💵 💴 💶Market Decline Wipes Out Over $500 Million in Liquidations💴 💶

In the past 24 hours, Bitcoin fell below $100,000. The leading cryptocurrency lost over 4% of its value, briefly dropping to $98,000. BeInCrypto data shows that Bitcoin initially reached $102,000 but succumbed to selling pressure. This decline follows broader market instability, which led to a 5% drop in the total cryptocurrency market capitalization. Meanwhile, other major cryptocurrencies also faced sharp declines. Ethereum, Solana, and BNB each lost more than 7%.

GLOBAL MARKETS

U.S. President Donald Trump’s decision to impose additional tariffs on Canada, Mexico, and China has raised fears of an escalating trade war and a slowdown in global economic growth. As a result, Asian stock markets and U.S. futures fell sharply. The U.S. dollar hit a historic high against the yuan, reached its highest level against the Canadian dollar since 2003, and against the Mexican peso since 2022.

Dollar’s Rise and Market ReactionSince Trump’s election, even mere tariff-related statements have supported the U.S. dollar. The Bloomberg Dollar Spot Index climbed nearly 1% last week, marking its best performance since mid-November. U.S. stocks, particularly in the automotive sector and companies with strong trade ties to China, declined on Friday. Bond investors must balance increasing market risks with inflation concerns. Analysts suggest that in the short term, trade tensions may escalate, potentially prompting other countries to retaliate or adopt similar policies. This could have a positive short-term effect on the dollar while also increasing U.S. bond yields.

Technical Overview

DXY

Bitcoin initiated an uptrend with Trump officially taking office, reaching as high as $109,000. Setting a new all-time high, BTC is expected to extend its bullish trend to $123,194 with daily closes above the $108,286 region.

Resistance: 118,500 / 123,550 / 131,029

Support: 108,985 / 92,000 / 88,362

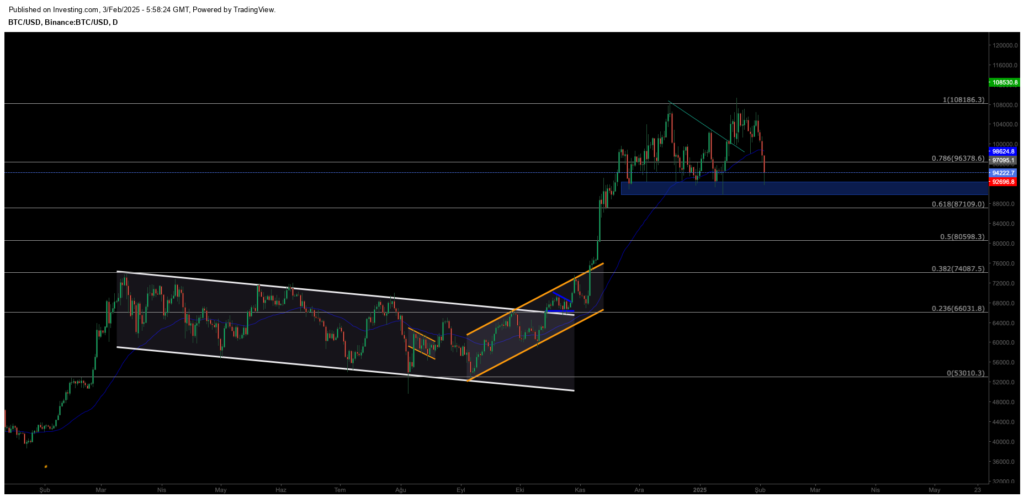

BTC/USD

Bitcoin experienced a sharp pullback following Trump’s tariff announcement, dropping to the $90,000 support level, where buyers stepped in. If this level is lost, selling pressure on BTC will intensify.

Resistance levels: 96,000 / 108,985 / 118,500

Support levels: 87,109 / 80,598 / 74,087

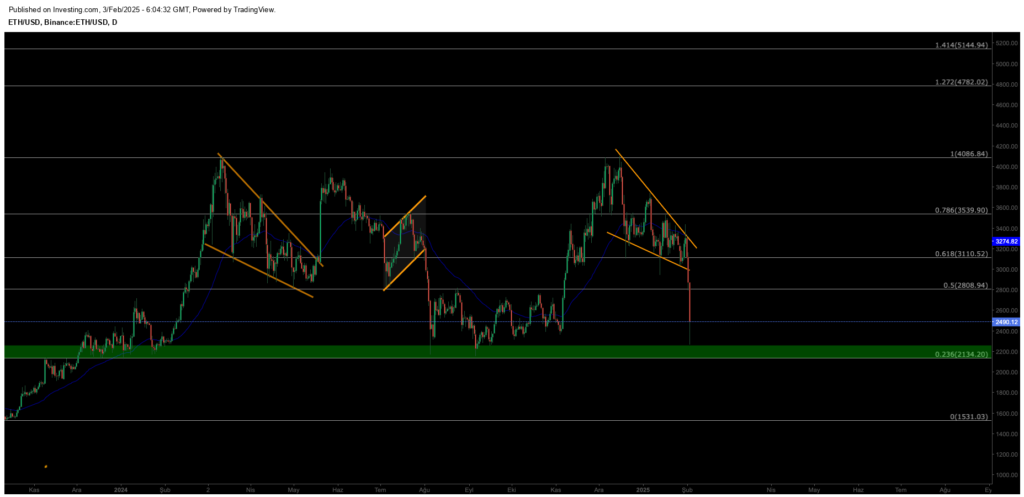

ETH/USD

Ethereum saw the expected sharp decline, retreating to the $2,200 support zone. Losing this level will extend selling pressure. However, if ETH manages to maintain a price above $2,800, it could regain upward momentum.

