💵 💴 💶Gold Prices Decline as Treasury Yields Rise💴 💶

Gold prices have declined due to rising yields in Treasury bonds and statements from Federal Reserve officials suggesting that interest rate cuts in 2025 could occur at a slower pace. Investors are anticipating this week’s economic data, which is expected to shed light on the Fed’s stance. The rise in bond yields continues to pressure gold prices. Nevertheless, based on forecasts of a decline in bond yields and the weakening of the dollar, gold is expected to reach $3,050/ounce by the end of the year. Furthermore, the possibility of escalating geopolitical tensions supports a cautious outlook, with upward risks for gold prices in such a scenario.

Biden Bans Offshore Oil and Gas Drilling in Most Federal Waters

President Joe Biden has moved to ban new offshore oil and natural gas drilling in most U.S. coastal waters, in a last-minute effort to block potential actions by the Trump administration aimed at expanding offshore drilling. With his term set to end in two weeks, Biden announced he used his authority under the federal Outer Continental Shelf Lands Act to protect offshore areas along the East and West Coasts, the eastern Gulf of Mexico, and parts of Alaska’s Northern Bering Sea from future oil and gas leasing.

Nvidia Unveils RTX 50 Series Gaming Chips at CES 2025Nvidia CEO Jensen Huang took the stage yesterday at CES 2025 to unveil the company’s latest generation of graphics processors for desktop and laptop gaming systems. The new GeForce RTX 50 series cards, based on Nvidia’s Blackwell architecture, which also powers its AI data center chips, promise a range of improvements for PC gamers and content creators.

Technical Overview

DXY

On the daily chart, the DXY index broke out of a falling wedge pattern and is continuing its upward trend. Currently trading at 109.10, the DXY is expected to maintain its upward trend unless the horizontal support level at 105.68 is breached. If the trend continues, the resistance levels to watch are 112.34 and 115. If the price consolidates significantly at the 112.34 level, the trend could potentially extend to 112.

Resistance Levels: 112.34 / 115.00 / 120.76

Support Levels: 107.34 / 105.68 / 104.38

BTC/USD

Bitcoin’s recovery process continues to gain momentum. Currently trading at 101,500 USD, Bitcoin’s critical support level stands at 87,956 USD. As long as Bitcoin stays above this level, the upward trend has the potential to extend to 108,995 USD. However, if the 92,000 USD support level is lost, a downward trend could see the price drop to 88,362 USD.

Resistance Levels: 108,985 / 118,500 / 123,550

Support Levels: 92,000 / 88,362 / 83,365

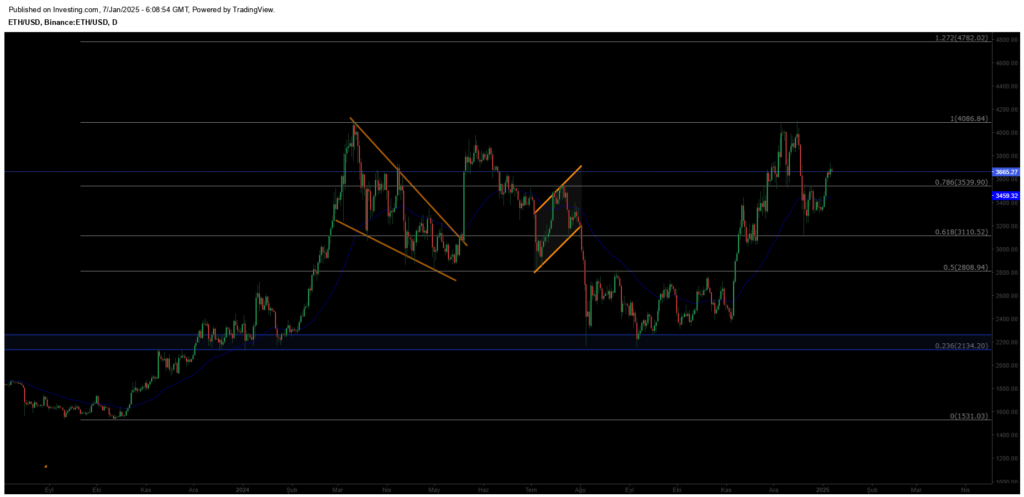

ETH/USD

Ethereum recently reached the anticipated target of 3,666 USD before experiencing a sharp pullback. It is currently trading at 3,459 USD. The critical level to watch here is 3,110 USD, which serves as a horizontal support point. As long as there is no significant close below this level, the outlook remains positive. However, if the support level is breached, the price could potentially decline to 2,808 USD.

Resistance Levels: 3,539 / 4,086 / 4,782

Support Levels: 3,110 / 2,808 / 2,134

NASDAQ

The Nasdaq index continues its uptrend within a rising channel on the weekly chart. However, a wedge formation within the channel has rejected the price at the resistance level, with the index currently trading at 21,368. If the 21,700 level is surpassed and maintained, the index could break the main channel resistance and extend its rally to 22,500. On the downside, breaking below the critical 20,695 support may invite selling pressure, potentially pulling the index down to 20,000.

