💵 💴 💶GLOBAL MARKETS💵 💴 💶

The dollar tried to maintain its value after posting its biggest drop in a month against major currencies, following a three-month high in U.S. Treasury yields, which then reversed direction. In Asia, mixed trading was observed, with some markets following Wall Street’s rally yesterday, while Japan’s Nikkei index fell 0.96% due to the yen’s recovery from a three-week low against the dollar. Japan’s upcoming elections on Sunday could result in the ruling coalition losing its parliamentary majority, and the possibility of political uncertainty has put additional pressure on Japanese stocks.

Eurozone PMI in a Downtrend

Eurozone PMI has been in a downward trend since June, raising concerns about the fragile economic recovery already impacted by the energy crisis. This situation has escalated to the point where the European Central Bank (ECB) has decided to accelerate its pace of rate cuts. In ECB President Christine Lagarde’s latest press conference, she emphasized the importance of deteriorating survey data when explaining October’s rate cut decision. This makes today’s data crucial for the markets, as they are increasingly pricing in a 50-basis-point cut for December. At the IMF meetings in Washington, hawkish members continue to oppose a 50-basis-point cut unless economic conditions worsen further. This indicates that the pace of cuts remains uncertain for upcoming meetings.

Is the BRICS Summit’s Bitcoin Plan Continuing?As part of the BRICS alliance’s plans to reduce the role of the dollar, various discussions have emerged regarding the potential role of Bitcoin and cryptocurrencies. Previously, there were talks about Russia potentially circumventing Western sanctions using Bitcoin. However, there has been no official confirmation that Bitcoin has been formally included on the BRICS agenda. Nonetheless, the alliance is reportedly exploring a blockchain-based payment system to facilitate cross-border transactions. The role of stablecoins in this process is also being closely monitored as developments unfold.

Technical Overview

DXY

The US Dollar Index (DXY) is continuing its upward trend with a strong recovery at the beginning of the week. Finding strength from the critical support level at 100.68, the DXY is expected to maintain its bullish momentum as long as it stays above this support. Notably, as long as it trades above the 100.68 level, upward movements are likely to accelerate. Buyers appear to be dominant in this area, and the index seems poised to move toward resistance levels.

Resistance Levels: 102.26 / 103.23 / 104.02

Support Levels: 100.68 / 98.00 / 97.00

BTC/USD

The pullback in BTCUSD continues. After the Iran-Israel incident, we saw declines in cryptocurrencies. The support level to watch is around the 60,000 region.Resistance

Resistances: 68,350 / 71,927 / 75,000

supports: 66,148 / 64,290 / 60,000

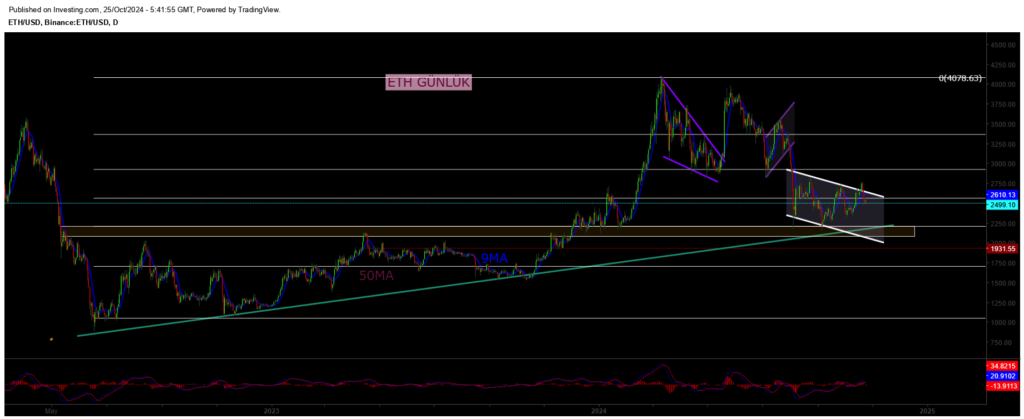

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

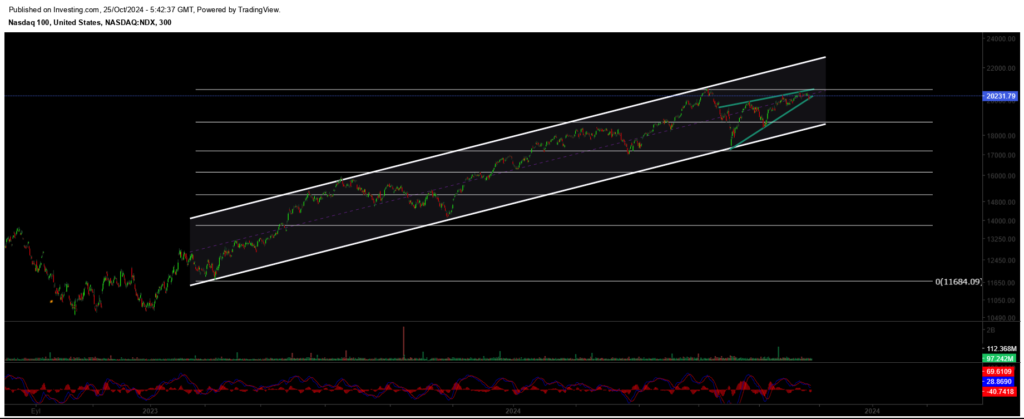

NASDAQ

The index continues its upward trend, and if it manages to hold above the 20,370 resistance level, the upward movement could accelerate. A break of this level would take the index towards the upper band of the ascending channel that has been forming since March 2023. In the event of a pullback, two critical support levels should be noted: the first being 19,600 as a significant short-term support, and in case of a deeper decline, the strong buying zone at 18,400 should be monitored. Buyers are expected to step in at these levels.

Resistances: 19,900 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,160

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

XAUUSD

XAUUSD, after gaining momentum from the support of the descending channel, has successfully broken through the resistance of the descending channel. As long as it continues to hold above this broken resistance area, gold could potentially reach a new all-time high (ATH) and extend its upward trend for a while. Particularly, maintaining stability above this resistance zone will accelerate the upward movement of gold.

Resistances: 2690 / 2740 / 2800

Supports: 2625 / 2585 / 2527

Leave A Comment