💵 💴 💶Fed’s Expectations for Sharp Interest Rate Cuts Rise!💵 💴 💶

A significant portion of U.S. Treasury yields briefly turned positive due to increased expectations of sharp interest rate cuts by the Fed following weaker-than-expected labor market data. On Wednesday, Treasury prices, particularly short-term bonds sensitive to monetary policy, rose as job openings in the U.S. fell to their lowest level since early 2021 in July. The yield on the two-year U.S. Treasury note fell below that of the ten-year note for only the second time since 2022, as investors positioned for a major rate cut this month. Interest rate swaps indicated that a 25-basis-point rate cut is fully priced in for this month’s policy meeting, with a greater than 30% chance of a 50-basis-point cut.

Bank of Canada Cuts Rates Again

The upcoming U.S. presidential elections are expected to increase volatility in the cryptocurrency market. K33 Research analyst Ventle Lunde noted that investors are pricing in a period of high volatility over the next three months, with the election period potentially having a significant impact on the crypto market. It is anticipated that a re-election of Donald Trump could be met with a positive reaction from the market, while other candidates are expected to maintain the status quo.

U.S. Elections Could Impact Crypto Markets

In China, the world’s largest oil importer, expectations of a slowdown in economic growth and decreased oil demand have exacerbated the decline in oil prices. Prices fell 5% yesterday, reaching their lowest level since December.

Technical Overview

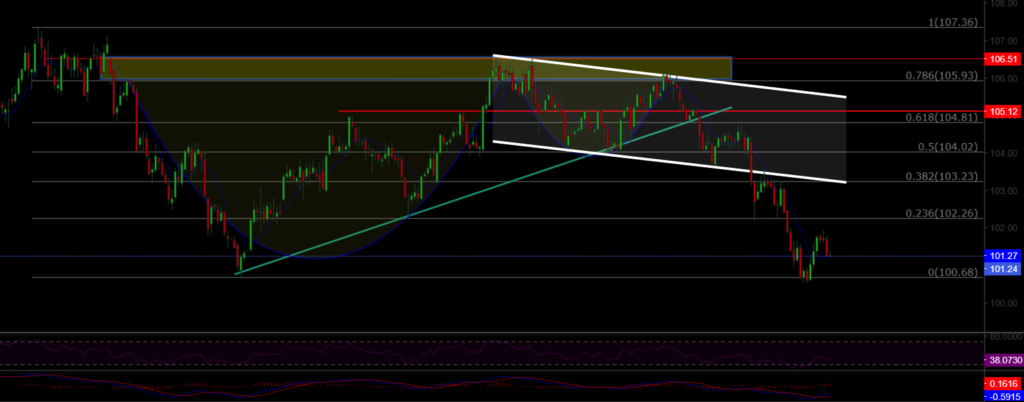

DXY

The Dollar Index (DXY) has started the week with a bullish trend and has declined to the expected support level of 100.68, showing signs of recovery. The loss of its channel support has turned it into resistance, continuing the downtrend. The 100.68 level is a critical support; losing this area could pull DXY further down.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

BTC/USD

With the recent pullback, BTC/USD has fallen below the 56,600 level. To confirm the start of a short-term upward trend, the price needs to stay above the 60,000 level. Key resistance levels to watch are 60,000 and 62,487.

Resistance: 60,000 / 62,487 / 64,290

Support: 56,600 / 52,498 / 50,000

ETH/USD

ETH/USD has broken its ascending channel pattern, continuing potential selling pressure. Currently trading around the 2,466 level after losing its major horizontal support, the 2,200 level is an important area to watch for potential buying interest.

Resistance: 2,565 / 3,000 / 3,364

Support: 2,200 / 1,700 / 1,052

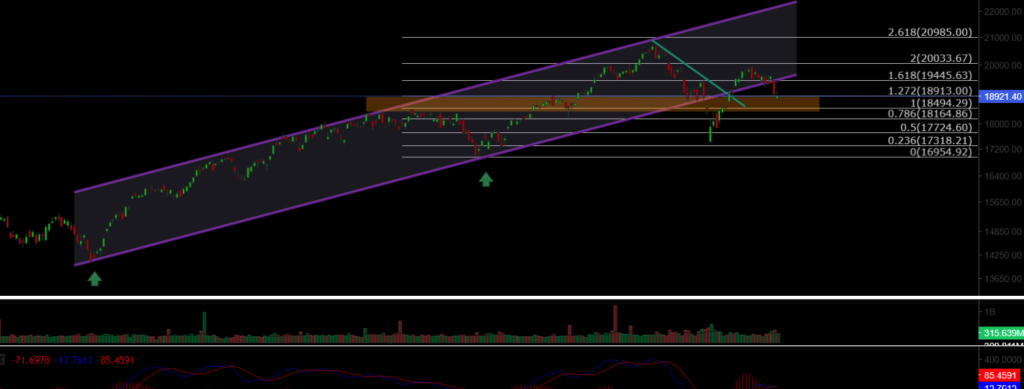

NASDAQ

The NASDAQ100 Index started the week with a bearish trend. After falling back to its channel support and losing it, the index has dropped to 18,900. If it loses the 18,490 level, the bearish trend will continue. Key support levels to watch are 18,164 and 17,724.

Resistance: 19,445 / 20,000 / 20,985

Support: 18,913 / 18,500 / 18,164

BRENT

Brent Crude Oil is continuing its medium-term correction. After losing its support level, oil has fallen to the lower support level of the descending channel. There may be a rebound from these levels, but losing the channel’s lower band could lead to new lows.

Resistance: 74.45 / 76.98 / 79.84

Support: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD has broken its ascending channel resistance, managing to stay above both horizontal and channel resistance levels. It reached the target resistance level of 1.114 but fell back after losing the 1.11 resistance level. The 1.0983 level is a key support to monitor.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

XAUUSD

XAU/USD broke out of its descending channel pattern with significant volume, reaching the ATH level of 2,530. With the support of the ascending triangle pattern lost, the price may continue to retreat due to geopolitical risks. The 2,450 level is a key support and potential buying area.

Resistance: 2,530 / 2,570 / 2,600

Support: 2,488 / 2,477 / 2,450

Leave A Comment