💵 💴 💶GLOBAL MARKETS💴 💶

While U.S. stock futures declined, bond yields remained near an eight-month high. Investors are closely monitoring the non-farm payrolls data, which could impact global bond market movements. The U.S. December non-farm payrolls report will be released today at 16:30 Turkish time (TSI). Nasdaq futures dropped 0.6%, and S&P 500 futures fell 0.5%. Wall Street was closed yesterday for a public holiday marking the funeral of former U.S. President Jimmy Carter.

El Salvador Eyes Discounted Bitcoin from U.S. Sale

President Nayib Bukele hinted at the possibility of El Salvador acquiring Bitcoin at discounted prices following the U.S. government’s decision to sell $6.7 billion worth of Bitcoin. The U.S. Department of Justice approved the sale of Bitcoin seized from the Silk Road dark web marketplace.

U.S. Bond Market Sees 2023 HighsU.S. Treasury bonds gained value, with 30-year bond yields retreating from their highest levels since early 2023. The bond market will close early at 2:00 PM New York time due to a national day of mourning for former President Jimmy Carter. U.S. equity markets will remain fully closed. Meanwhile, the British pound fell to its lowest level in a year, and U.K. gilts dropped as concerns grew over the Labour Party government’s ability to manage budget deficits amid rising borrowing costs.

Technical Overview

DXY

DXYThe DXY index broke out of a descending wedge structure on the daily chart and is maintaining its uptrend. Currently trading at 108.58, the uptrend is likely to continue as long as the 105.68 horizontal support level holds. Resistance levels to watch are 112.34 and 115.00, with a possible continuation to 120.76 if momentum remains strong.

Resistance Levels: 112.34 / 115.00 / 120.76

Support Levels: 107.34 / 105.68 / 104.38

BTC/USD

Bitcoin, after showing signs of recovery, experienced a sharp pullback yesterday, dropping to 94,400 USD. Currently, it is holding above its horizontal support. A breach of this level could lead to further declines toward 87,100 USD.

• Resistance Levels: 108,985 / 118,500 / 123,550

Support Levels: 92,000 / 88,362 / 83,365

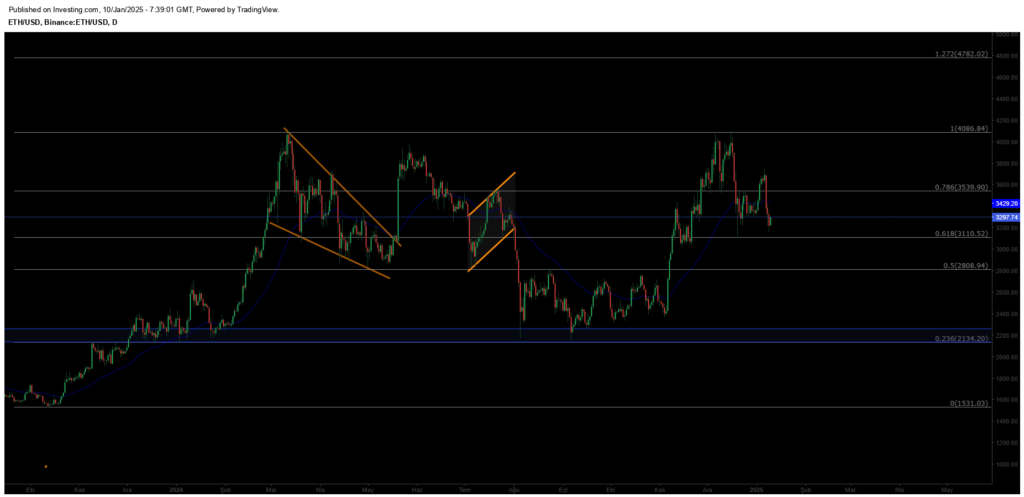

ETH/USD

Ethereum fell to 3,290 USD after losing the 3,539 USD support level, re-entering a bearish trend. For recovery, it needs to close above 3,539 USD, which could signal a market rebound. A critical support level to watch is 3,110 USD.