Resistance levels: 2,808 / 3,110 / 3,539

Support levels: 2,134 / 1,530 / 1,300

NASDAQ

The NAS100 index has experienced a sharp pullback in response to the launch of China’s AI initiative, reflecting significant pressure on U.S. indices. The major support level to watch on the index is $19,643. Losing this level could intensify the selling pressure on the index.

Resistance Levels: 22,143 / 25,320 / 26,979

Support Levels: 19,643 / 17,681 / 16,303

BRENT

Brent oil is in recovery mode, reclaiming its previously lost channel. Having broken above the 76.98 resistance, the price is likely to target the 85.00 range. The critical support level is 72.37, which should hold to maintain the uptrend.

Resistance Levels: 80.00 / 85.84 / 95.53

Support Levels: 76.15 / 70.17/ 69.99

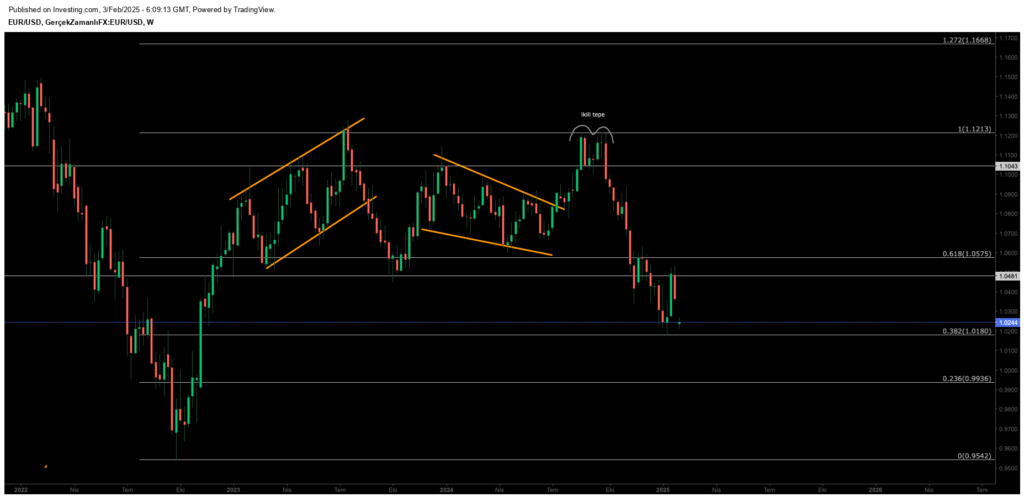

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

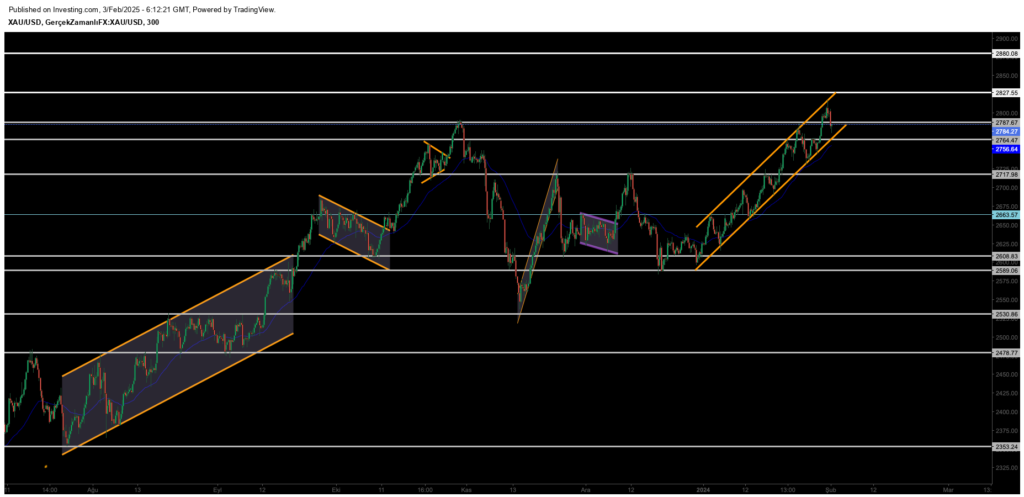

XAUUSD

Gold reached a new ATH (All-Time High) before pulling back. The 2764 level serves as a major support—losing this level could increase selling pressure further.

Resistance levels: 2787 / 2800 / 2850

Support levels: 2764 / 2717 / 2608

Leave A Comment