Resistances: 23,117 / 24,380 / 26,200

Supports: 20,694 / 18,788 / 17,291

BRENT

Brent crude has shown mid-term recovery, regaining its previously lost channel structure. Having surpassed the 76.98 resistance level, the price is likely to rise towards the 80.00–82.00 range if it maintains this level. Key support stands at 72.37, where buyers are expected to step in to sustain the trend.

Resistances: 76.15 / 85.84 / 95.53

Supports: 70.17 / 69.00 / 67.80

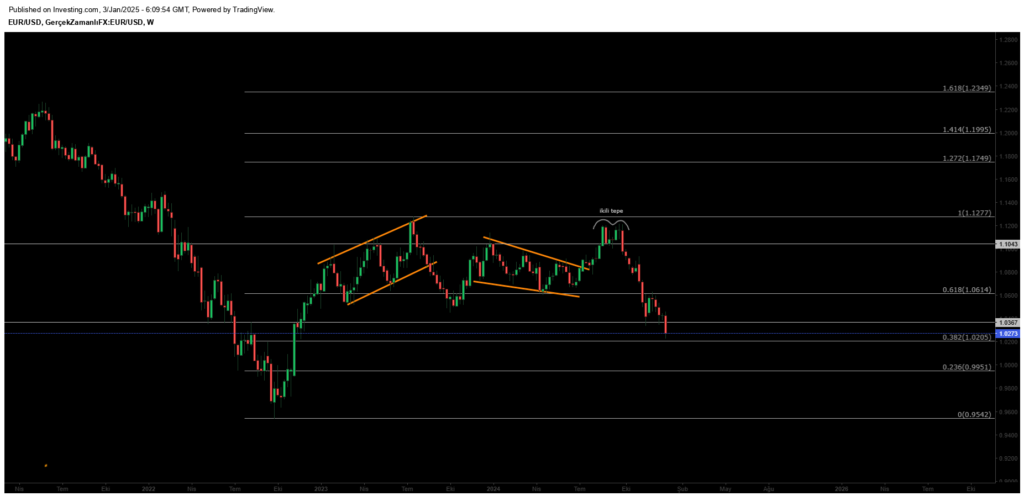

EURUSD

The Euro formed a double top at 1.11 and entered a downtrend. Losing the 1.10 support led to a pullback to the lower channel boundary at 1.07. After breaking the rising support level, the Euro slid to 1.046. At this critical support level, buyers are likely to re-enter the market. However, if the support is broken, the Euro may face deeper declines, potentially reaching 1.099. Price action at these levels will be pivotal in determining the next directional move.

Resistances: 1.0575 / 1.1043 / 1.1213

Supports: 1.0180 / 0.9936 / 0.9542

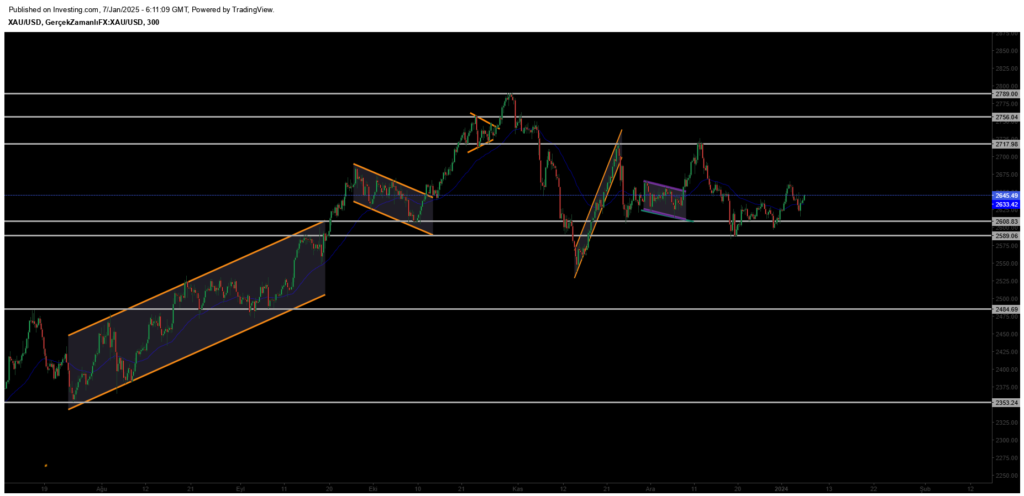

XAUUSD

Gold recovered from the 2608 level and successfully reached the anticipated target. With the breakout of the descending channel resistance, gold managed to rise back above the 2710 resistance level. As long as it maintains its position above this resistance level, it is expected to sustain its upward momentum and preserve the potential to rise toward the 2756 region.

Resistances: 2757 / 2790 / 2800

Supports: 2608 / 2622 / 2590

Leave A Comment