💵 💴 💶Record Targets for Gold Prices💵 💴 💶

Gold market bulls are aiming to reach a milestone of $3,000 per ounce, driven by central banks’ monetary expansion policies and the competition in the U.S. presidential elections. Spot gold reached an all-time high of $2,572.81 per ounce on Friday, marking its strongest annual performance since 2020.

Meta Platforms’ AI Training in the UK

Meta has announced that in the coming months, it will begin using public content shared by adults on Facebook and Instagram in the UK to train its AI models. The company had previously paused the training following regulatory backlash in the region. In a statement on Friday, Meta said it will use public posts, including photos, captions, and comments, to train its AI models. However, the company emphasized that the content would not include private messages or data from users under 18.

Rising Crypto Donations and Bets in the 2024 U.S. Elections

Breadcrumbs, a blockchain analytics platform, reports that cryptocurrency donations to political campaigns have doubled since 2022. The sector has surpassed traditional industries like oil and banking, contributing over $190 million. Most cryptocurrency donations are supporting Republican candidates, the Republican Party, or crypto-friendly Democrats. Major individual contributors include Marc Andreessen and Ben Horowitz, each donating around $24.9 million. The Winklevoss twins follow with $10.1 million. Ripple executives Chris Larsen, Brad Garlinghouse, and Stuart Alderoty have contributed over $3 million. Other notable donors include Coinbase CEO Brian Armstrong and Kraken’s Jesse Powell.

Technical Overview

DXY

The Dollar Index (DXY) continues to consolidate this week. Buyers are stepping in at the 100.68 support level, and recoveries are ongoing. If the DXY closes below this level with volume, it will increase the selling pressure on the index. As long as it stays above the 100.68 support zone, its momentum will remain upward.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

BTC/USD

BTCUSD continues its recovery. To confirm the start of a short-term uptrend, it needs to trade above the 60,000 level. Key resistance levels to watch are 60,000 and 62,487. The current support level is 52,685.

Resistances: 60,000 / 62,487 / 64,290

Supports: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD broke its rising channel structure, continuing its potential selling pressure. It is currently priced at 2466, having lost its horizontal major support. The 2200 level is a key support zone to monitor where buyers may step in.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

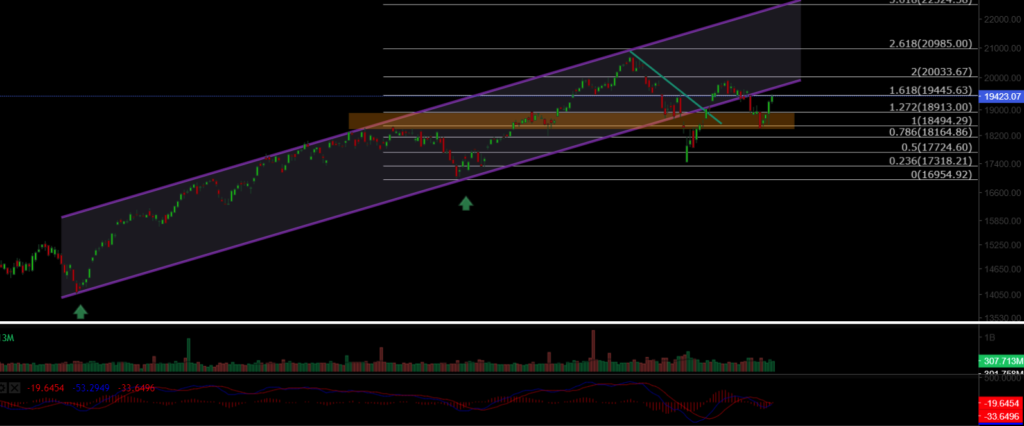

NASDAQ

NASDAQ 100 Index continues the week with a positive trend. After falling back to its channel support at the 18900 level and losing it, the index has regained upward momentum from its major support. The resistance level to watch is 19,445.

Resistances: 19,445 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,164

BRENT

Brent Crude Oil continues its medium-term correction. It has lost its support level and declined to the lower support level of its falling channel, maintaining its downward trend due to selling pressure. To resume its upward trend, it needs to break above the 74.45 level with volume.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke the rising channel resistance and managed to stay above both horizontal resistance and channel resistance, reaching the 1.114 target resistance level. It has since fallen back below the 1.11 resistance level and experienced a pullback. The key support level to monitor for EURUSD is 1.0983.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

XAUUSD

XAUUSD broke through the 2527 resistance level with strong volume and reached our anticipated target of 2577. If it closes above this region, the upward trend in gold will likely continue toward the 2646 level.

Resistances: 2646 / 2670 / 2690

Supports: 2577 / 2527 / 2477

Leave A Comment