💵 💴 💶Texas Lieutenant Governor Declares 2025 as Bitcoin Reserve Year💴 💶

The movement to establish a U.S. national Bitcoin reserve has been gaining momentum for months. Around 15 states are drafting laws to create Bitcoin reserves at the state level, and Texas has been an early and consistent member of this coalition. Today, Lieutenant Governor Dan Patrick listed the establishment of the Texas Reserve as a “priority” for 2025. While the national effort to create a reserve appears to be growing, it has faced some setbacks. President Trump issued an executive order to create a “digital stock” that is not exclusive to Bitcoin and is not integrated with the Federal Reserve.

Stable Interest Rates Could Boost Cryptocurrencies

Despite keeping interest rates steady, the Fed’s statement highlighted that inflation remains high and removed previous references to progress toward the 2% target. This suggests that further rate cuts may not be imminent. However, stable employment levels and economic resilience are easing recession fears, supporting speculative assets like Bitcoin and other cryptocurrencies. President Trump had urged the Fed to continue cutting rates, but central bank officials opted to maintain their current stance.

GLOBAL MARKETSThe U.S. dollar initially rose following the Federal Reserve’s decision to keep its policy rate unchanged and its message that there would be no rush for a new rate cut, before stabilizing. Due to public holidays in major markets, including Hong Kong and China, Asian markets experienced low trading volumes. The Fed kept interest rates steady in line with expectations, and Fed Chair Jerome Powell stated they would not rush to cut rates again. U.S. President Donald Trump’s expected policies continue to pose risks to the Fed’s monetary policy. Trump is expected to impose new tariffs on Canada, Mexico, and possibly China this Saturday. After Wall Street’s closing, the earnings reports from the seven largest U.S. tech companies were mixed. While Microsoft exceeded quarterly revenue forecasts, Tesla’s fourth-quarter profit margins fell short of expectations.

Technical Overview

DXY

Bitcoin initiated an uptrend with Trump officially taking office, reaching as high as $109,000. Setting a new all-time high, BTC is expected to extend its bullish trend to $123,194 with daily closes above the $108,286 region.

Resistance: 118,500 / 123,550 / 131,029

Support: 108,985 / 92,000 / 88,362

BTC/USD

Bitcoin surged to $109,000 following Donald Trump’s official return to office, but faced selling pressure after failing to sustain above the $108,286 level. If BTC closes above the $108,186 resistance, it could climb further to $123,194.

Resistance: 108,985 / 118,500 / 123,550

Support: 92,000 / 88,362 / 80,598

ETH/USD

Ethereum has seen a long-awaited rise, reaching $3,400. The next critical resistance zone to monitor is $3,539. A strong breakout above this level could further sustain Ethereum’s uptrend.

Resistances: 3,539 / 4,086 / 4,782

Supports: 3,110 / 2,808 / 2,134

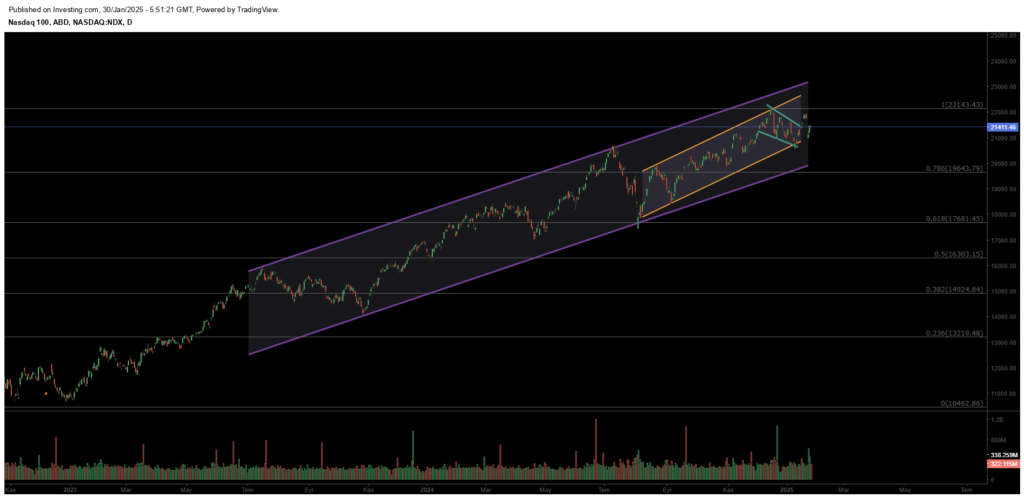

NASDAQ

The NAS100 index has experienced a sharp pullback in response to the launch of China’s AI initiative, reflecting significant pressure on U.S. indices. The major support level to watch on the index is $19,643. Losing this level could intensify the selling pressure on the index.

Resistance Levels: 22,143 / 25,320 / 26,979

Support Levels: 19,643 / 17,681 / 16,303

BRENT

Brent oil is in recovery mode, reclaiming its previously lost channel. Having broken above the 76.98 resistance, the price is likely to target the 85.00 range. The critical support level is 72.37, which should hold to maintain the uptrend.

Resistance Levels: 80.00 / 85.84 / 95.53

Support Levels: 76.15 / 70.17/ 69.99

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

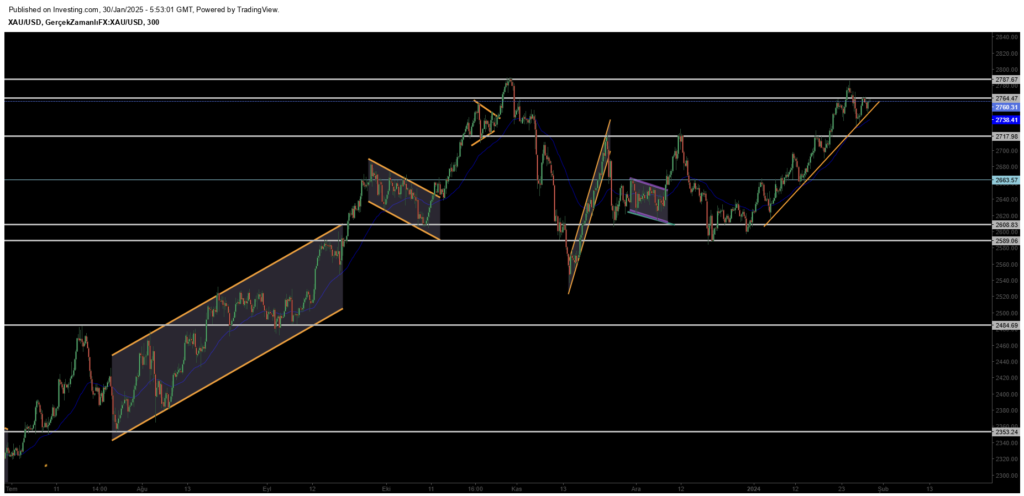

XAUUSD

Gold, after initiating an upward momentum, experienced a pullback from the 2787 resistance zone and lost its current support level. A close below this area is expected to maintain the selling pressure on gold.

Resistance Levels: 2760 / 2790 / 2800

Support Levels: 2717 / 2763 / 2666

Leave A Comment