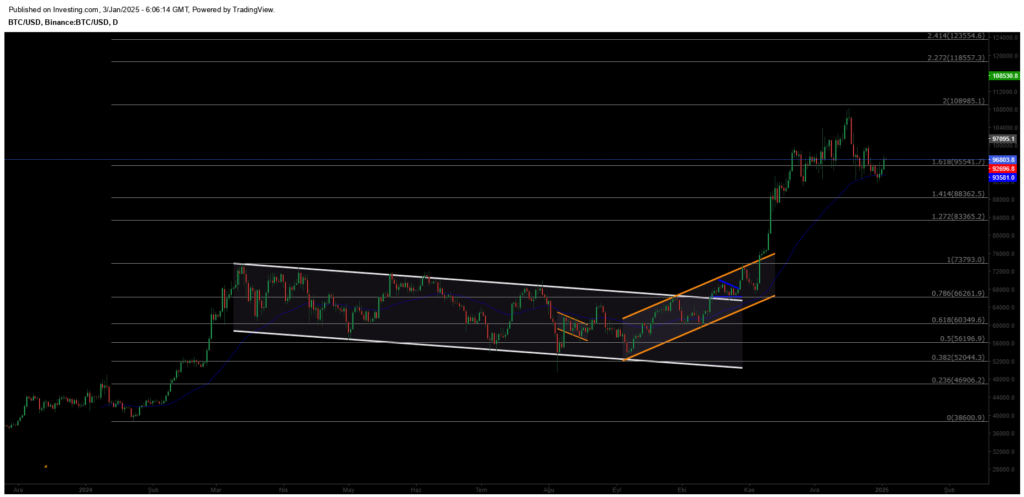

BTC/USD

Bitcoin’s recovery process continues to gain momentum. Currently trading at 96,800 USD, Bitcoin’s critical support level stands at 87,956 USD. As long as Bitcoin stays above this level, the upward trend has the potential to extend to 108,995 USD. However, if the 92,000 USD support level is lost, a downward trend could see the price drop to 88,362 USD.

Resistance Levels: 108,985 / 118,500 / 123,550

Support Levels: 92,000 / 88,362 / 83,365

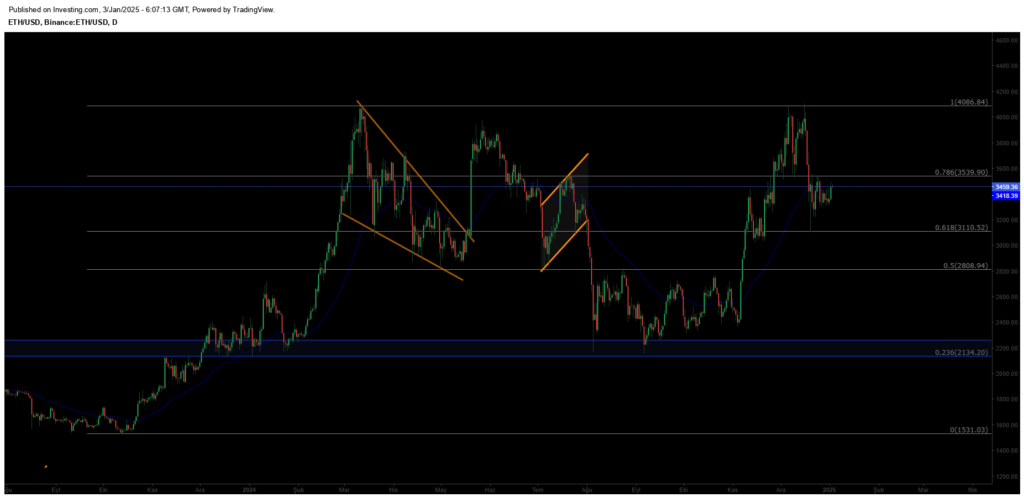

ETH/USD

Ethereum recently reached the anticipated target of 4,086 USD before experiencing a sharp pullback. It is currently trading at 3,459 USD. The critical level to watch here is 3,110 USD, which serves as a horizontal support point. As long as there is no significant close below this level, the outlook remains positive. However, if the support level is breached, the price could potentially decline to 2,808 USD.

