💵 💴 💶US Dollar: Harris Narrowly Won the Debate💵 💴 💶

Yesterday, Donald Trump and Kamala Harris debated key issues such as abortion rights, immigration policy, and the economy for over 90 minutes. In the previous Trump-Biden debate, Biden had clearly lost, but this time there was no definitive “knockout” victory. Markets gave Harris a points victory, and a CNN poll showed that 63% of voters saw Harris as the winner. In the forex markets, while Trump’s win was associated with the dollar, the dollar generally followed a weak trend.

Yen Rising

While debates in the US are making headlines, the movement of the Japanese yen also drew attention. The Japanese currency strengthened against the US dollar after a member of the Bank of Japan (BoJ) hinted that interest rate hikes are still on the table. Although most BoJ observers expect the central bank to keep interest rates unchanged at its upcoming meeting, these comments serve as a reminder that rate hikes are still on the agenda if economic and price expectations are met.

Bitcoin Price Stable

After the inflation data release, the Bitcoin price showed almost no change. The largest cryptocurrency was trading at $56,600 at the time of writing. Paul Ashworth, an analyst at Capital Economics, noted in a recent client note, “We believe the Fed will start a rate-cutting policy with a 25 basis point cut. The core inflation rate coming in at 3.2% is high… This situation arose due to a 5.2% increase in housing costs.”

Technical Overview

DXY

The Dollar Index continues to consolidate this week. DXY, which found buyers at the 100.68 support level, shows continued recoveries. If the index closes below this level with volume, it will increase selling pressure. As long as it trades above the 100.68 support level, its momentum will be upward.

Resistance: 102.26 / 103.23 / 104.02

Support: 100.68 / 98.00 / 97.00

BTC/USD

BTCUSD continues to recover. To confirm the start of a short-term upward trend, it needs to trade above the $60,000 level. Key resistance levels to watch are $60,000 and $62,487. Current support is at $52,685.

Resistance: 60,000 / 62,487 / 64,290

Support: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD continues to exert potential selling pressure after breaking its rising channel pattern. Currently trading at $2,466, ETHUSD has lost its major horizontal support. The key support and buying region to monitor is around $2,200.

Resistance: 2,565 / 3,000 / 3,364

Support: 2,200 / 1,700 / 1,052

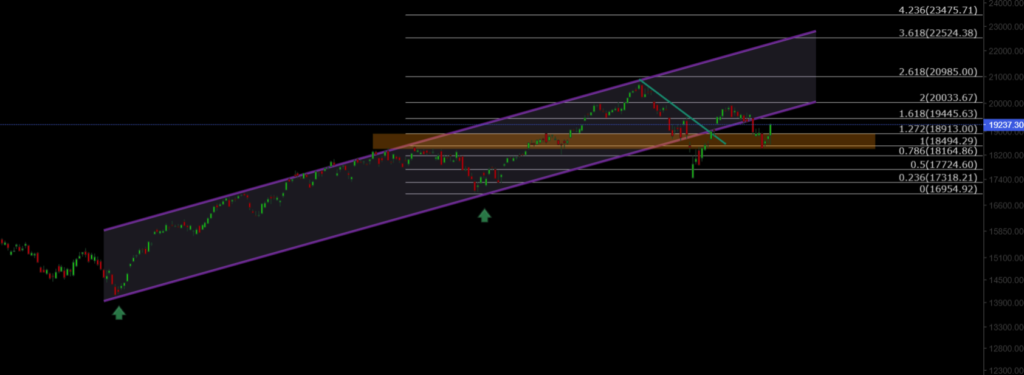

NASDAQ

The NASDAQ100 Index started the week with a bearish trend. The index fell back to the channel support level and dropped to 18,900. It has since found buyers and showed signs of recovery with an upward reaction. The resistance level to watch is 19,445.

Resistance: 19,445 / 20,000 / 20,985

Support: 18,913 / 18,500 / 18,164

BRENT

Brent Oil continues its medium-term correction. After losing its support level, oil has dropped to the lower support level of the falling channel and maintains a downtrend with selling pressure. For a new upward trend to begin, it needs to gain above the 74.45 level with volume.

Resistance: 74.45 / 76.98 / 79.84

Support: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke the rising channel resistance and managed to stay above both horizontal resistance and channel resistance, reaching the 1.114 target resistance level. It has since fallen back below the 1.11 resistance level and experienced a pullback. The key support level to monitor for EURUSD is 1.0983.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

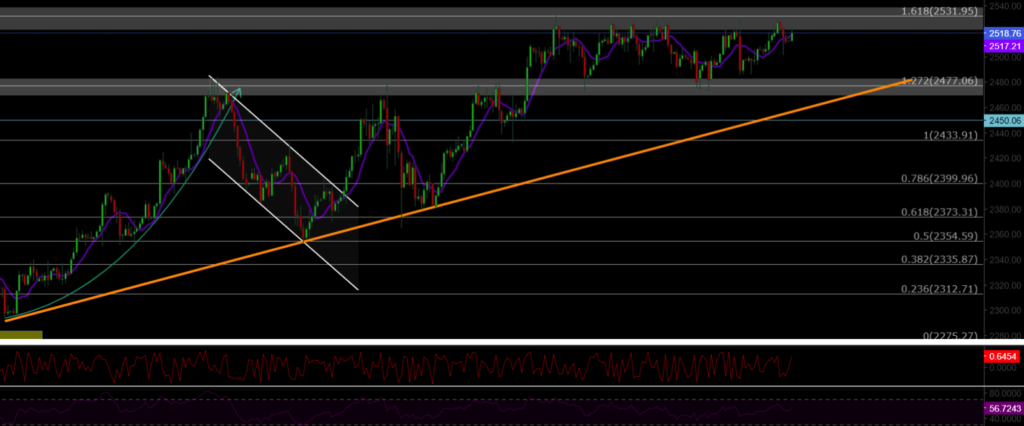

XAUUSD

XAUUSD broke the falling channel structure significantly and reached the 2530 ATH level. With geopolitical risks continuing, gold’s decline could persist. The key support level to monitor, and where buying might emerge, is the rising support level at 2450.

Resistance: 2,530 / 2,570 / 2,600

Support: 2,488 / 2,477 / 2,450

Leave A Comment