💵 💴 💶Gold Price Performance and U.S. Presidential Elections💵 💴 💶

This year, gold has been one of the best-performing commodities, gaining over 35% since the beginning of the year and setting record highs. This rise has been supported by expectations of interest rate cuts, heavy central bank purchases, and strong Asian demand. In addition to high geopolitical risks, uncertainty ahead of the contentious U.S. elections has also contributed to gold’s record-breaking surge. We believe that gold will continue to perform well regardless of the U.S. election outcome. With geopolitical risks remaining high in the short term, gold has long been a preferred safe-haven asset during periods of such risks.

Nvidia’s $700 Million Run Labs Acquisition Under EU Review

The European Commission has decided to review Nvidia’s plan to acquire Tel Aviv-based AI workload management startup Run Labs Ltd. This move comes after Italy invoked its national authority, stating that the deal could pose risks and requested an EU-level review. According to EU law, a member state can direct a transaction to the EU for review if it could affect local competition and harm trade in the Single Market. Italy’s competition authority indicated that Nvidia’s acquisition of Run Labs could impact competition in the markets where the two companies operate. Run Labs specializes in AI workload management technologies, making this acquisition a strategic move for Nvidia. The Commission’s acceptance of this referral underscores the importance of preserving competitive balance in the AI sector.

MicroStrategy’s $42 Billion Bitcoin StrategyMicroStrategy aims to intensify its Bitcoin strategy with the “21/21 Plan,” targeting $42 billion over three years. Half of this amount will come from equity and the other half from fixed-income issuances. The company aims to accumulate a total of 412,220 Bitcoin by the end of 2025, anticipating Bitcoin to reach $175,000 by that time. This unique strategy, combining traditional financial instruments with Bitcoin investments, allows the company’s net asset value (NAV) to trade at a premium of 2.7x. Analyst Mark Palmer suggests that this differentiation from spot Bitcoin ETFs could attract more institutional investors.

Technical Overview

DXY

The Dollar Index (DXY) is strongly recovering at the start of the week, continuing its upward trend. Finding strength at the critical support level of 100.68, the DXY is expected to maintain its upward momentum as long as it stays above this support. Especially as it trades above the 106.68 level, upward movements are anticipated to accelerate. Buyers are observed to be dominant in this area, and the index is likely to advance toward resistance levels.

Resistances: 104.76 / 106.00 / 107.35

Supports: 104.02 / 102.26 / 100.68

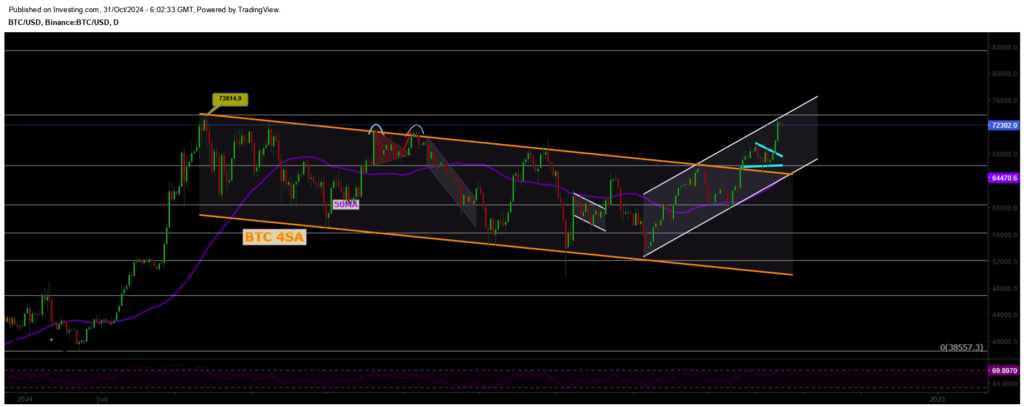

BTC/USD

Bitcoin has reached the resistance of the descending channel structure and successfully broke through with significant volume. This resistance zone is crucial for BTC and could open the doors to a new bullish trend in the cryptocurrency markets. If Bitcoin manages to sustain its price above this strategic level, we may see bullish momentum for Bitcoin and other altcoins, triggering a rally that gains traction in the market. Therefore, the current levels represent a critical turning point that should be closely monitored.

