💵 💴 💶Urgency for the German Government; Economy💵 💴 💶

In January, at the World Economic Forum in Davos, Finance Minister Christian Lindner stated that a cup of espresso would be enough to get the German economy back on track. However, this assessment has changed completely in recent months. There is a growing perception in German politics that the economy has lost its international competitiveness over the last decade and is facing both cyclical and structural issues. Whether the German economy is the “sick man” is debatable, but the fact remains that it has seen almost no growth in the past four years and requires a profound renewal. Volkswagen’s issues, which have been in the spotlight since early September, have heightened the sense of urgency within the German government. Unfortunately, efforts to revive the economy have so far lacked coordination. Instead, stagnation has intensified tensions within the government; for example, Economy Minister Robert Habeck announced a new plan for the “Germany Fund” last week, followed by two separate dialogue meetings held by Chancellor Olaf Scholz and Finance Minister Lindner with the private sector.

Dissolution of Trump-Focused Trades After Recent Polls

The U.S. dollar began election week on a generally weak note. Markets are digesting Friday’s low employment figures, which were significantly impacted by weather conditions. Meanwhile, recent polls show that Democrats are gaining momentum in some key states, which may have led to the dissolution of Trump-focused trades. For instance, a recent poll indicates Kamala Harris is leading in Iowa, a state previously strong for Republicans. According to ABC’s “fivethirtyeight” data, Donald Trump is leading in all key states except Michigan and Wisconsin. However, in Nevada and Pennsylvania, his lead is less than 0.5%. If Harris wins all Democrat-leaning states (226 Electoral College votes) and secures Michigan, Wisconsin, and Pennsylvania, she could win the presidency with exactly 270 votes. Even if Iowa shifts to the Democrats, it only provides six votes (compared to Pennsylvania’s 19) and would not create a significant difference.

Why is Bitcoin Rising? Key Insights from Michael SaylorMicroStrategy’s CEO, Michael Saylor, shared important insights on the rise of Bitcoin, Wall Street’s shift towards crypto, and future strategies. Here are Saylor’s views: Why is Bitcoin Rising? Saylor pointed out that Bitcoin’s acceptance as digital gold and its establishment as a new asset class are supporting the price increase. Additionally, BlackRock CEO Larry Fink’s endorsement of Bitcoin and the launch of the iShares Bitcoin ETF have played a significant role. Impact of U.S. Elections on Crypto Saylor believes that regulatory clarity after the U.S. presidential elections will boost Bitcoin and other crypto assets’ prices. A decrease in interest rates and regulators recognizing Bitcoin as a legitimate asset class could steer investors away from real estate, gold, and bonds toward Bitcoin. MicroStrategy’s Strategy and Views on Ethereum MicroStrategy plans to accumulate a total of 412,220 Bitcoins by the end of 2025. Saylor described other crypto assets as in a gray area, noting that Ethereum is not part of MicroStrategy’s investment plan.

Technical Overview

DXY

The Dollar Index (DXY) is strongly recovering at the start of the week, continuing its upward trend. Finding strength at the critical support level of 100.68, the DXY is expected to maintain its upward momentum as long as it stays above this support. Especially as it trades above the 106.68 level, upward movements are anticipated to accelerate. Buyers are observed to be dominant in this area, and the index is likely to advance toward resistance levels.

