💵 💴 💶Wall Street Closes Mixed as S&P 500 Rally Slows💵 💴 💶

On Thursday, Wall Street exhibited a mixed performance. Investors evaluated Nvidia’s results announced the day before, which led to a decline in the Nasdaq. However, stronger-than-expected U.S. GDP data helped the Dow index rise to a record high. The Dow index closed the day in positive territory following robust growth in the second quarter, reflecting the resilience of the U.S. economy. However, Nvidia put pressure on market risk appetite. Treasury yields and the dollar rose as strong data diminished expectations of a larger Fed rate cut. With investors considering upcoming inflation data, gold prices increased. Meanwhile, oil prices rose due to supply disruptions from Libya and Iraq.

Libya Oil Supply Disruption

Oil prices surged above $81 per barrel, up over 3%, following news that Libya’s political conflict might halt oil production. The internationally recognized Tripoli-based government wants to replace the current central bank governor. However, the unrecognized Eastern Libyan government supports the current governor and is using this as a negotiating tactic by threatening to stop oil production. Libya’s oil production is between 1.1 and 1.2 million barrels per day, making this situation significant for the oil market.

Bitcoin Amount on Exchanges Hits Yearly Low

The amount of Bitcoin on cryptocurrency exchanges has reached its lowest level of the year. This situation could be a catalyst for Bitcoin to successfully retest and exceed $60,000. CryptoQuant participant Gaah noted on August 29 that “the reduction in Bitcoin reserves on exchanges indicates a decrease in selling pressure, which, if demand continues to rise, could potentially support a bull market.”

Technical Overview

DXY

The Dollar Index (DXY) has continued to decline this week and has retreated to the support level of 100.68, the region we anticipated. Losing its channel support, it has turned into a resistance, continuing the downtrend. The 100.68 level is crucial to monitor as the DXY might recover from this zone. If it loses the 100.68 area under selling pressure, it could drop to 98.00.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

BTC/USD

With the recent pullback, BTC/USD has fallen below $60,000. As long as the 56,650 level is not lost, the short-term trend may gain upward momentum. Key resistance levels to watch are $60,000 and $62,487.

Resistances: 60,000 / 62,487 / 64,290

Supports: 56,600 / 52,498 / 50,000

ETH/USD

ETH/USD has continued its potential selling pressure after breaking its rising channel structure. Currently trading around 2,466, it has lost its major horizontal support. The 2,200 level is a significant area to watch for potential buying interest.

Resistances: 2,565 / 3,000 / 3,364

Supports: 2,200 / 1,700 / 1,052

NASDAQ

The NASDAQ 100 Index started the week positively. After regaining the lost rising channel, it has managed to trade at 19,500. The index might continue its upward trend if it recovers from the channel support. The volume trend shows increasing entries into the index. The 18,913 level is a key support to watch.

Resistances: 20,000 / 20,985 / 22,250

Supports: 19,445 / 18,913 / 18,500

BRENT

Brent crude oil is continuing its medium-term correction. The price experienced a pullback with the recent oil data release. The 76.98 level is an important support to monitor.

Resistances: 79.84 / 82.15 / 84.46

Supports: 76.98 / 74.45 / 72.37

EURUSD

EUR/USD broke its rising channel resistance and managed to stay above both horizontal and channel resistance levels. It reached the target resistance of 1.114 but has faced selling pressure. EUR/USD might test the 1.1277 level.

Resistances: 1.127 / 1.130 / 1.135

Supports: 1.117 / 1.088 / 1.080

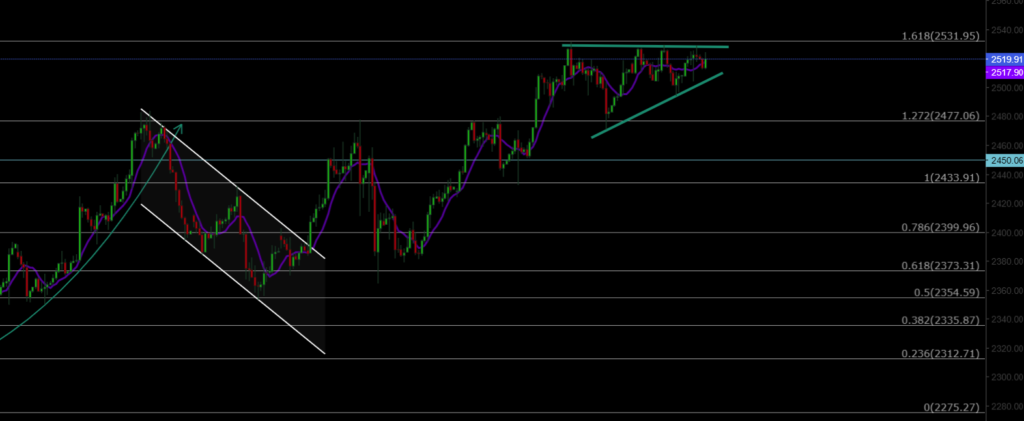

XAUUSD

XAU/USD broke its declining channel structure with significant volume, reaching a new ATH (all-time high) of 2,530. It continues to trade within an ascending triangle formation. Sustained volume-based closures above 2,530 will drive gold to new ATH levels. Key support levels to monitor are 2,500 and 2,477.

Resistances: 2,530 / 2,570 / 2,600

Supports: 2,488 / 2,477 / 2,450

Leave A Comment