Resistances: 68,350 / 71,927 / 75,000

Supports: 66,148 / 64,290 / 60,000

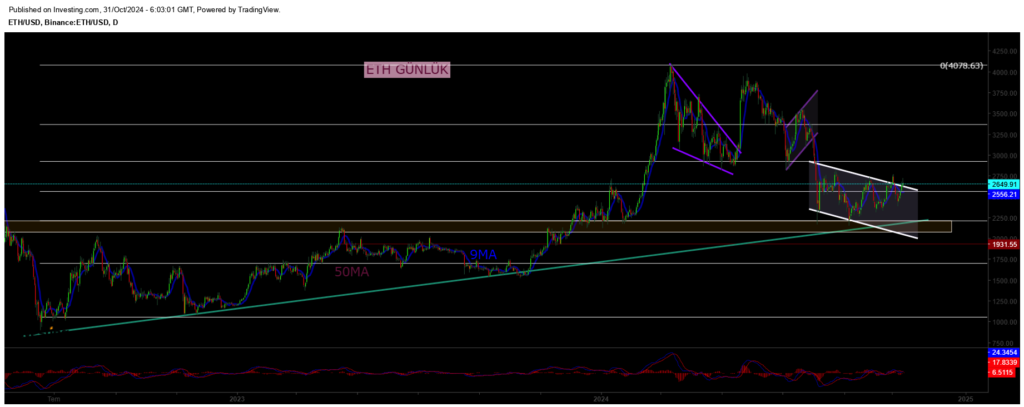

ETH/USD

ETHUSD continues to trade within the descending channel pattern, remaining under pressure. After losing its horizontal major support, ETHUSD is now priced around the 2400 level. If selling deepens, the critical support level to watch is 2100, where buyers are expected to strengthen. On the other hand, for the upward trend in ETH to continue, it needs to close decisively above the major resistance at 2922 with strong volume. If this resistance is breached, a new uptrend could begin.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

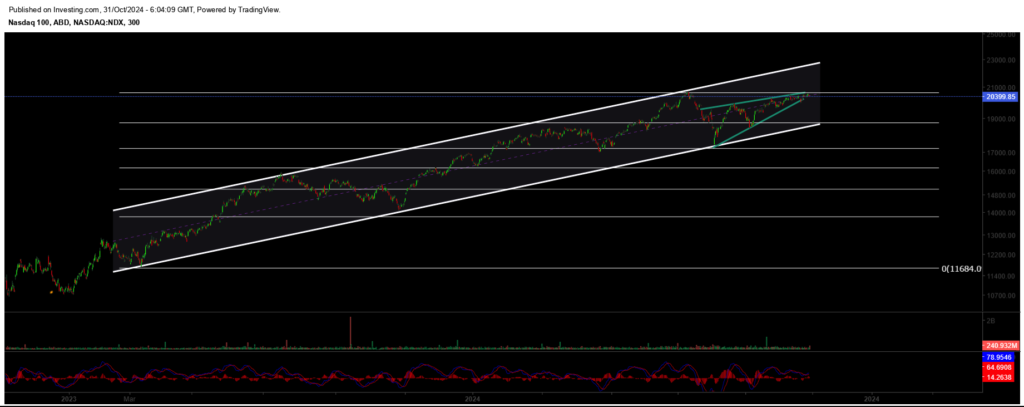

NASDAQ

The index, continuing its uptrend, may accelerate its upward movement if it prices above the 20,635 resistance level. Breaking through this level could push the index towards the upper band of the rising channel structure formed since March 2023. In case of a pullback, two key support levels come into focus: in the short term, the 19,600 level is a significant support zone. For a deeper correction, the 18,400 level serves as a strong buying area, where buyers are expected to step in.

Resistances: 20,635 / 22,400 / 23,000

Supports: 18,913 / 18,670 / 17,200

BRENT

Brent crude has shown medium-term recovery and regained its previous channel structure, continuing its upward trend. It has surpassed the 76.98 resistance zone, and as long as it holds above this level, it is expected to rise towards the 80.00 – 82.00 range. In the event of a pullback, the critical support level to monitor is the 72.37 zone, where buyers are expected to become active. Maintaining this support is crucial for the continuation of the trend.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EUR/USD successfully broke through its ascending channel resistance and has been trading above both horizontal and channel resistance. It held above the 1.0983 resistance zone and reached our target of 1.114. However, facing selling pressure around 1.11, it lost this zone, creating a “deviation” and leading to a pullback. Now, the critical support level to watch for EUR/USD is 1.0983. Maintaining this level is crucial for stabilizing the price.

Resistances: 1.114 / 1.130 / 1.135

Supports: 1.098 / 1.088 / 1.080

XAUUSD

Gold surpassed the 2,742 resistance zone, reaching a new all-time high and heading strongly towards the 2,800 level. In this uptrend, the 2,745 level stands out as a key support; as long as gold stays above this level, it could maintain its upward momentum. As it moves towards the 2,800 target, investors should closely watch whether gold continues to trade above this support zone.

Resistances: 2800 / 2850 / 2910

Supports: 2740 / 2690 / 2625

Leave A Comment