💵 💴 💶New Hampshire and North Dakota Consider Adding Bitcoin to State Treasury💴 💶

Lawmakers in North Dakota have proposed a bill that integrates digital assets and precious metals into the state’s investment strategy. House Concurrent Resolution 3001 directs the State Treasurer and Investment Board to allocate a portion of major state funds, such as the general fund and legacy fund, to these alternative assets.

GLOBAL MARKETS

In the U.S., non-farm payrolls rose by 256,000 in December, surpassing expectations, according to data released on Friday. The stronger-than-expected increase in non-farm payrolls has heightened the significance of the U.S. Consumer Price Index (CPI) data set to be released on Wednesday. If the core inflation rate exceeds the expected 0.2%, expectations for interest rate cuts may be completely shelved.

U.S. Employment Weakens Fed’s Rate Cut ExpectationsU.S. employment data once again exceeded expectations, reinforcing the view that Federal Reserve (Fed) officials are not compelled to cut rates anytime soon. Next month’s benchmark employment revision could change this outlook. However, in an environment where inflation remains persistently high, risks appear to lean towards the Fed keeping rates steady for an extended period.

Technical Overview

DXY

DXY On the daily chart, the DXY has broken out of a descending wedge structure and appears to be maintaining its upward trend. It is currently trading at the 109.85 level. As long as the horizontal support level of 105.68 is not breached, the upward trend in the DXY is likely to continue for some time. If the trend persists, the potential resistance levels are 112.34 and 115, respectively. Should the price break out at the 112.34 region with significant volume, the uptrend may extend toward the 115 levels.

Resistances: 112.34 / 115.00 / 120.76

Supports: 107.34 / 105.68 / 104.38

BTC/USD

After the recovery phase, Bitcoin experienced a sharp pullback, retreating once again to the $94,400 level. It is currently holding above the horizontal support level. If this region is lost, Bitcoin’s decline is likely to continue for some time, making a drop to the $87,100 level inevitable. However, as long as the price remains above the support level, the trend could potentially reverse direction.

Resistances: 108,985 / 118,500 / 123,550

Supports: 92,000 / 88,362 / 83,365

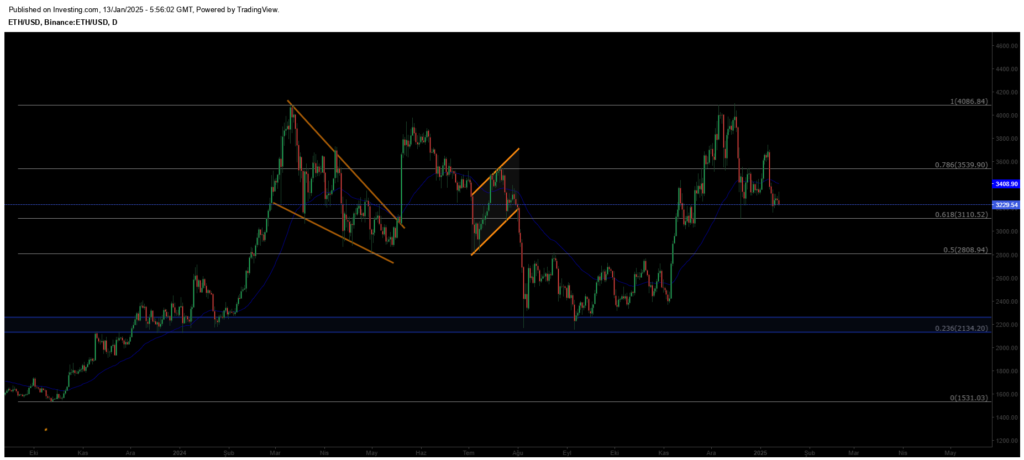

ETH/USD

The anticipated decline in Ethereum has materialized, pulling back to the $3,230 level. Losing the $3,539 support level has put Ethereum back into a selling trend. For a recovery to take place, it needs to close above the $3,539 level, which could initiate a broader market recovery. The key support level to watch is the $3,110 zone.

Resistances: 3,539 / 4,086 / 4,782

Supports: 3,110 / 2,808 / 2,134

NASDAQ

The uptrend in the index continues to strengthen within the ascending channel structure on the weekly charts. In the short term, alongside the descending channel it has formed, a potential breakout above resistance could lead to a short-term uptrend toward the 22,143 level. On pullbacks, the key support level to watch is the 19,643 zone.

Resistances: 22,143 / 25,320 / 26,979

Supports: 19,643 / 17,681 / 16,303

BRENT

Brent oil shows medium-term recovery and has regained its previous channel structure, maintaining its uptrend. After surpassing the 76.98 resistance, sustained momentum above this level could push prices to the 80.00–82.00 range. The critical support level is at 72.37.

Resistance Levels: 80.00 / 85.84 / 95.53

Support Levels: 76.15 / 70.17 / 69.00

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

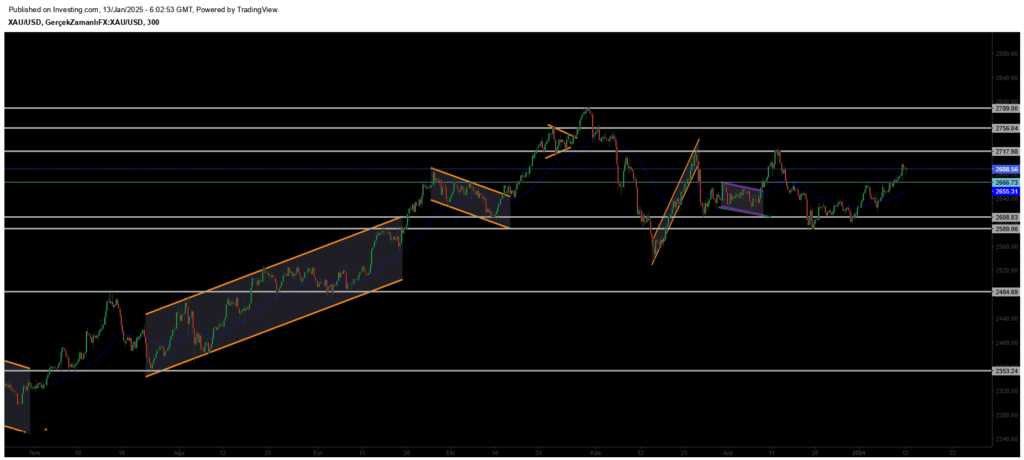

XAUUSD

Gold has gained momentum after rebounding from the 2610 support zone, resuming its upward trend. Breaking through the key resistance at the 2666 level with strong volume, it continues its bullish path. However, it may retest the recently broken resistance level. In case of a pullback, 2665 will serve as a key support zone to monitor.

Resistance Levels: 2717 / 2756 / 2790

Support Levels: 2666 / 2589 / 2550

Leave A Comment