💵 💴 💶MicroStrategy Continues Bitcoin Investments, but Stock Remains Unresponsive💴 💶

MicroStrategy has added 2,138 BTC to its Bitcoin portfolio, bringing its total holdings to 446,400 BTC. This latest acquisition reaffirms the company’s commitment to its Bitcoin strategy. MicroStrategy Buys 2,138 More BTC In a press release, MicroStrategy announced the purchase of 2,138 BTC for a total of $209 million. This acquisition, made at an average price of $97,837 per Bitcoin, brings the company’s total Bitcoin holdings to 446,400 BTC. So far, the company has spent a total of $27.9 billion on its Bitcoin investments, achieving an average cost of $62,428 per Bitcoin.

People’s Bank of China Highlights Crypto Regulations in Annual Financial Stability Report

The People’s Bank of China (PBOC) dedicated a section of its 2024 Financial Stability Report to cryptocurrency regulations, discussing Hong Kong’s crypto licensing regime and global regulatory efforts. The report noted that Hong Kong is “actively exploring” crypto licensing. In June 2023, Hong Kong introduced a licensing regime for crypto trading platforms, allowing licensed exchanges to serve individual investors. This approach contrasts with the current regulations in mainland China, where crypto trading remains banned.

GLOBAL MARKETSAsian markets declined in cautious trading on the final day of the year, while the dollar maintained its value against other currencies. Trading was influenced by the policies expected to be implemented by U.S. President-elect Donald Trump and projections of fewer interest rate cuts in the U.S. by 2025 than previously anticipated. With reduced trading volumes due to the New Year holiday and Japan’s official holiday for the remainder of the week, rising bond yields pressured stocks while supporting the dollar. Gains seen prior to the New Year were largely erased.

Technical Overview

DXY

The U.S. Dollar Index (DXY) continues to trade within a descending wedge on the daily chart. Currently priced at 106.39, the index is holding above the 105.68 horizontal support level, suggesting the uptrend may persist for a while longer. If the trend continues, potential resistance levels are 107.34 and 110. A strong breakout above 107.34 could push the index towards 112.

Resistances: 108.00 / 110.00 / 115.76

Supports: 105.68 / 104.38 / 103.46

BTC/USD

The recovery process in Bitcoin continues to gain strength. Currently, it is trading at $94,691. Following yesterday’s declines, the recovery movements are ongoing. At this point, the critical level to watch is $87,956. As long as Bitcoin stays above this support level, the upward trend is likely to continue towards the $108,995 level. However, if the $95,540 support is lost, a potential downtrend could push the price down to $88,362.

Resistance levels: 108,985 / 118,500 / 123,550

Support levels: 95,000 / 88,362 / 83,365

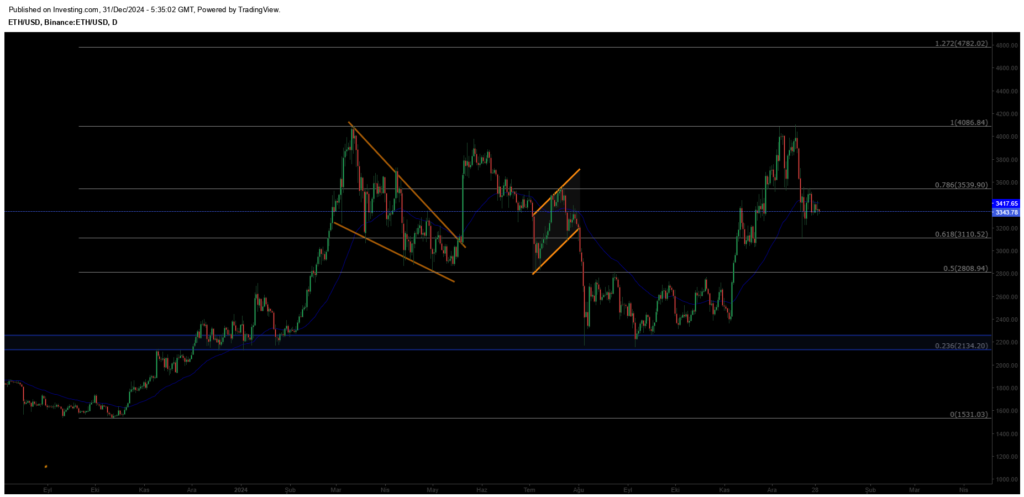

ETH/USD

In Ethereum, the anticipated target of $4,086 was reached, followed by a sharp pullback. Currently, it is trading at $3,256. At this point, the critical level to watch closely is $3,110, which serves as a horizontal support point. As long as there is no significant close below this level, the outlook will remain positive. However, if a close occurs below this support level, a potential downtrend could push the price down to $2,808.

