💵 💴 💶GLOBAL MARKETS💵 💴 💶

This week, statements from at least nine Fed officials, including Fed Chairman Jerome Powell and New York Fed President John Williams, will be closely monitored. Additionally, leading manufacturing PMI data will be released in many countries, while in the U.S., consumer confidence and durable goods orders data will also be announced. Looking at central banks, the Swiss National Bank is almost certain to cut interest rates by 25 basis points on Thursday, with a 41% chance of a 50 basis points cut priced in. The Swedish Central Bank, which will announce its rate decision on Wednesday, is also expected to lower rates by 25 basis points. On the other hand, the Reserve Bank of Australia (RBA), set to announce its rate decision tomorrow, is expected to keep rates steady at 4.35%, given the continued high level of inflation.

Ban on Chinese Software and Hardware in U.S.-Connected Vehicles

The move stems from security risks related to Chinese companies collecting data on U.S. drivers and infrastructure. It is also seen as a precaution against the possibility of internet-connected vehicles being manipulated by foreign actors. The regulation aims to ban the import and sale of vehicles from China, particularly those equipped with communication systems and autonomous driving software and hardware. This step is seen as a harsher move in the ongoing restrictions the U.S. has placed on Chinese software, vehicles, and components. Last week, the Biden administration imposed a 100% tariff on electric vehicles imported from China and introduced new tax hikes on electric vehicle batteries and critical minerals.

Is Bitcoin Preparing to Outperform Gold?

Bitcoin’s value has risen by an astonishing 350,000% since its inception compared to its safe-haven rival, gold. New signals indicate that Bitcoin may be on the verge of another price rally and could gain new momentum against the precious metal.

Technical Overview

DXY

The Dollar Index continues to consolidate this week. The DXY continues to recover after finding buyers at the 100.68 support level. If it closes below this region with volume, the selling pressure on the index will increase. As long as it remains above the 100.68 support region, its momentum will be upward.

Resistance levels: 102.26 / 103.23 / 104.02

Support levels: 100.68 / 98.00 / 97.00

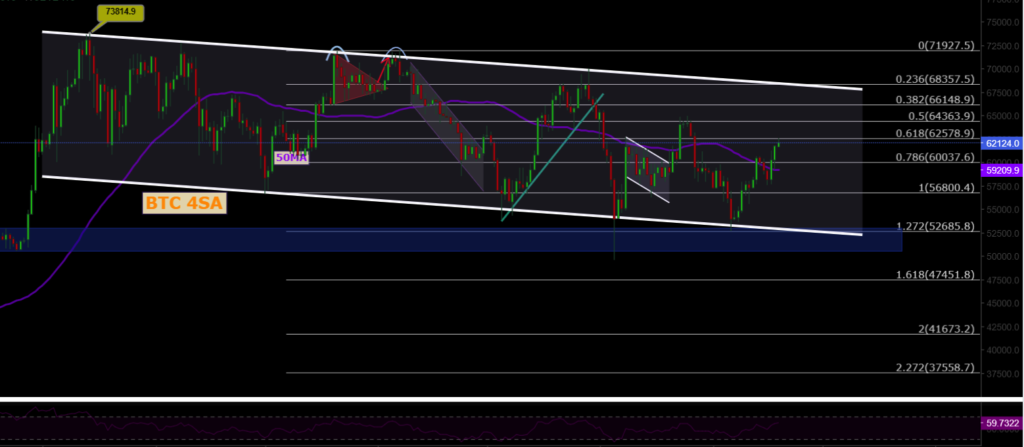

BTC/USD

The uptrend in BTCUSD continues. If it closes above the 64,300 level, BTC is likely to continue up to the 68,350 level. That area appears to be a major resistance zone for BTC. Voluminous daily closes above the 68,350 region indicate that the trend in BTC and cryptocurrencies could continue.

Resistance levels: 64,290 / 66,148 / 68,350

Support levels: 62,487 / 60,000 / 56,600

ETH/USD

ETHUSD has broken out of its ascending channel, continuing to experience potential selling pressure. It continues to hover around the 2,600 level, having lost its horizontal major support. The 2,200 level should be watched as a region of strong support. For the uptrend to continue on the ETH side, it needs to close with volume above the major resistance level of 2,922.

Resistance levels: 2,565 / 3,000 / 3,364

Support levels: 2,200 / 1,700 / 1,052

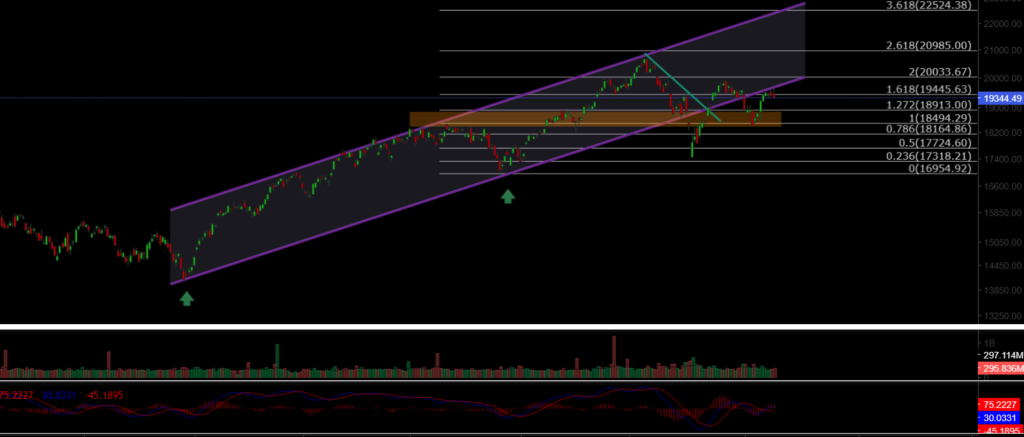

NASDAQ

The NASDAQ100 index continues the week with gains. After pulling back and losing its channel support, the index retreated to the 18,900 region but managed to re-enter its upward trend from the major support region. The 19,445 region stands out as the resistance level to watch.

Resistance levels: 19,445 / 20,000 / 20,985

Support levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is seeing medium-term recoveries. Having regained its lost channel structure, oil continues its upward trend. If it reclaims the 76.98 level, it could price up to the 80.00–82.00 level. The 72.37 region stands out as the support level to watch.

Resistance levels: 74.45 / 76.98 / 79.84

Support levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD has broken its ascending channel resistance and managed to price above both horizontal and channel resistance. It has remained above the 1.0983 resistance region and reached our target resistance level of 1.114. It then lost the 1.11 resistance level under selling pressure, leaving behind a deviation and pulling back. The 1.0983 level stands out as the support level to watch in EURUSD.

Resistance levels: 1.114 / 1.130 / 1.135

Support levels: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD continues to price within its ascending channel structure. After closing with volume above the 2,585 resistance level, it continued its upward momentum and reached a new ATH level of 2,628. The 2,644 region stands out as the resistance area to watch.

Resistance levels: 2,644 / 2,690 / 2,720

Support levels: 2,585 / 2,527 / 2,477

Leave A Comment