Resistances: 104.76 / 106.00 / 107.35

Supports: 104.02 / 102.26 / 100.68

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

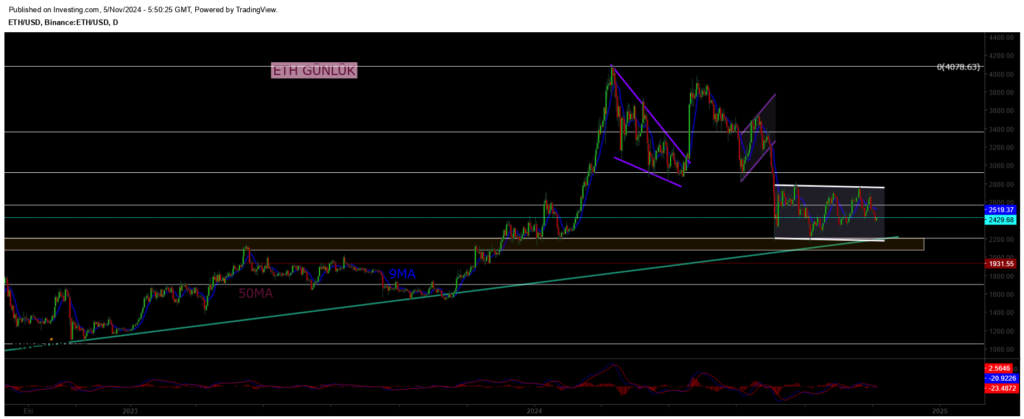

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

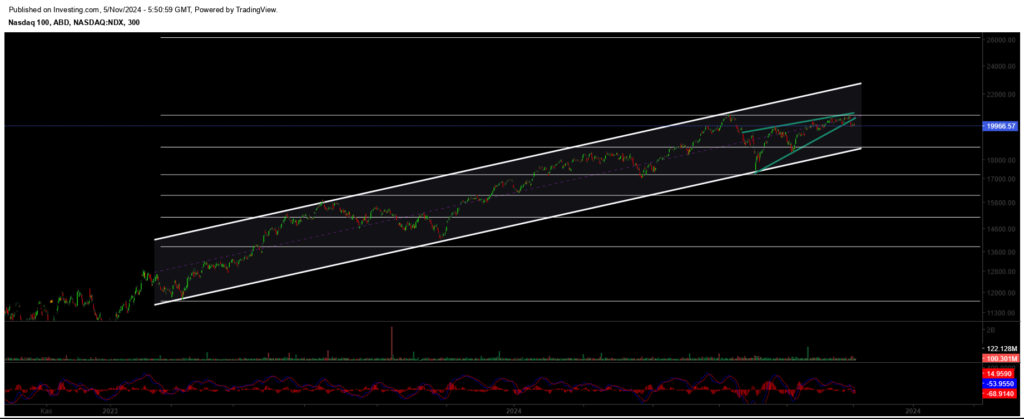

NASDAQ

The index, continuing its uptrend, may accelerate its upward movement if it prices above the 20,635 resistance level. Breaking through this level could push the index towards the upper band of the rising channel structure formed since March 2023. In case of a pullback, two key support levels come into focus: in the short term, the 19,600 level is a significant support zone. For a deeper correction, the 18,400 level serves as a strong buying area, where buyers are expected to step in.

Resistances: 20,635 / 22,400 / 23,000

Supports: 18,913 / 18,670 / 17,200

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

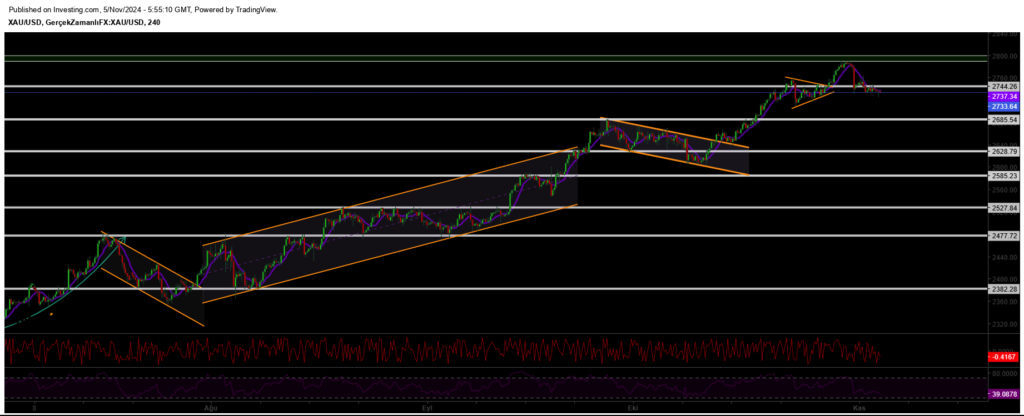

XAUUSD

Gold surpassed the 2,742 resistance zone, reaching a new all-time high and heading strongly towards the 2,800 level. In this uptrend, the 2,745 level stands out as a key support; as long as gold stays above this level, it could maintain its upward momentum. As it moves towards the 2,800 target, investors should closely watch whether gold continues to trade above this support zone.

Resistances: 2800 / 2850 / 2910

Supports: 2740 / 2690 / 2625

Leave A Comment