Resistance levels: 3,539 / 4,086 / 4,782

Support levels: 3,110 / 2,808 / 2,134

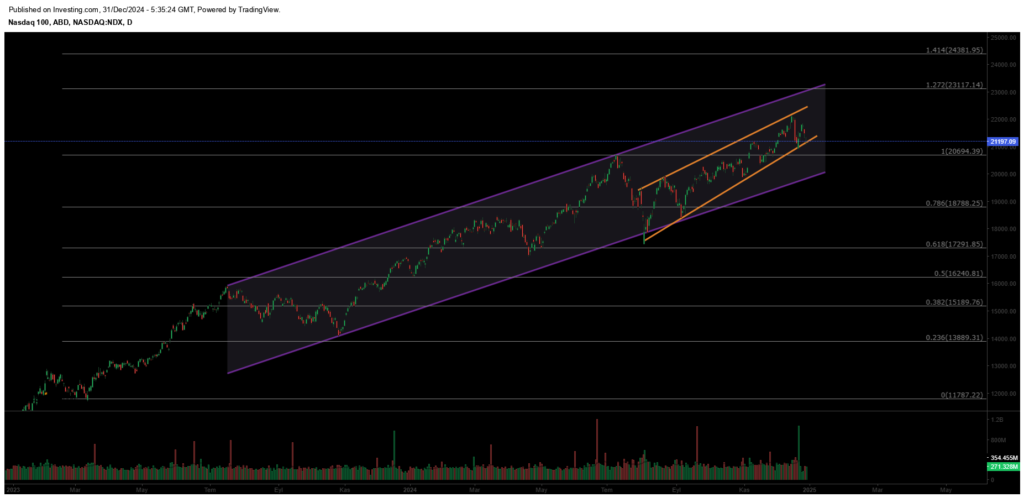

NASDAQ

The Nasdaq index continues its uptrend within a rising channel on the weekly chart. However, a wedge formation within the channel has rejected the price at the resistance level, with the index currently trading at 21,368. If the 21,700 level is surpassed and maintained, the index could break the main channel resistance and extend its rally to 22,500. On the downside, breaking below the critical 20,695 support may invite selling pressure, potentially pulling the index down to 20,000.

Resistances: 23,117 / 24,380 / 26,200

Supports: 20,694 / 18,788 / 17,291

BRENT

Brent crude has shown mid-term recovery, regaining its previously lost channel structure. Having surpassed the 76.98 resistance level, the price is likely to rise towards the 80.00–82.00 range if it maintains this level. Key support stands at 72.37, where buyers are expected to step in to sustain the trend.

Resistances: 76.15 / 85.84 / 95.53

Supports: 70.17 / 69.00 / 67.80

EURUSD

The Euro formed a double top at 1.11 and entered a downtrend. Losing the 1.10 support led to a pullback to the lower channel boundary at 1.07. After breaking the rising support level, the Euro slid to 1.046. At this critical support level, buyers are likely to re-enter the market. However, if the support is broken, the Euro may face deeper declines, potentially reaching 1.099. Price action at these levels will be pivotal in determining the next directional move.

Resistances: 1.0575 / 1.1043 / 1.1213

Supports: 1.0180 / 0.9936 / 0.9542

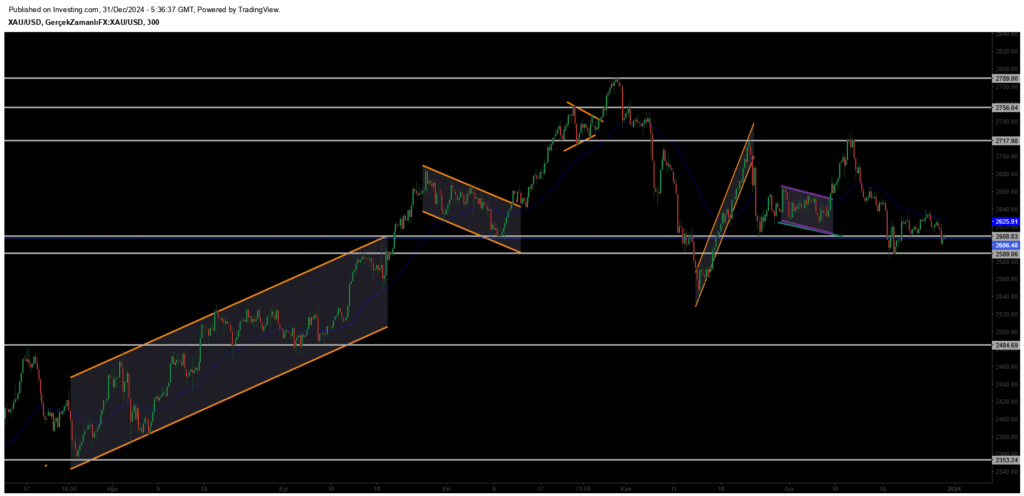

XAUUSD

Gold recovered from the 2608 level and successfully reached the anticipated target. With the breakout of the descending channel resistance, gold managed to rise back above the 2710 resistance level. As long as it maintains its position above this resistance level, it is expected to sustain its upward momentum and preserve the potential to rise toward the 2756 region.

Resistances: 2757 / 2790 / 2800

Supports: 2608 / 2622 / 2590

Leave A Comment