💵 💴 💶Global Markets💴 💶

Asian markets rose, tracking Wall Street, while inflation data released in the US yesterday limited expectations of a Fed rate cut. The dollar slightly declined, while the yen surged to a one-month high, supported by rate hike expectations. The US Consumer Price Index (CPI) fell from 2.9% to 2.7% annually in December, in line with expectations, while core inflation rose 3.2%, below the forecasted 3.3%.

Oklahoma and Texas Advance Bitcoin Reserve Proposals

Texas, with the largest budget surplus among US states, aims to incorporate Bitcoin into its financial strategy. According to Schwertner’s proposal, the state wants to be the first to establish such a reserve and lead in this area. With less than a week until President-elect Trump takes office, it is evident that Republican state leaders will attempt to adopt BTC as a strategic reserve asset.

Trump Trade Risks Becoming a TrapFollowing Donald Trump’s election, markets have faced sector-specific sell-offs and volatility in the bond market, associated with Trump Trade. For S&P 500 investors, an escape from this scenario seems challenging. A recovery requires a more moderate approach to tariffs and commitments to sustainable budget deficits. As a result, investors should closely monitor this week’s cabinet confirmation hearings, as they are as significant as Q4 financial results.

Technical Overview

DXY

DXY On the daily chart, the DXY has broken out of a descending wedge structure and appears to be maintaining its upward trend. It is currently trading at the 109.85 level. As long as the horizontal support level of 105.68 is not breached, the upward trend in the DXY is likely to continue for some time. If the trend persists, the potential resistance levels are 112.34 and 115, respectively. Should the price break out at the 112.34 region with significant volume, the uptrend may extend toward the 115 levels.

Resistances: 112.34 / 115.00 / 120.76

Supports: 107.34 / 105.68 / 104.38

BTC/USD

Bitcoin’s recovery is ongoing, with momentum from a horizontal support level pushing it close to $100,000. Breaking the descending resistance level could extend Bitcoin’s uptrend to the $108,186 region.

Resistances: 108,985 / 118,500 / 123,550

Supports: 92,000 / 88,362 / 83,365

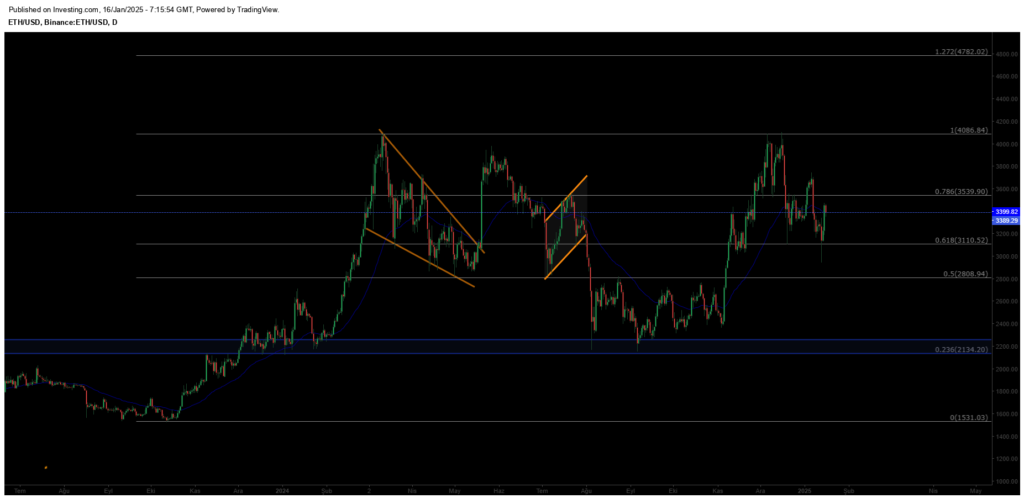

ETH/USD

Ethereum has seen a long-awaited rise, reaching $3,400. The next critical resistance zone to monitor is $3,539. A strong breakout above this level could further sustain Ethereum’s uptrend.

Resistances: 3,539 / 4,086 / 4,782

Supports: 3,110 / 2,808 / 2,134

NASDAQ

The index’s uptrend continues to strengthen within the ascending channel structure on weekly charts. Short-term declines could lead to resistance breakouts, potentially driving the index back to 22,143 in the near term. The key support zone to watch for pullbacks is 19,643.

Resistances: 22,143 / 25,320 / 26,979

Supports: 19,643 / 17,681 / 16,303

BRENT

Brent Crude is experiencing medium-term recoveries and has regained its previously lost channel structure, continuing its uptrend. Having surpassed the 76.98 resistance level, prices are expected to climb toward the 85.00 range if sustained above this level. Key support during pullbacks is 72.37.

Resistances: 85.84 / 95.53 / 102.43

Supports: 80.00 / 76.15 / 70.17

EURUSD

The Euro formed a double top at the 1.11 level and entered a downtrend. After breaking below the 1.10 support, it has retreated to the lower band of its channel at 1.0367. Buyers may step in at this critical support, but a break lower could see further declines to 1.018.

Resistance Levels: 1.0575 / 1.1043 / 1.1213

Support Levels: 1.0180 / 0.9936 / 0.9542

XAUUSD

Gold has gained momentum after rebounding from the 2610 support zone, resuming its upward trend. Breaking through the key resistance at the 2666 level with strong volume, it continues its bullish path. However, it may retest the recently broken resistance level. In case of a pullback, 2665 will serve as a key support zone to monitor.

Resistance Levels: 2717 / 2756 / 2790

Support Levels: 2666 / 2589 / 2550

Leave A Comment