💵 💴 💶GLOBAL MARKETS💵 💴 💶

Fed Releases September Meeting Minutes

The Federal Reserve (Fed) has released the minutes of its September meeting, where it cut interest rates for the first time in four years. These minutes reveal that the majority were in consensus for a 50-basis-point rate cut. The Fed reduced the policy rate by 50 basis points, bringing it to the 4.75-5.00% range. Officials stated that this cut was made in response to developments in the U.S. economy and the balance of risks. Key Highlights from the September Minutes: Policy Decisions: Fed officials emphasized that decisions are shaped by economic data, and they do not follow a predetermined path. This flexibility is seen as essential for dealing with economic uncertainties. 50 Basis Point Cut: The majority supported a 50 bp cut; however, a few participants suggested that a smaller 25 bp cut might be more aligned with the normalization process. Rate Cut and Quantitative Tightening: Despite the rate cut, Fed officials stressed the need to continue quantitative tightening, which refers to the reversal of measures taken during periods of monetary expansion. Economic Forecasts: Growth forecasts for the second half of 2024 have been downgraded, with weaker labor market indicators expected.

US Bank Earnings Reports Expected to Show Declines in Profits

JPMorgan Chase and Wells Fargo are set to release their earnings reports this week, and investors are particularly focused on the banks’ net interest income. Recent strong employment data has added uncertainty to the future of Federal Reserve rate cuts. The third-quarter profits of these two banks are expected to decline, as interest income shrinks and credit demand remains low. Banks have made significant gains in net interest income over the past few years due to Fed rate hikes. However, weak credit growth, rising deposits, and increasing unemployment, along with higher provisions for loan losses, are now putting pressure on profitability. Further rate cuts could reduce banks’ interest income but may also increase borrowing and transaction activity.

GLOBAL MARKETS

Asian stocks found support from rising Chinese equity markets, fueled by the People’s Bank of China (PBOC) rolling out 500 billion yuan in support measures aimed at revitalizing capital markets. Meanwhile, the U.S. dollar traded near its two-month high ahead of the release of U.S. inflation data later today. Investors are closely watching for more clues regarding potential rate cuts from the Federal Reserve as the consumer inflation data is released. Economists polled by Reuters expect core inflation to remain stable at 3.2% year-over-year. As part of its support measures, the PBOC announced that financial institutions interested in participating in the newly established financing program, announced on September 24, can begin submitting applications.

Technical Overview

DXY

The Dollar Index continues the week with a bullish momentum. The DXY, which found support at the 100.68 level, is showing signs of recovery. As long as it remains priced above the 100.68 support zone, its upward momentum is expected to continue.

Resistance levels: 102.26 / 103.23 / 104.02

Support levels: 100.68 / 98.00 / 97.00

BTC/USD

Recoveries in BTCUSD continue. The price is bouncing back from the MA50 level, which acts as a buying zone at 60,037, and is continuing its trend to test the channel resistance again. The 66,150 level emerges as the key resistance area to watch.

Resistance levels: 64,290 / 66,148 / 68,350

Support levels: 60,000 / 56,600 / 52,685

ETH/USD

ETHUSD broke its rising channel and continues to face selling pressure. It is currently priced at the 2,600 level, having lost its horizontal major support. The key support to monitor is 2,200, which is where buyers are expected to be stronger. To continue its upward trend, ETH needs to close above the major resistance level of 2,922 with strong volume.

Resistance Levels: 2,565 / 3,000 / 3,364

Support Levels: 2,200 / 1,700 / 1,052

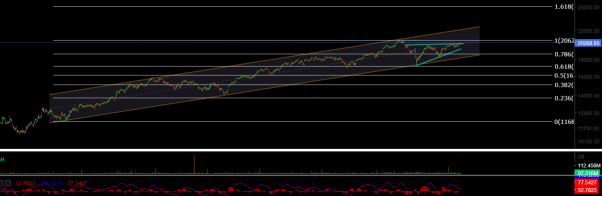

NASDAQ

The NASDAQ100 Index continues the week with a bearish trend. The index, which has approached the 19,900 resistance zone, is likely to see further pullbacks as long as it continues to price below this resistance level. The key support zone to watch is at the 18,490 level.

Resistance levels: 19,900 / 20,000 / 20,985

Support levels: 18,913 / 18,500 / 18,164

BRENT

Brent oil is showing medium-term recoveries. Having regained its channel structure, Brent continues its upward trend. If it can reclaim the 76.98 area, it will likely price in the 80.00 – 82.00 range. The key support level to watch is 72.37.

Resistance Levels: 74.45 / 76.98 / 79.84

Support Levels: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke its rising channel resistance, managing to hold above both the horizontal resistance and channel resistance. It stayed above the 1.0983 resistance zone and reached our target resistance level of 1.114. After facing selling pressure and losing the 1.11 level, it saw a pullback. The key support level to monitor is 1.0983.

Resistance Levels: 1.114 / 1.130 / 1.135

Support Levels: 1.098 / 1.088 / 1.080

XAUUSD

Gold (XAUUSD) continues its selling pressure after losing the 2625 support level. It has retested this level and converted it into resistance. The 2585 level stands out as a potential buying zone. To confirm a continuation of the uptrend, it is essential to monitor a breakout of the falling resistance.

Resistance Levels: 2625 / 2690 / 2720

Support Levels: 2585 / 2527 / 2472

Leave A Comment