GLOBAL MARKETS

Data released in the U.S. yesterday showed that jobless claims fell more than expected last week, indicating that concerns about the labor market might be overstated. Following this data, the probability of a 50 basis point interest rate cut dropped from 69% to 54%.

Some Federal Reserve (Fed) officials have expressed increased confidence that inflation has slowed sufficiently for rate cuts. The yield on U.S. Treasury bonds has risen this week due to decreased demand for safe-haven assets. The yield on the 10-year U.S. Treasury bonds (US10Y) was at 3.9781%, and it is preparing to close the week up by 18 basis points.

What happened in the crypto market?

A group of U.S. politicians aims to create a Digital Economic Zone in the country exempt from Bitcoin taxes. A judge in New York approved a settlement between FTX, Alameda, and the CFTC, allowing FTX creditors to recover $12.7 billion. Meanwhile, Ripple Labs was fined $125 million as part of a lawsuit initiated by the U.S. Securities and Exchange Commission (SEC).

New Statement from Trump’s Sons: We Will Shake Up the Crypto World

U.S. presidential candidate Donald Trump has quickly warmed up to the crypto world. Following many commitments made by Trump regarding the crypto space, the latest step comes from his two sons. Eric Trump announced yesterday, and Donald Trump Jr. today, that they will soon unveil a new and significant crypto project.

Eric Trump stated, “I’m absolutely in love with crypto. Decentralized finance… Get ready for a big announcement soon.”

Donald Trump Jr. added, “We are going to shake up the crypto world with a big ‘thing’. Decentralized finance is the future. Don’t get left behind.”

Technical Overview

BTC/USD

BTC/USD continues its uptrend. The pair, which had fallen to the $50,000 level, has recently bounced back from the support area and reached the $62,000 resistance zone. A close above this resistance would add upward momentum to the pair. The support level to watch is $52,500.

Resistance: 62,000 / 64,000 / 66,000

Support: 60,000 / 56,600 / 52,500

ETH/USD

ETH/USD broke through the rising channel structure and continued its potential selling pressure. Currently trading at the major horizontal support level of $2,700, the pair has entered an uptrend from this area. The resistance level to monitor is $2,922. Closing above this level would continue the trend.

Resistance: 2,565 / 3,364 / 4,078

Support: 2,565 / 2,200 / 1,700

NASDAQ

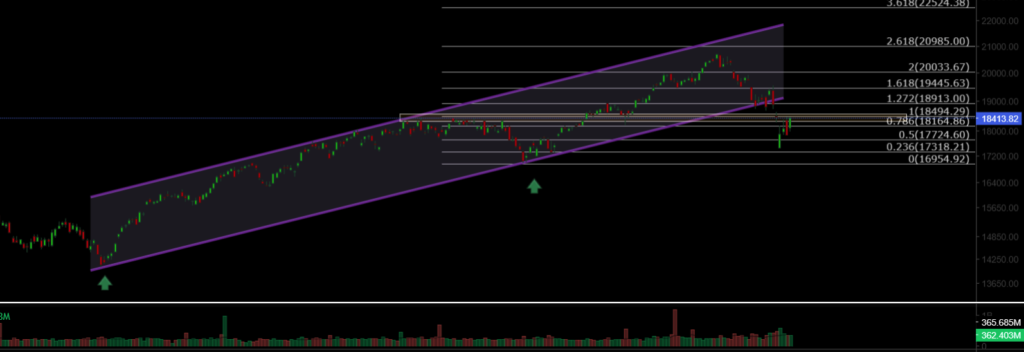

NASDAQ

The NASDAQ100 Index lost its support from the rising channel structure and is experiencing selling pressure as it starts the week. The index is trading around the 18,424 resistance level, and if the expected selling pressure emerges, it could continue its downward trend from this level. Losing the 16,954 level could lead to new lows in the index.

Resistance: 18,164 / 18,494 / 18,913

Support: 17,724 / 17,318 / 16,954

DXY

The Dollar Index lost its support from the falling channel and could see selling pressure down to the 102.26 level if no new attempts to enter the channel are observed. The resistance level to watch is 103.23.

Resistance: 103.23 / 104.02 / 104.81

Support: 102.26 / 100.68 / 100

BRENT

Brent Crude Oil continues its short-term downtrend. It remains within the falling channel structure, with the support level to monitor being $74.45. If the decline continues, it may reach this support level. To start an uptrend, the price needs to break the falling resistance within the channel.

Resistance: 79.84 / 82.15 / 84.46

Support: 76.98 / 74.45 / 72.37

EURUSD

EUR/USD has managed to break through the falling channel resistance and is gaining momentum from the channel support, trading above the 1.0881 resistance level. It recently saw a pullback from the 1.098 resistance level. The rising channel structure is being tested, and breaking the resistance level could lead to higher levels for EUR/USD.

Resistance: 1.098 / 1.0114 / 1.012

Support: 1.088 / 1.080 / 1.071

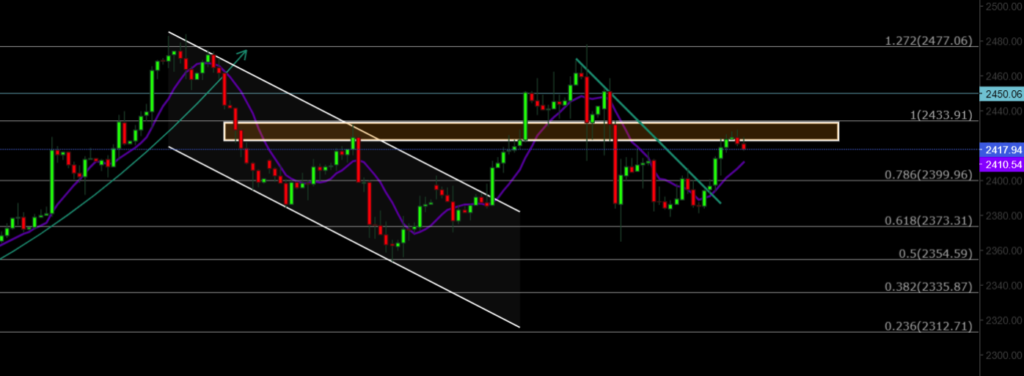

XAUUSD

XAU/USD broke out of the falling channel structure with strong volume and managed to trade above the 2,400 resistance level but lost the support and is currently under selling pressure. In the short term, it continues to trade at $2,417 after breaking the falling resistance level. The support level to watch is $2,373. Breaking the 2,433 resistance level would continue the uptrend for gold.

Resistance: 2,433 / 2,477 / 2,488

Support: 2,400 / 2,373 / 2,354

Leave A Comment