💵 💴 💶Bitcoin ETF Options Set to Hit the Market, Volatility May Increases💵 💴 💶

With the U.S. Securities and Exchange Commission (SEC) approving options trading on spot Bitcoin ETFs, the potential for increased volatility in Bitcoin has risen. This development, especially for ETFs like BlackRock’s iShares Bitcoin BTC Trust (IBIT), is expected to attract significant investor interest. Options for spot Bitcoin ETFs have been approved. Last Friday, the SEC granted approval for the listing and trading of options on several spot Bitcoin ETFs on NYSE American LLC and Cboe Exchange, Inc. These new products are expected to provide asymmetrical returns for U.S.-based retail investors while drawing institutional investors into the market. Kbit CEO Ed Tolson noted that IBIT options will be particularly appealing to retail investors. He emphasized that institutional market makers are likely to take short positions, increasing volatility by buying as prices rise and selling as they fall.

GLOBAL MARKETS

Gold prices have surged to record highs, while the dollar continues to strengthen, putting pressure on the yen and euro. Asian markets struggled to find direction as investors refrained from making major moves ahead of the upcoming U.S. presidential elections. Gold reached a record high of $2,749.07 in early trading. Changing expectations about the speed and scale of interest rate cuts by the U.S. Federal Reserve also dampened risk appetite.

Mixed Markets, Rising YieldsU.S. markets had a mixed performance on Monday. The Nasdaq Composite Index rose, while the S&P 500 and Dow Jones Industrial Average fell, with the Dow Jones ending a three-day winning streak. The 10-year Treasury yield increased by roughly 12 basis points. In Europe, the Stoxx 600 index dropped 0.66%, with nearly all sectors declining, except for oil and gas stocks, which gained 0.6%.

Technical Overview

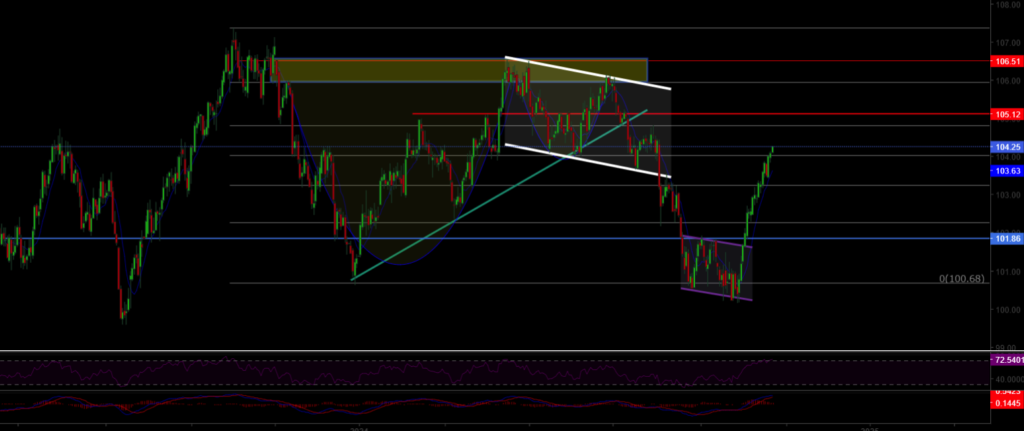

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistances: 68,350 / 71,927 / 75,000

supports: 66,148 / 64,290 / 60,000

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

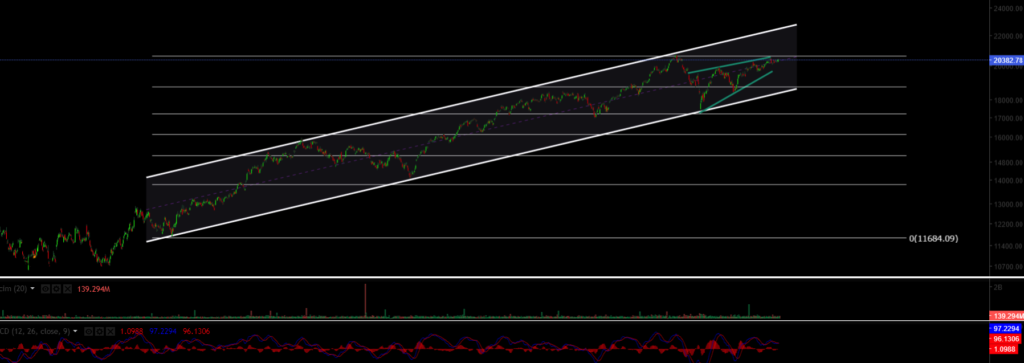

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

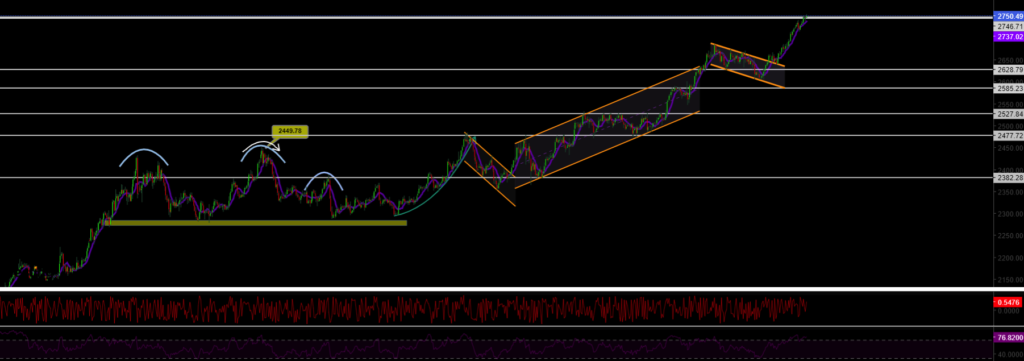

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment