💵 💴 💶Starting the Day…💵 💴 💶

Details of Donald Trump’s crypto project have been revealed: How will the token distribution be?

Once again facing an assassination attempt over the weekend, Donald Trump gave a speech during a Space broadcast on X (formerly Twitter) late at night, where he both expressed his support for the crypto world and introduced his new project. As he has stated many times before, Trump emphasized that the Biden administration and the SEC are taking a hostile stance towards cryptocurrencies. Trump participated in the broadcast for about 40 minutes of the 2-hour session.

GLOBAL MARKETS

There were fluctuating trades in Asian markets, while the U.S. dollar and Treasury yields were under pressure ahead of the expected easing cycle from the Federal Reserve (Fed), which is due tomorrow. The possibility of the central bank making a larger-than-expected rate cut is also on the table.

With public holidays continuing in China and South Korea, there were low trading volumes, and investors are now focused on the Fed’s decision tomorrow, with the likelihood of a 50 basis point rate cut increasing. The drop in U.S. Treasury yields is another factor putting pressure on the dollar. The yield on two-year U.S. Treasury notes (US2YT=RR), which closely tracks near-term rate expectations in the U.S., fell to 3.5280% yesterday, its lowest level in two years, and most recently stood at 3.5571%.

China’s Oil Demand is Declining

In early trading in Asia this morning, despite lower-than-expected data from China over the weekend, oil prices rose. However, oil-related data also came in weak. Chinese refineries processed about 12.6 million barrels of crude oil per day in August, a nearly 10% decline month-over-month and a 17.5% decline year-over-year. These figures show that apparent oil demand fell below 12.5 million barrels per day, down more than 15% year-over-year, marking the lowest level since August 2022. Additionally, China’s crude oil stockpiles increased by about 3.2 million barrels per day in August, the largest monthly stockpile increase since 2015.

Technical Overview

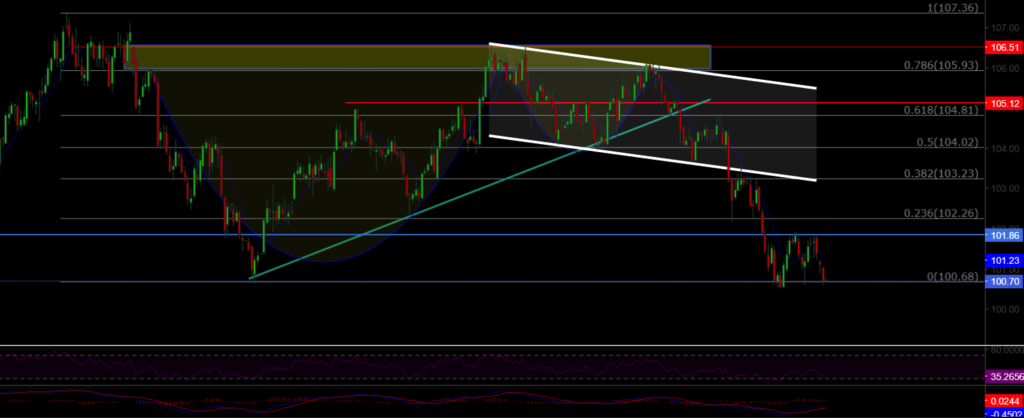

DXY

The Dollar Index (DXY) continues to consolidate this week. Buyers are stepping in at the 100.68 support level, and recoveries are ongoing. If the DXY closes below this level with volume, it will increase the selling pressure on the index. As long as it stays above the 100.68 support zone, its momentum will remain upward.

Resistances: 102.26 / 103.23 / 104.02

Supports: 100.68 / 98.00 / 97.00

BTC/USD

BTCUSD continues its recovery. To confirm the start of a short-term uptrend, it needs to trade above the 60,000 level. Key resistance levels to watch are 60,000 and 62,487. The current support level is 52,685.

Resistances: 60,000 / 62,487 / 64,290

Supports: 56,600 / 52,498 / 50,000

ETH/USD

ETHUSD broke its rising channel structure, continuing its potential selling pressure. It is currently priced at 2466, having lost its horizontal major support. The 2200 level is a key support zone to monitor where buyers may step in.

Resistances: 2565 / 3000 / 3364

Supports: 2200 / 1700 / 1052

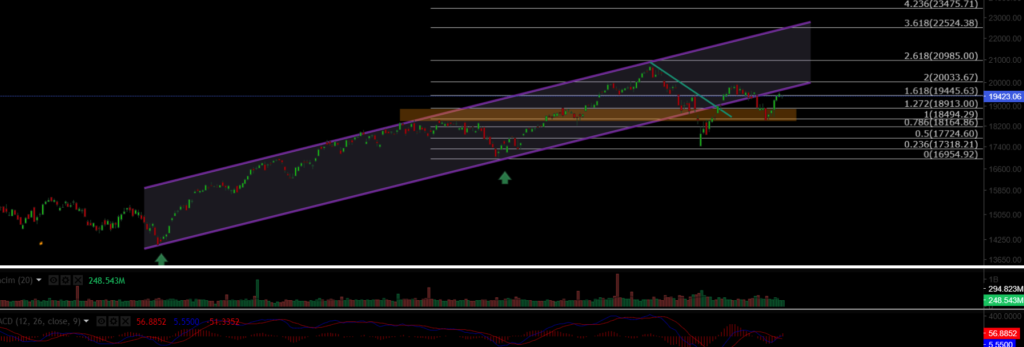

NASDAQ

NASDAQ 100 Index continues the week with a positive trend. After falling back to its channel support at the 18900 level and losing it, the index has regained upward momentum from its major support. The resistance level to watch is 19,445.

Resistances: 19,445 / 20,000 / 20,985

Supports: 18,913 / 18,500 / 18,164

BRENT

Brent Crude Oil continues its medium-term correction. It has lost its support level and declined to the lower support level of its falling channel, maintaining its downward trend due to selling pressure. To resume its upward trend, it needs to break above the 74.45 level with volume.

Resistances: 74.45 / 76.98 / 79.84

Supports: 72.37 / 71.00 / 70.50

EURUSD

EURUSD broke the rising channel resistance and managed to stay above both horizontal resistance and channel resistance, reaching the 1.114 target resistance level. It has since fallen back below the 1.11 resistance level and experienced a pullback. The key support level to monitor for EURUSD is 1.0983.

Resistance: 1.127 / 1.130 / 1.135

Support: 1.117 / 1.088 / 1.080

XAUUSD

XAUUSD broke through the 2527 resistance level with strong volume and reached our anticipated target of 2577. If it closes above this region, the upward trend in gold will likely continue toward the 2646 level.

Resistances: 2646 / 2670 / 2690

Supports: 2577 / 2527 / 2477

Leave A Comment