💵 💴 💶ICE Brent Continues to Recover💵 💴 💶

After dropping below $70 per barrel earlier this month, ICE Brent has recovered this morning, rising above $75 per barrel. Increasing tensions in the Middle East are bringing back a risk premium to the oil market, although demand concerns persist. Meanwhile, signs of improvement from China have somewhat increased, as the People’s Bank of China reduced the reverse repo rate by 10 basis points and may take additional measures to support economic growth. China has announced its third and likely final oil product export quota for the current year. Under the latest quota, China approved the export of 8 million tons of gasoline, diesel, and jet fuel, bringing the total export quota for this year to 41 million tons, slightly higher than the 40 million tons set for 2023. Additionally, China announced a 1 million-ton export quota for low-sulfur fuel oil, with the annual total at around 13 million tons, a 2% decrease compared to last year.

GLOBAL MARKETS

Asian stocks have risen to their highest levels in more than two and a half years, boosted by economic support measures announced in China. Meanwhile, in the U.S., expectations of continued interest rate cuts have kept risk appetite high, with the dollar under pressure. China’s financial regulators, during a press conference where they announced a series of measures, stated that they would reduce the reserve requirement ratio for banks by 50 basis points and lower mortgage interest rates to revive the slowing economic growth. Following these steps, Chinese stock markets rose.

The War Among Bitcoin Miners is Over: Agreement and Announcement

The tension that began with a $950 million offer from Bitcoin miner RIOT Platforms in April appears to have come to an end for now. RIOT and Bitfarms have reached an agreement to end the acquisition discussions. According to statements from both parties, RIOT has withdrawn most of its demands towards Bitfarms and agreed to remain silent (without making new demands) until Bitfarms’ annual meeting in 2026, with some exceptions. RIOT also agreed not to acquire additional shares in the company without approval from Bitfarms’ board. Currently, RIOT holds a 19.9% stake, making it the largest shareholder in Bitfarms. As part of the agreement, RIOT’s demands were partially accepted. One of these demands was the resignation of Bitfarms’ co-founder, Andres Finkielsztain, from the board. Recently, RIOT succeeded in appointing its preferred “independent” CEO, and with Finkielsztain’s departure, RIOT has further solidified its influence.

Technical Overview

DXY

The Dollar Index continues to consolidate this week. The DXY continues to recover after finding buyers at the 100.68 support level. If it closes below this region with volume, the selling pressure on the index will increase. As long as it remains above the 100.68 support region, its momentum will be upward.

Resistance levels: 102.26 / 103.23 / 104.02

Support levels: 100.68 / 98.00 / 97.00

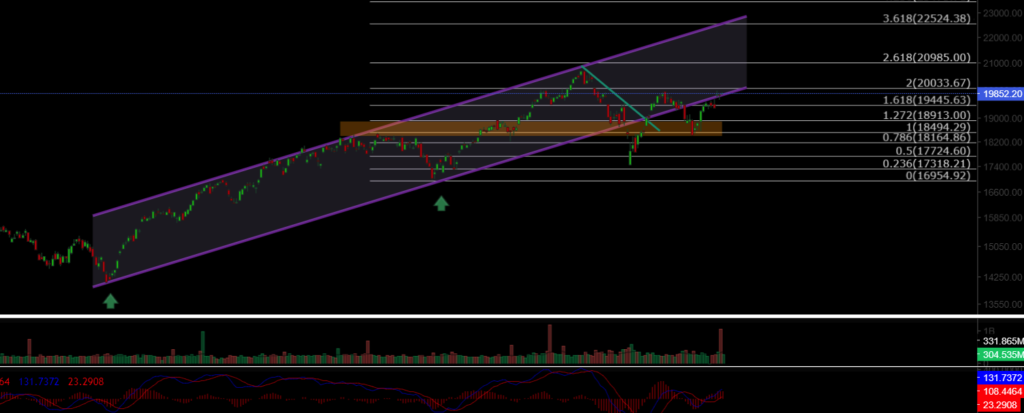

BTC/USD

The uptrend in BTCUSD continues. If it closes above the 64,300 level, BTC is likely to continue up to the 68,350 level. That area appears to be a major resistance zone for BTC. Voluminous daily closes above the 68,350 region indicate that the trend in BTC and cryptocurrencies could continue.

Resistance levels: 64,290 / 66,148 / 68,350

Support levels: 62,487 / 60,000 / 56,600

ETH/USD

ETHUSD has broken out of its ascending channel, continuing to experience potential selling pressure. It continues to hover around the 2,600 level, having lost its horizontal major support. The 2,200 level should be watched as a region of strong support. For the uptrend to continue on the ETH side, it needs to close with volume above the major resistance level of 2,922.

Resistance levels: 2,565 / 3,000 / 3,364

Support levels: 2,200 / 1,700 / 1,052

NASDAQ

The NASDAQ100 index continues the week with gains. After pulling back and losing its channel support, the index retreated to the 18,900 region but managed to re-enter its upward trend from the major support region. The 19,445 region stands out as the resistance level to watch.

Resistance levels: 19,445 / 20,000 / 20,985

Support levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is seeing medium-term recoveries. Having regained its lost channel structure, oil continues its upward trend. If it reclaims the 76.98 level, it could price up to the 80.00–82.00 level. The 72.37 region stands out as the support level to watch.

Resistance levels: 74.45 / 76.98 / 79.84

Support levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD has broken its ascending channel resistance and managed to price above both horizontal and channel resistance. It has remained above the 1.0983 resistance region and reached our target resistance level of 1.114. It then lost the 1.11 resistance level under selling pressure, leaving behind a deviation and pulling back. The 1.0983 level stands out as the support level to watch in EURUSD.

Resistance levels: 1.114 / 1.130 / 1.135

Support levels: 1.098 / 1.088 / 1.080

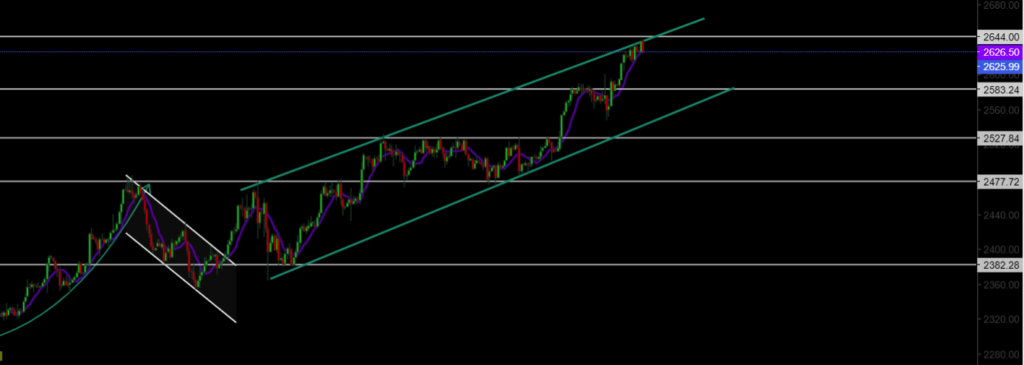

XAUUSD

XAUUSD continues to price within its ascending channel structure. After closing with volume above the 2,585 resistance level, it continued its upward momentum and reached a new ATH level of 2,628. The 2,644 region stands out as the resistance area to watch.

Resistance levels: 2,644 / 2,690 / 2,720

Support levels: 2,585 / 2,527 / 2,477

Leave A Comment