Resistance Levels: 3,539 / 4,086 / 4,782

Support Levels: 3,110 / 2,808 / 2,134

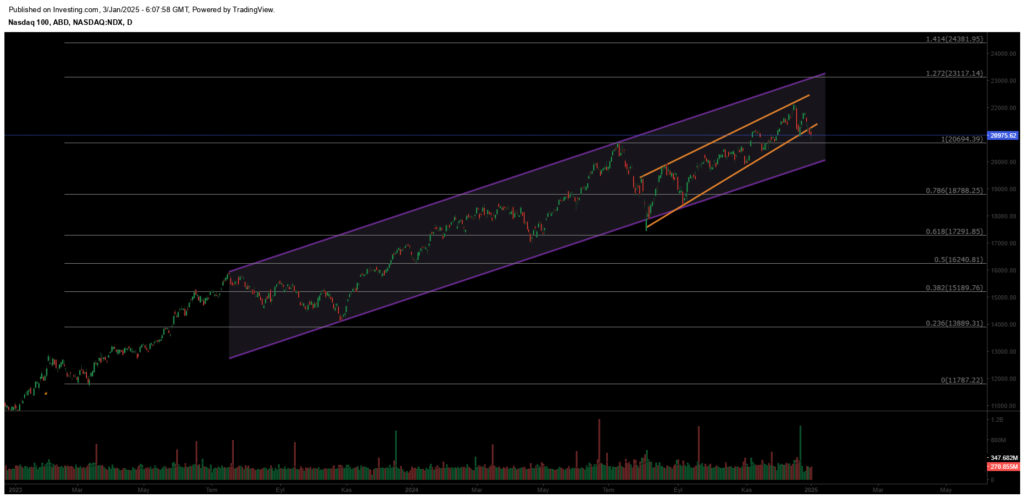

NASDAQ

The Nasdaq index continues its uptrend within a rising channel on the weekly chart. However, a wedge formation within the channel has rejected the price at the resistance level, with the index currently trading at 21,368. If the 21,700 level is surpassed and maintained, the index could break the main channel resistance and extend its rally to 22,500. On the downside, breaking below the critical 20,695 support may invite selling pressure, potentially pulling the index down to 20,000.

Resistances: 23,117 / 24,380 / 26,200

Supports: 20,694 / 18,788 / 17,291

BRENT

Brent crude has shown mid-term recovery, regaining its previously lost channel structure. Having surpassed the 76.98 resistance level, the price is likely to rise towards the 80.00–82.00 range if it maintains this level. Key support stands at 72.37, where buyers are expected to step in to sustain the trend.

Resistances: 76.15 / 85.84 / 95.53

Supports: 70.17 / 69.00 / 67.80

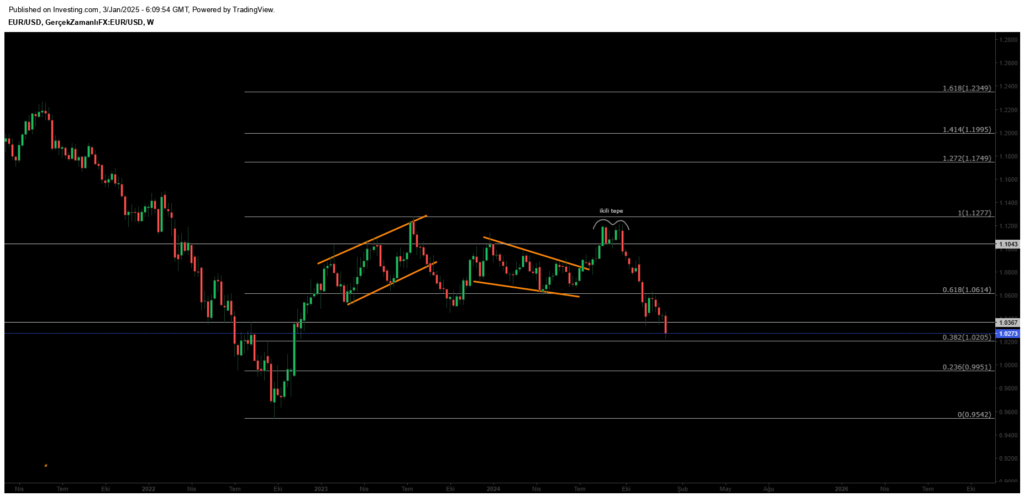

EURUSD

The Euro formed a double top at 1.11 and entered a downtrend. Losing the 1.10 support led to a pullback to the lower channel boundary at 1.07. After breaking the rising support level, the Euro slid to 1.046. At this critical support level, buyers are likely to re-enter the market. However, if the support is broken, the Euro may face deeper declines, potentially reaching 1.099. Price action at these levels will be pivotal in determining the next directional move.

Resistances: 1.0575 / 1.1043 / 1.1213

Supports: 1.0180 / 0.9936 / 0.9542

XAUUSD

Gold recovered from the 2608 level and successfully reached the anticipated target. With the breakout of the descending channel resistance, gold managed to rise back above the 2710 resistance level. As long as it maintains its position above this resistance level, it is expected to sustain its upward momentum and preserve the potential to rise toward the 2756 region.

Resistances: 2757 / 2790 / 2800

Supports: 2608 / 2622 / 2590

Leave A Comment