Resistance Levels: 3,539 / 4,086 / 4,782

Support Levels: 3,110 / 2,808 / 2,134

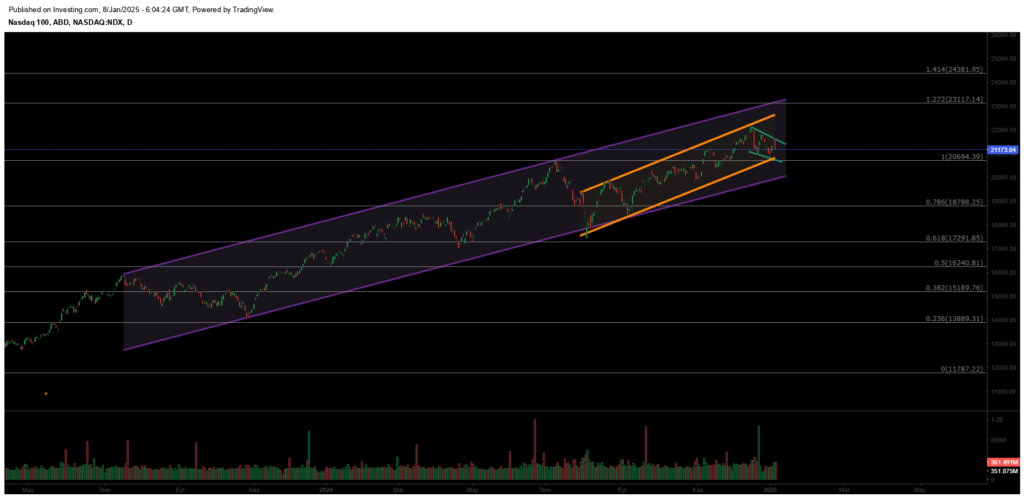

NASDAQ

The Nasdaq index continues its uptrend within a rising channel on the weekly charts. A short-term descending channel may lead to further gains if resistance is broken, potentially pushing the index toward 22,000. Key support to monitor is at 20,690.

Resistance Levels: 23,117 / 24,380 / 26,200

Support Levels: 20,694 / 18,788 / 17,291

BRENT

Brent oil shows medium-term recovery and has regained its previous channel structure, maintaining its uptrend. After surpassing the 76.98 resistance, sustained momentum above this level could push prices to the 80.00–82.00 range. The critical support level is at 72.37.

Resistance Levels: 80.00 / 85.84 / 95.53

Support Levels: 76.15 / 70.17 / 69.00

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

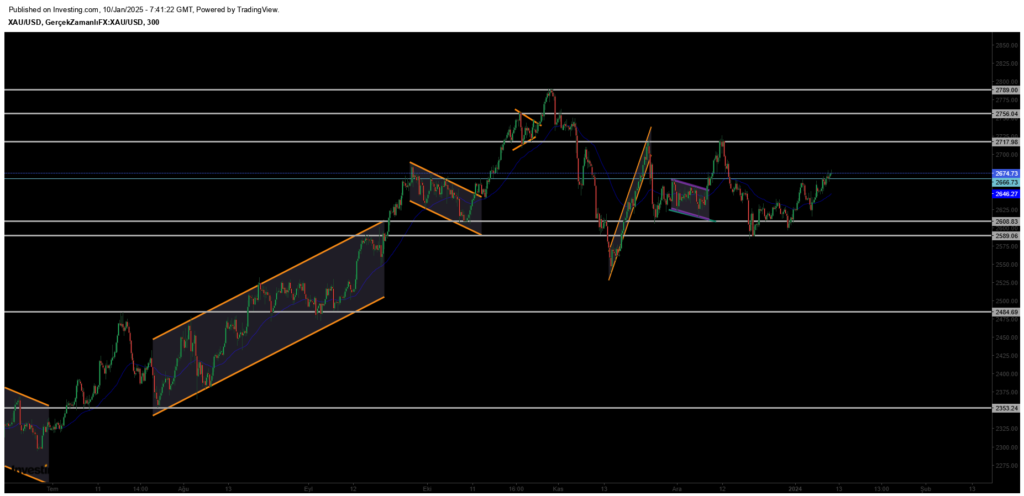

XAUUSD

Gold has gained momentum after rebounding from the 2610 support zone, resuming its upward trend. Breaking through the key resistance at the 2666 level with strong volume, it continues its bullish path. However, it may retest the recently broken resistance level. In case of a pullback, 2665 will serve as a key support zone to monitor.

Resistance Levels: 2717 / 2756 / 2790

Support Levels: 2666 / 2589 / 2550

Leave A Comment